- Australia

- /

- Commercial Services

- /

- NSX:SUG

3 ASX Dividend Stocks Yielding Up To 7.7%

Reviewed by Simply Wall St

The Australian market has recently experienced a setback, with the ASX200 down 0.5% to 8,308 points after breaking a five-day rally, as all sectors faced declines amidst cautious consumer spending despite some economic relief measures. In such fluctuating conditions, dividend stocks can offer investors a measure of stability and income potential by providing regular payouts even when market volatility is high.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.35% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.52% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.62% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.79% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.01% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.64% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.18% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.06% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 9.52% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.50% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited offers integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia with a market cap of A$277.06 million.

Operations: Lindsay Australia Limited's revenue is primarily derived from its Transport segment at A$577.36 million, followed by Rural at A$155.44 million and Hunters at A$87.44 million, with a smaller contribution from Corporate at A$4.99 million.

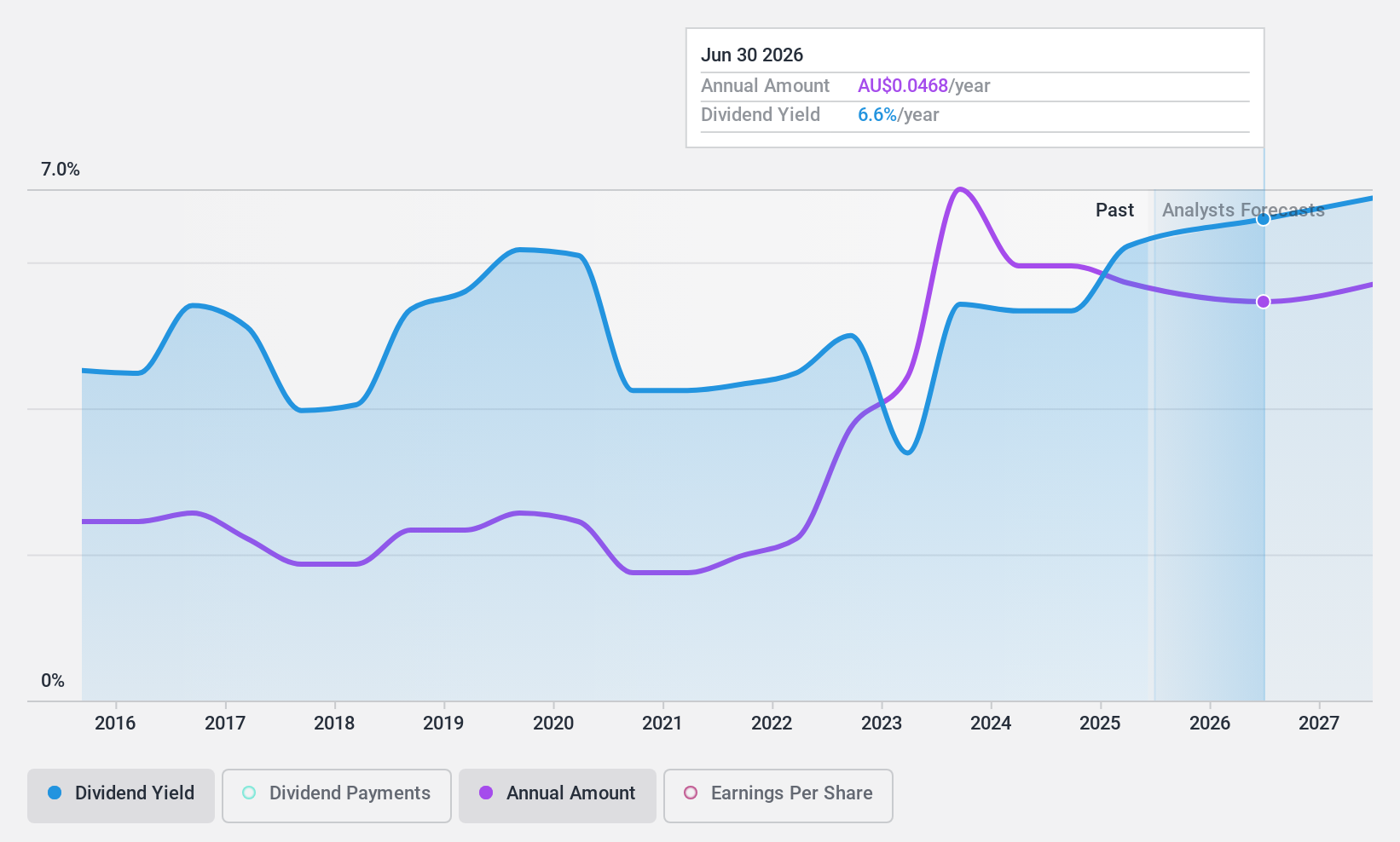

Dividend Yield: 5.6%

Lindsay Australia's dividend sustainability is supported by its payout ratio of 56% and a low cash payout ratio of 18.8%, indicating dividends are well covered by earnings and cash flows. However, the company's dividend history has been unstable over the past decade, with volatility in payments. Despite offering a yield of 5.57%, which is below top-tier Australian payers, it trades at good value compared to peers and industry averages.

- Take a closer look at Lindsay Australia's potential here in our dividend report.

- Our valuation report here indicates Lindsay Australia may be undervalued.

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.29 billion.

Operations: Perenti Limited generates revenue from Drilling Services (A$598.10 million), Contract Mining Services (A$2.54 billion), and Mining Services and Idoba (A$239.06 million).

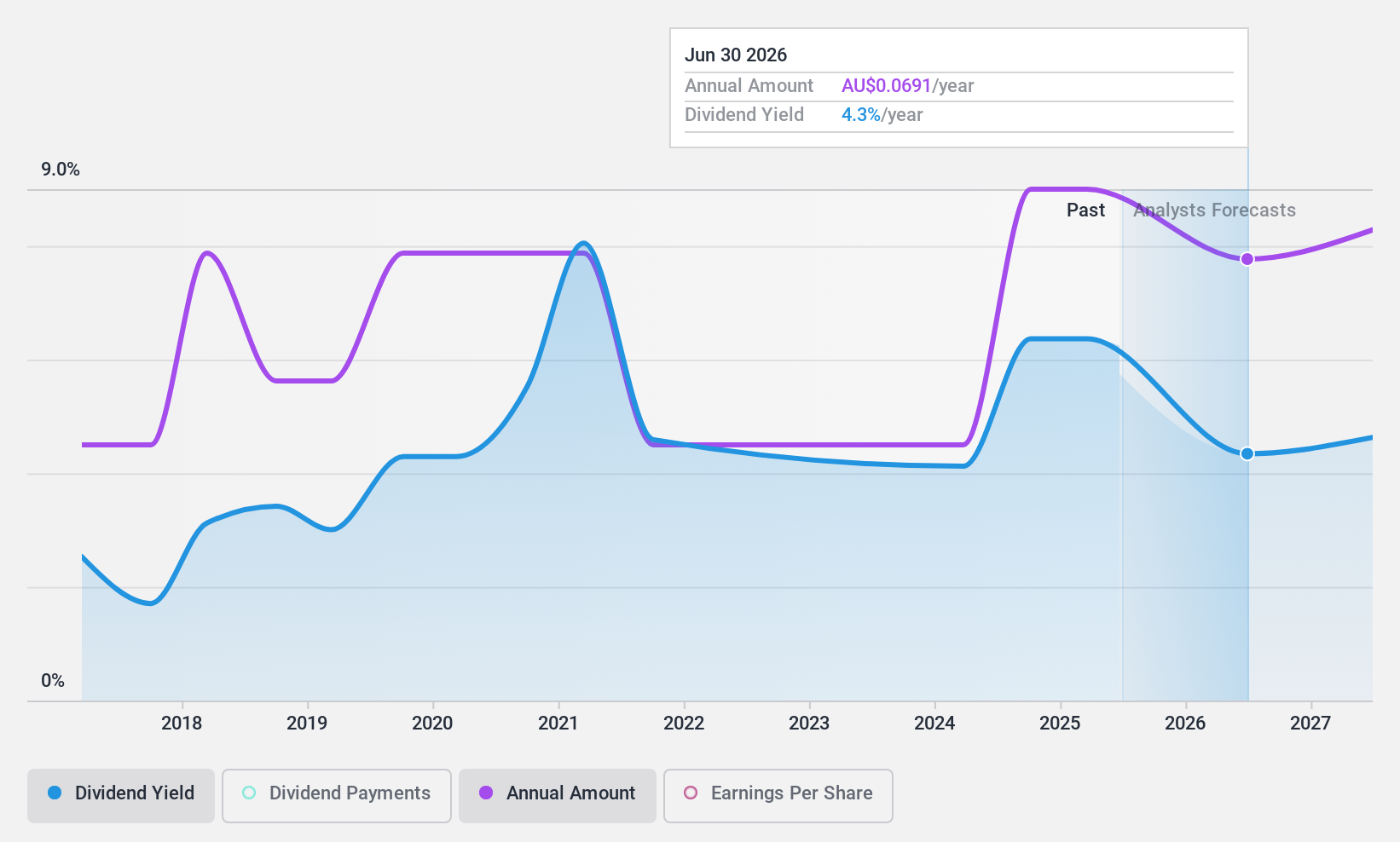

Dividend Yield: 5.7%

Perenti's dividend payments, while covered by earnings and cash flows with payout ratios of 55.3% and 48.2% respectively, have been volatile over the past decade, indicating an unstable track record. The dividend yield of 5.71% is below the top tier in Australia but represents good value as the stock trades significantly below its estimated fair value. Recent presentations at IMARC 2024 highlight a focus on mining electrification and technology advancements, potentially impacting future growth prospects.

- Get an in-depth perspective on Perenti's performance by reading our dividend report here.

- The analysis detailed in our Perenti valuation report hints at an deflated share price compared to its estimated value.

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$379.80 million.

Operations: Sugar Terminals Limited generates revenue of A$115.38 million from the sugar industry segment.

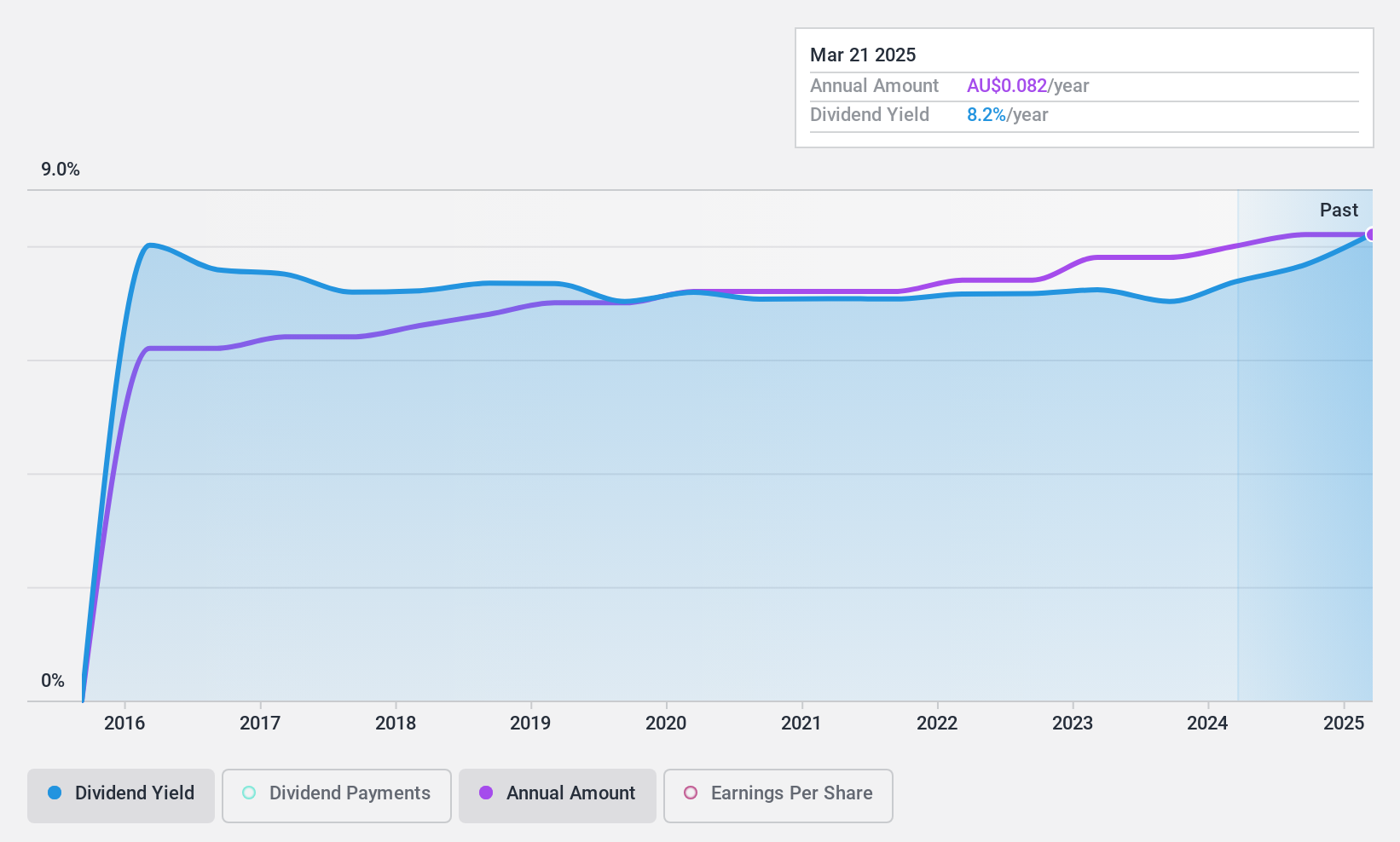

Dividend Yield: 7.8%

Sugar Terminals' dividend yield of 7.77% ranks in the top 25% of Australian dividend payers, supported by a payout ratio of 89.8%, indicating coverage by earnings and cash flows (81.8%). Despite only nine years of payments, dividends have been stable and growing. Trading at a significant discount to its estimated fair value enhances its appeal for value-focused investors. Recent board changes may influence governance, with retirements announced for two directors at the upcoming AGM on November 20, 2024.

- Unlock comprehensive insights into our analysis of Sugar Terminals stock in this dividend report.

- Upon reviewing our latest valuation report, Sugar Terminals' share price might be too pessimistic.

Where To Now?

- Click this link to deep-dive into the 32 companies within our Top ASX Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSX:SUG

Sugar Terminals

Provides storage and handling solutions for bulk sugar and other commodities in Australia.

Flawless balance sheet with solid track record and pays a dividend.