- Australia

- /

- Retail Distributors

- /

- ASX:BAP

Bapcor Limited (ASX:BAP) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Bapcor Limited (ASX:BAP) is about to trade ex-dividend in the next 4 days. You will need to purchase shares before the 28th of August to receive the dividend, which will be paid on the 11th of September.

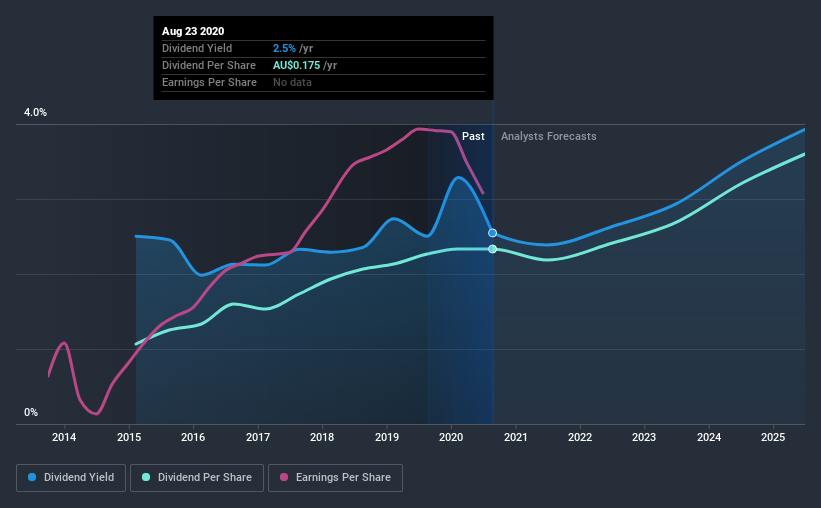

Bapcor's next dividend payment will be AU$0.095 per share. Last year, in total, the company distributed AU$0.17 to shareholders. Looking at the last 12 months of distributions, Bapcor has a trailing yield of approximately 2.5% on its current stock price of A$6.87. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Bapcor

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Bapcor is paying out an acceptable 65% of its profit, a common payout level among most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 22% of its cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. For this reason, we're glad to see Bapcor's earnings per share have risen 19% per annum over the last five years. Bapcor is paying out a bit over half its earnings, which suggests the company is striking a balance between reinvesting in growth, and paying dividends. Given the quick rate of earnings per share growth and current level of payout, there may be a chance of further dividend increases in the future.

Bapcor also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. It's hard to grow dividends per share when a company keeps creating new shares.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, six years ago, Bapcor has lifted its dividend by approximately 14% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

Is Bapcor an attractive dividend stock, or better left on the shelf? Bapcor's growing earnings per share and conservative payout ratios make for a decent combination. We also like that it paid out a lower percentage of its cash flow. It's a promising combination that should mark this company worthy of closer attention.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. In terms of investment risks, we've identified 2 warning signs with Bapcor and understanding them should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Bapcor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bapcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:BAP

Bapcor

Supplies vehicle parts, accessories, automotive equipment, and services and solutions in Australia, New Zealand, and Thailand.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026