- Australia

- /

- Metals and Mining

- /

- ASX:FAL

3 Promising ASX Penny Stocks With Market Caps Up To A$40M

Reviewed by Simply Wall St

As the Australian market navigates a cautious atmosphere, with eyes on retail sales figures and interest rate speculations, investors are keenly assessing opportunities amid fluctuating conditions. Penny stocks, often associated with smaller or emerging companies, continue to attract attention for their potential to offer growth at lower price points. When backed by robust financial health, these stocks can present compelling opportunities for those looking beyond traditional investment avenues.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.38M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$242.07M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.93 | A$486.42M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.08 | A$322.17M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Algorae Pharmaceuticals (ASX:1AI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Algorae Pharmaceuticals Limited is a pharmaceutical development company focused on the research and development of living cells technologies primarily in New Zealand, with a market cap of A$13.50 million.

Operations: The company generates revenue of A$0.13 million from its research and development activities in living cell technologies.

Market Cap: A$13.5M

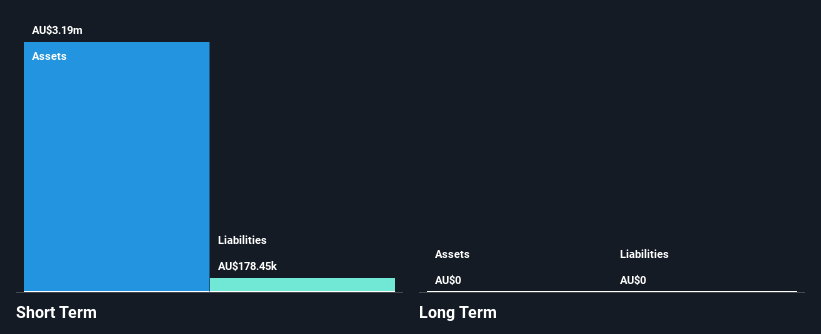

Algorae Pharmaceuticals, with a market cap of A$13.50 million, is a pre-revenue company focused on living cell technologies. Despite having no debt and sufficient cash runway for over a year, its financial performance remains challenging due to unprofitability and declining earnings over the past five years. The management team and board are relatively inexperienced, which could impact strategic direction. While the stock's weekly volatility has stabilized at 21%, it remains higher than most Australian stocks, indicating potential risk for investors seeking stability in penny stocks. Short-term assets comfortably cover liabilities, ensuring some financial resilience amidst volatility concerns.

- Click here to discover the nuances of Algorae Pharmaceuticals with our detailed analytical financial health report.

- Assess Algorae Pharmaceuticals' previous results with our detailed historical performance reports.

Falcon Metals (ASX:FAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Falcon Metals Limited is involved in the discovery, exploration, and development of mineral deposits in Australia, with a market cap of A$23.01 million.

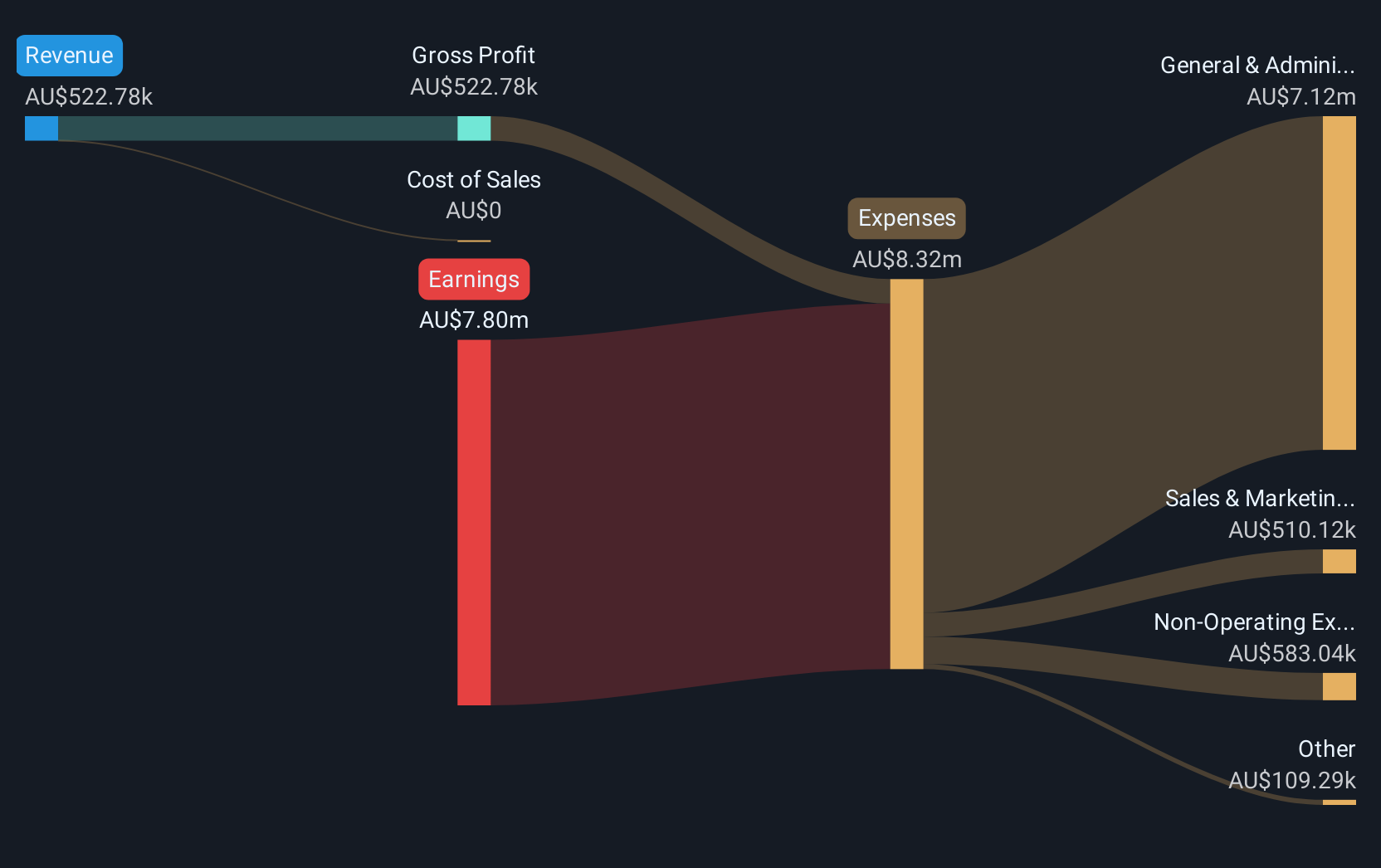

Operations: No revenue segments are reported for Falcon Metals Limited.

Market Cap: A$23.01M

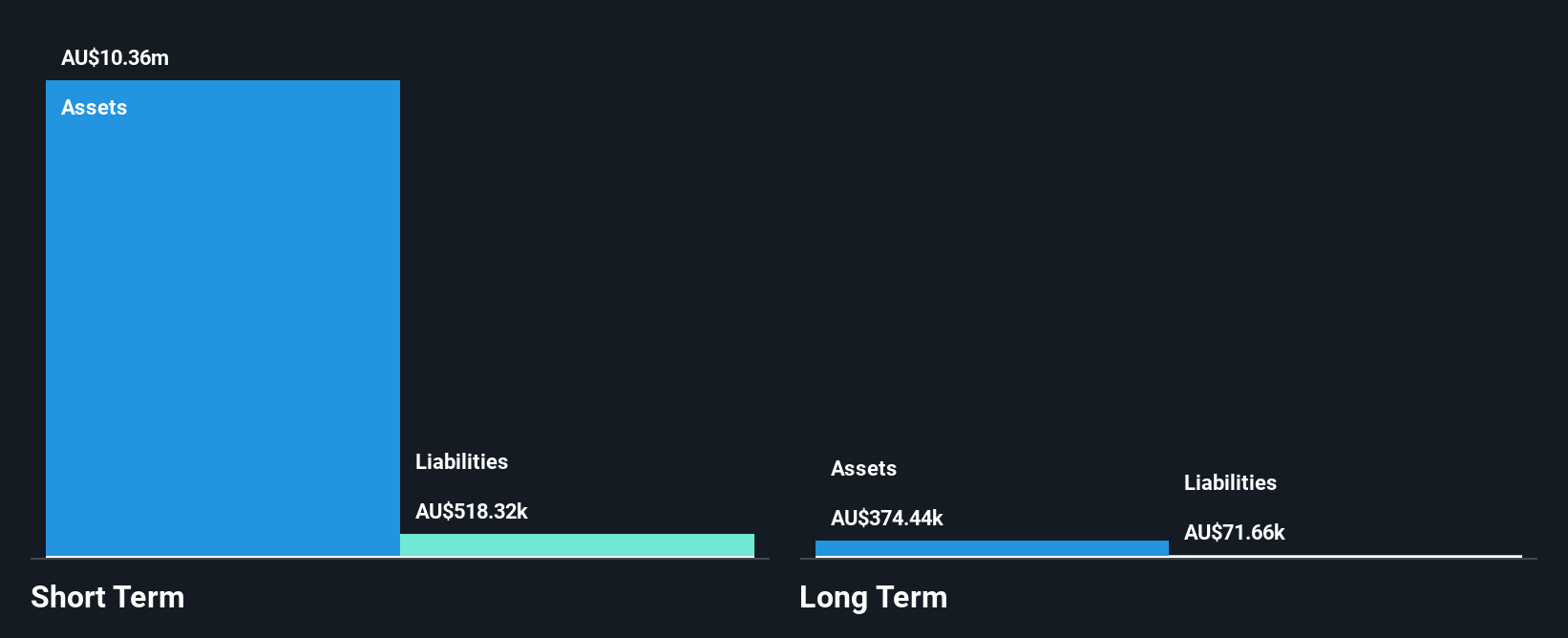

Falcon Metals Limited, with a market cap of A$23.01 million, is pre-revenue and remains unprofitable. The company has no debt and maintains a strong financial position, with short-term assets of A$12.3 million covering both short-term and long-term liabilities comfortably. Its cash runway is sufficient for over two years if free cash flow continues to decline at historical rates. Despite these strengths, Falcon's negative return on equity (-45.48%) reflects ongoing profitability challenges. Recent presentations at industry conferences highlight management's efforts to engage with stakeholders amid decreased stock volatility from 16% to 10% over the past year.

- Unlock comprehensive insights into our analysis of Falcon Metals stock in this financial health report.

- Understand Falcon Metals' track record by examining our performance history report.

S2 Resources (ASX:S2R)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: S2 Resources Ltd is involved in the exploration and evaluation of mineral properties in Australia and Finland, with a market capitalization of A$35.32 million.

Operations: S2 Resources Ltd has not reported any revenue segments.

Market Cap: A$35.32M

S2 Resources Ltd, with a market cap of A$35.32 million, is pre-revenue and unprofitable, yet maintains a debt-free status. Its short-term assets of A$7.1 million exceed both short-term and long-term liabilities, indicating solid financial health despite having less than a year of cash runway at current expenditure rates. The company has not diluted shareholders recently but faces challenges with declining earnings forecasts over the next three years. Recent changes include the resignation of its auditor BDO Audit (WA) Pty Ltd., which may impact investor confidence as it navigates these financial hurdles and strategic decisions at its upcoming AGM.

- Take a closer look at S2 Resources' potential here in our financial health report.

- Gain insights into S2 Resources' future direction by reviewing our growth report.

Summing It All Up

- Unlock our comprehensive list of 1,049 ASX Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Falcon Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FAL

Falcon Metals

Engages in the discovery, exploration, and development of mineral deposits in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives