- Australia

- /

- Specialty Stores

- /

- ASX:APE

Why Eagers Automotive (ASX:APE) Is Up 16.4% After Mitsubishi Partnership and A$501 Million Equity Raise

Reviewed by Sasha Jovanovic

- Eagers Automotive announced a major equity raising and a new strategic partnership with Mitsubishi Corporation, including the issuance of convertible preferred stock and a follow-on equity offering totaling over A$501 million completed in early October 2025.

- This capital injection and institutional backing highlight both significant investor confidence and Eagers Automotive's ambitions to strengthen its expansion, technology investment, and operational capabilities in the Australian automotive sector.

- We'll examine how this Mitsubishi partnership and substantial capital raising influence Eagers Automotive's investment narrative and prospects for future growth.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Eagers Automotive Investment Narrative Recap

To be a shareholder in Eagers Automotive, you need to believe in its ability to leverage scale, execute on technology investments, and capture more of the fast-evolving Australian auto market. The A$501 million capital raise with Mitsubishi Corporation directly supports these ambitions, providing near-term funding to drive expansion, the most important short-term catalyst. However, while this move boosts balance sheet strength, it does not materially reduce the risk that shifting consumer preferences toward online sales and direct-to-consumer models could erode dealership profitability.

Among recent company announcements, the completion of the A$501 million follow-on equity offering is the most relevant to the current news. It immediately enhances financial flexibility, giving Eagers greater room to pursue acquisitions, technology, and efficiencies, areas analysts consider vital for sustaining growth as the market becomes more competitive and consumer behavior continues to shift.

On the other hand, investors should be aware that even with increased funding, the structural risk of shrinking dealership channel margins remains...

Read the full narrative on Eagers Automotive (it's free!)

Eagers Automotive's outlook anticipates A$15.1 billion in revenue and A$358.9 million in earnings by 2028. This forecast is based on a 7.3% annual revenue growth rate and implies an earnings increase of approximately A$151 million from current earnings of A$207.8 million.

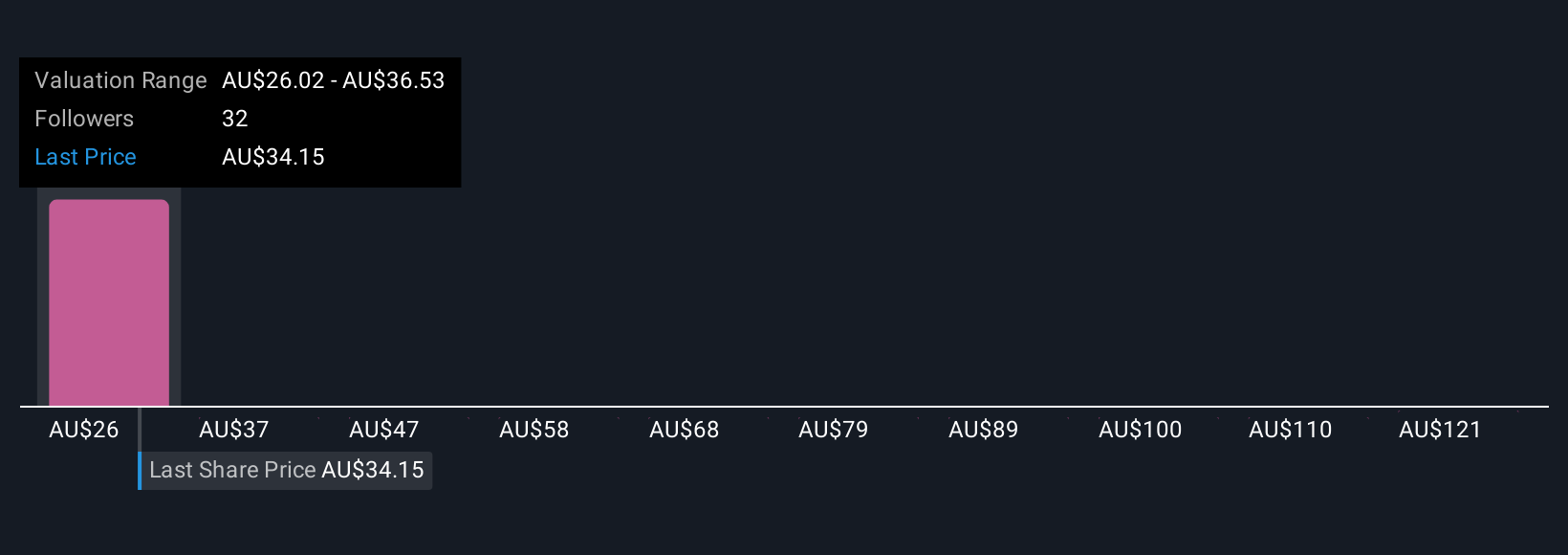

Uncover how Eagers Automotive's forecasts yield a A$26.02 fair value, a 24% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for Eagers Automotive, with targets ranging widely from A$26.02 to A$131.15 per share. This breadth of opinion highlights why focusing on scale, operational efficiency, and adaptation to new auto retail trends is key for the company’s success, so consider reviewing multiple viewpoints on this stock.

Explore 3 other fair value estimates on Eagers Automotive - why the stock might be worth over 3x more than the current price!

Build Your Own Eagers Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eagers Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eagers Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eagers Automotive's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APE

Eagers Automotive

Owns and operates motor vehicle dealerships in Australia and New Zealand.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026