The Australian market recently experienced a downturn, with the ASX200 closing down 0.24% after a five-day rally, as most sectors faced declines except for Utilities. In such fluctuating conditions, identifying promising investment opportunities requires careful consideration of financial health and growth potential. Penny stocks, though an older term, continue to represent smaller or less-established companies that might offer significant value when they possess strong fundamentals and clear growth paths.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$242.07M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.38M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$327.26M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.615 | A$789.03M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.95 | A$486.42M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aussie Broadband (ASX:ABB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia with a market cap of A$1.06 billion.

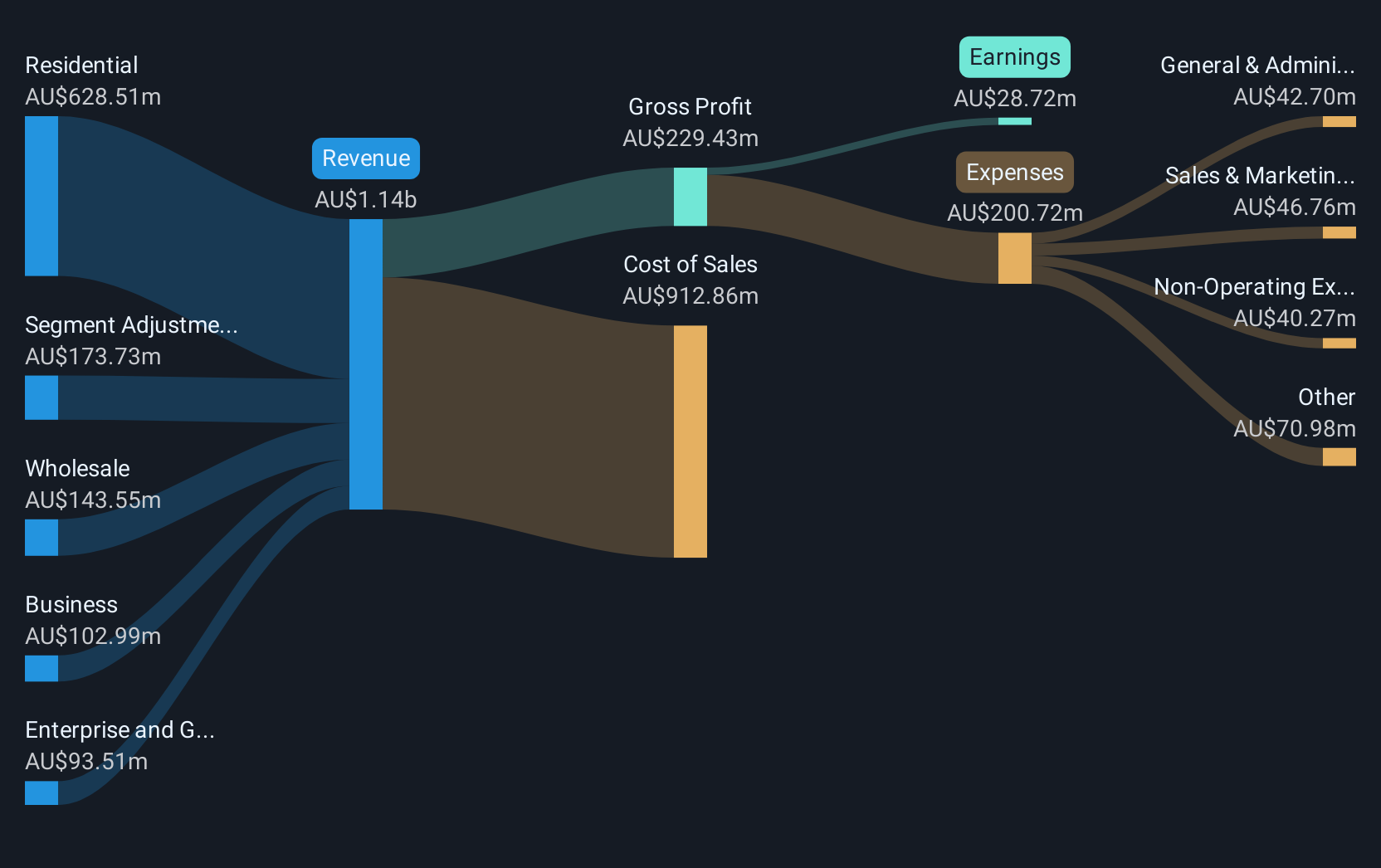

Operations: The company's revenue is derived from several segments, including Residential (A$585.07 million), Wholesale (A$159.73 million), Business (A$96.97 million), Enterprise and Government (A$88.04 million), and Symbio Group (A$69.93 million).

Market Cap: A$1.06B

Aussie Broadband Limited, with a market cap of A$1.06 billion, has recently announced a share buyback program to optimize its capital position and enhance shareholder value. The company shows stable weekly volatility at 4% and satisfactory net debt to equity ratio of 14.6%. However, short-term assets do not cover long-term liabilities (A$401.8M), and shareholders experienced an 8.3% dilution last year due to new shares issued. Despite these challenges, earnings grew by 21.5% over the past year, outpacing the industry average of 2.5%, though still below its five-year growth rate of 69.3%.

- Navigate through the intricacies of Aussie Broadband with our comprehensive balance sheet health report here.

- Examine Aussie Broadband's earnings growth report to understand how analysts expect it to perform.

Articore Group (ASX:ATG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Articore Group Limited operates as an online marketplace for art and design products across Australia, the United States, the United Kingdom, and internationally with a market cap of A$77.89 million.

Operations: The company generates revenue of A$492.99 million from its Redbubble and Teepublic marketplaces.

Market Cap: A$77.89M

Articore Group Limited, with a market cap of A$77.89 million, faces challenges as it remains unprofitable despite generating A$492.99 million in revenue from its Redbubble and Teepublic marketplaces. The company is trading at 82.4% below estimated fair value and has a cash runway exceeding three years even with shrinking free cash flow. Its board lacks experience, averaging 2.2 years tenure, and recent investor activism highlights concerns over strategic direction and profitability potential, urging for board changes to unlock shareholder value. Articore's short-term assets (A$49.8M) do not cover its short-term liabilities (A$68.7M).

- Dive into the specifics of Articore Group here with our thorough balance sheet health report.

- Explore Articore Group's analyst forecasts in our growth report.

VRX Silica (ASX:VRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VRX Silica Limited, along with its subsidiaries, focuses on the exploration and development of mineral properties in Australia, with a market cap of A$27.01 million.

Operations: The company generates revenue from its mineral exploration activities, amounting to A$0.03 million.

Market Cap: A$27.01M

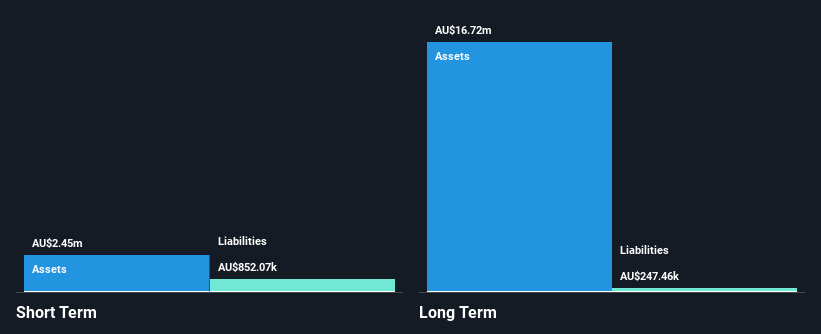

VRX Silica Limited, with a market cap of A$27.01 million, is pre-revenue and unprofitable, having experienced increased losses over the past five years at 4.7% annually. Despite being debt-free for the last five years and having short-term assets (A$2.4M) exceeding both its short and long-term liabilities, VRX has faced shareholder dilution recently due to a follow-on equity offering of A$5 million in December 2024. The company’s cash runway is projected to last six months based on free cash flow estimates but has been bolstered by recent capital raising efforts. Its board is seasoned with an average tenure of 14.3 years.

- Click to explore a detailed breakdown of our findings in VRX Silica's financial health report.

- Learn about VRX Silica's historical performance here.

Make It Happen

- Click here to access our complete index of 1,049 ASX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.