- Australia

- /

- Medical Equipment

- /

- ASX:IPD

ImpediMed Leads Our Trio Of ASX Penny Stock Highlights

Reviewed by Simply Wall St

The Australian market has recently experienced a downturn, with the ASX200 breaking its five-day rally and sectors across the board showing declines. Despite this, opportunities still exist for investors willing to explore lesser-known areas of the market. Penny stocks, though an older term, continue to represent potential growth avenues by focusing on smaller or newer companies that combine affordability with promising fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.38M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$242.07M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.93 | A$486.42M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.08 | A$322.17M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

ImpediMed (ASX:IPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ImpediMed Limited is a medical technology company that manufactures and sells bioimpedance spectroscopy (BIS) medical devices in the United States and Europe, with a market cap of A$107.25 million.

Operations: The company generates revenue of A$10.32 million from its medical segment.

Market Cap: A$107.25M

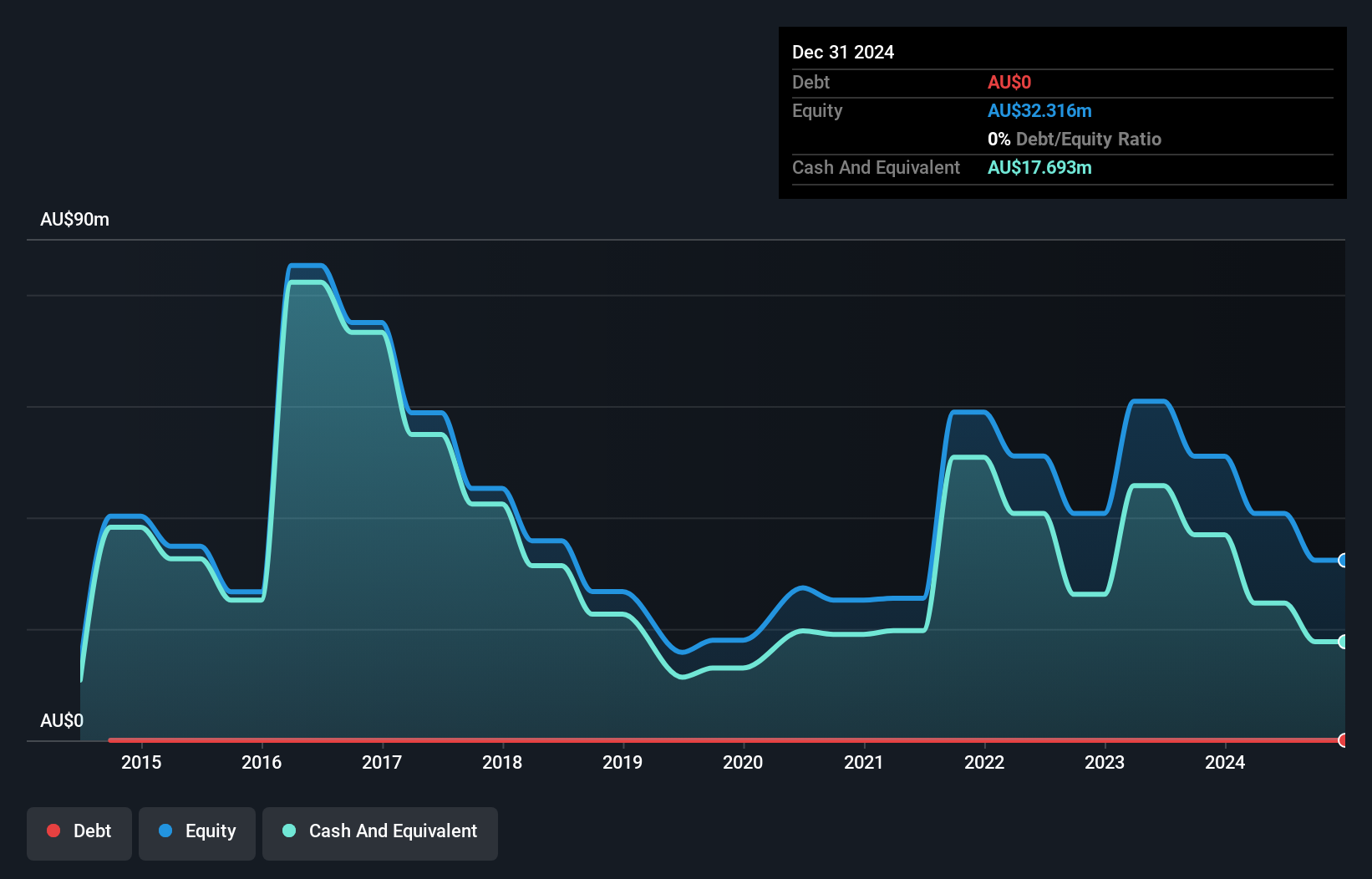

ImpediMed Limited, with a market cap of A$107.25 million, operates in the medical technology sector and generates A$10.32 million in revenue from its medical segment. The company is debt-free and has maintained stable weekly volatility over the past year. Despite being unprofitable, ImpediMed has reduced its losses by 3.2% annually over five years and forecasts earnings growth of 67.52% per year. It has sufficient cash runway for more than a year based on current free cash flow levels, though both its board and management team are relatively inexperienced with short tenures averaging around one year each.

- Click here to discover the nuances of ImpediMed with our detailed analytical financial health report.

- Review our growth performance report to gain insights into ImpediMed's future.

Shaver Shop Group (ASX:SSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shaver Shop Group Limited operates as a retailer of personal care and grooming products in Australia and New Zealand, with a market capitalization of A$174.90 million.

Operations: The company's revenue is primarily derived from retail store sales of specialist personal grooming products, totaling A$219.37 million.

Market Cap: A$174.9M

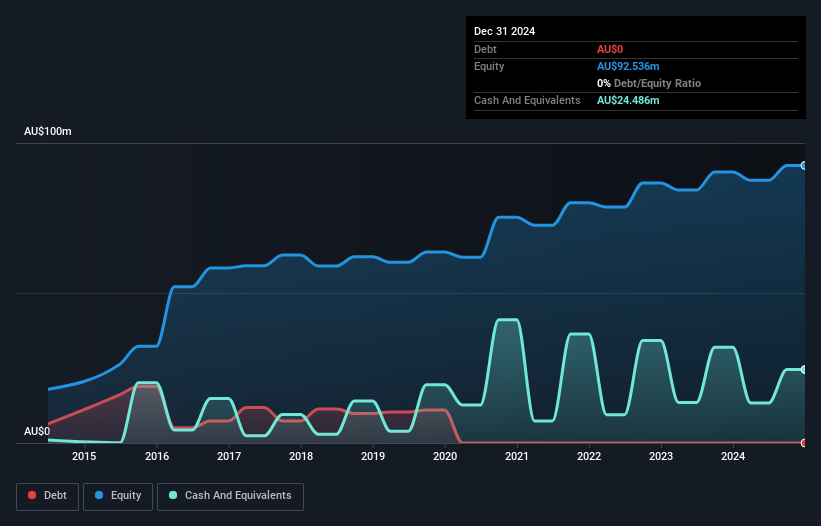

Shaver Shop Group Limited, with a market cap of A$174.90 million, is debt-free and trades at a good value compared to peers. Its earnings have grown by 11.4% annually over the past five years, though recent negative earnings growth (-10.1%) poses challenges in comparing it to industry averages. The company maintains high-quality earnings despite a slight decline in net profit margins from 7.5% to 6.9%. With seasoned management and board members averaging tenures of over eight years, Shaver Shop's short-term assets (A$39.4M) comfortably cover both short-term (A$29.2M) and long-term liabilities (A$10.8M).

- Click to explore a detailed breakdown of our findings in Shaver Shop Group's financial health report.

- Understand Shaver Shop Group's earnings outlook by examining our growth report.

Thorney Technologies (ASX:TEK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thorney Technologies Ltd is an investment company focusing on technology-related businesses, with a market capitalization of A$51.76 million.

Operations: The company's revenue segment is derived solely from its investments, which reported a negative revenue of A$-11.70 million.

Market Cap: A$51.76M

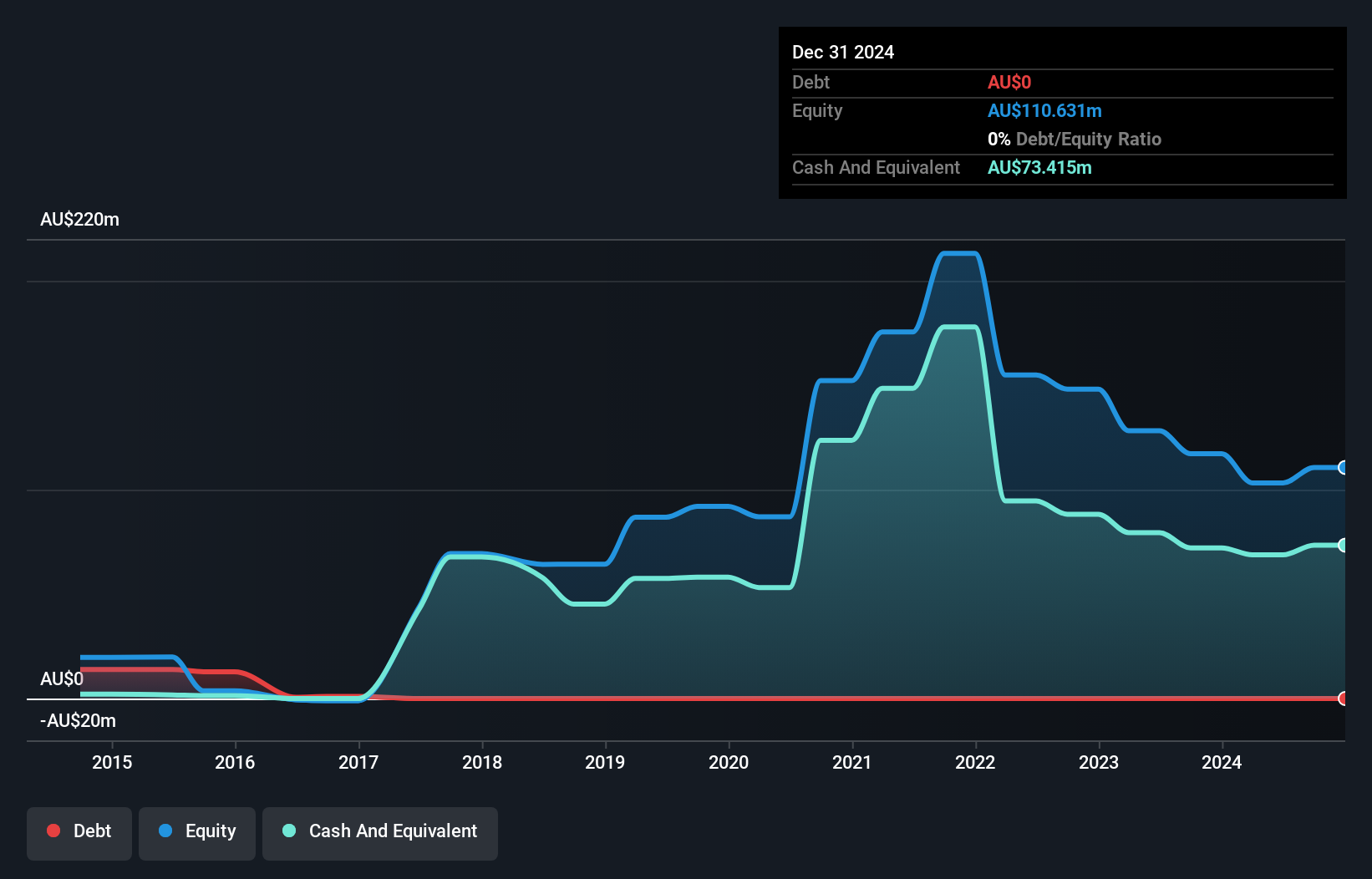

Thorney Technologies Ltd, with a market capitalization of A$51.76 million, focuses on technology-related investments and remains pre-revenue with negative earnings. The company has initiated a share repurchase program to buy back up to 5.08% of its issued shares by October 2025, potentially enhancing shareholder value. Despite being unprofitable and experiencing increased losses over the past five years at a rate of 50.2% annually, Thorney Technologies is debt-free and boasts sufficient cash runway for over three years based on current free cash flow levels. Its board is experienced with an average tenure exceeding eight years, providing stable governance amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Thorney Technologies.

- Learn about Thorney Technologies' historical performance here.

Make It Happen

- Jump into our full catalog of 1,049 ASX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPD

ImpediMed

A medical technology company, manufactures, and sells bioimpedance spectroscopy (BIS) technology medical devices in the Unites States and Europe.

Adequate balance sheet slight.

Market Insights

Community Narratives