Top 3 Undervalued Small Caps With Insider Action In Australia For September 2024

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the ASX200 closing up 0.58% at 8,091.9 points amid a flurry of earnings reports and flat retail sales data. While sectors like Industrials and Energy posted gains, Consumer Discretionary stocks faced declines, reflecting broader economic uncertainties. In such a dynamic environment, identifying undervalued small-cap stocks with insider action can offer unique opportunities for investors looking to capitalize on potential growth and strategic moves within these companies.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 20.0x | 2.4x | 6.22% | ★★★★★☆ |

| Beach Energy | NA | 1.6x | 31.05% | ★★★★★☆ |

| SHAPE Australia | 13.9x | 0.3x | 35.42% | ★★★★☆☆ |

| Elders | 22.9x | 0.5x | 49.21% | ★★★★☆☆ |

| Lycopodium | 9.6x | 1.4x | 22.54% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 47.74% | ★★★★☆☆ |

| Eagers Automotive | 10.4x | 0.3x | 39.43% | ★★★★☆☆ |

| Credit Corp Group | 20.2x | 2.7x | 41.67% | ★★★★☆☆ |

| Codan | 34.5x | 5.1x | 13.15% | ★★★☆☆☆ |

| Coventry Group | 246.3x | 0.4x | -19.92% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

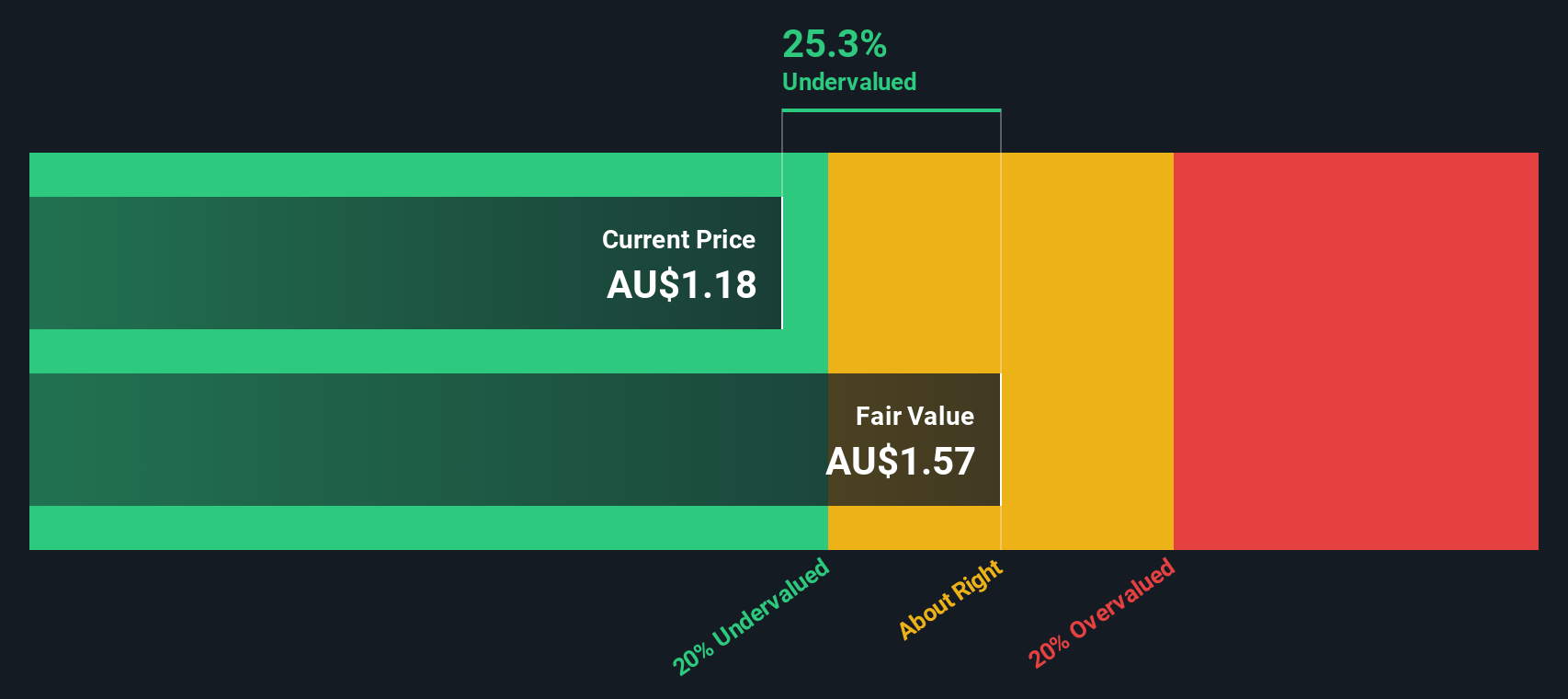

Abacus Group (ASX:ABG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Abacus Group is a diversified property investment company focused on commercial real estate, with a market cap of A$2.50 billion.

Operations: Abacus Group's revenue primarily comes from commercial operations, with recent figures showing A$192.35 million. The company has experienced fluctuations in its net income margin, reaching a peak of 1.3826% in March 2022 but recently falling to -1.2581% by September 2024. Operating expenses have varied, with general and administrative expenses consistently being a significant component.

PE: -4.5x

Abacus Group, a small cap in Australia, recently reported a net loss of A$241.04 million for the year ending June 30, 2024, compared to a net income of A$25.5 million the previous year. Despite this setback, earnings are forecasted to grow by 47.27% annually. Insider confidence is evident with recent share purchases over the past six months. The company announced an ordinary dividend of A$0.0425 per security for H1 2024, highlighting its commitment to returning value to shareholders despite current challenges.

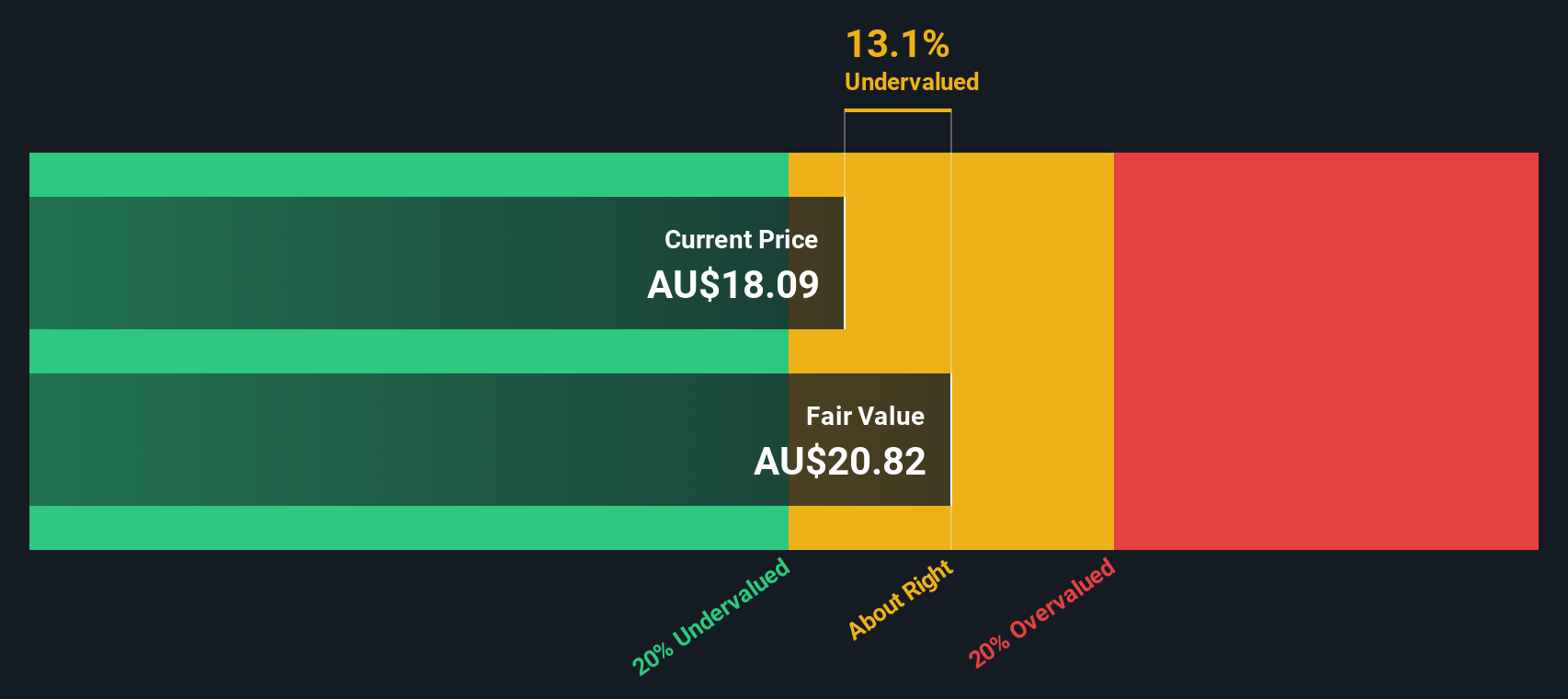

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading automotive retail group in Australia, primarily engaged in car retailing with operations that also include property management, and it has a market cap of A$3.27 billion.

Operations: Eagers Automotive generates revenue primarily from car retailing, which accounted for A$10.50 billion. The company has seen fluctuations in its net income margin, reaching as high as 3.75% and dipping to -1.42%. Operating expenses have varied significantly, with general and administrative expenses being a major component, peaking at A$759.21 million.

PE: 10.4x

Eagers Automotive, a small cap in Australia, reported A$5.46 billion in sales for the half-year ending June 30, 2024, up from A$4.82 billion the previous year. Despite a dip in net income to A$116 million from A$137.76 million, the company announced a dividend of A$0.24 per share and plans to repurchase up to 25.8 million shares by June 2025. Insider confidence is evident with recent purchases indicating potential growth prospects amidst its low-risk funding profile reliant on external borrowing.

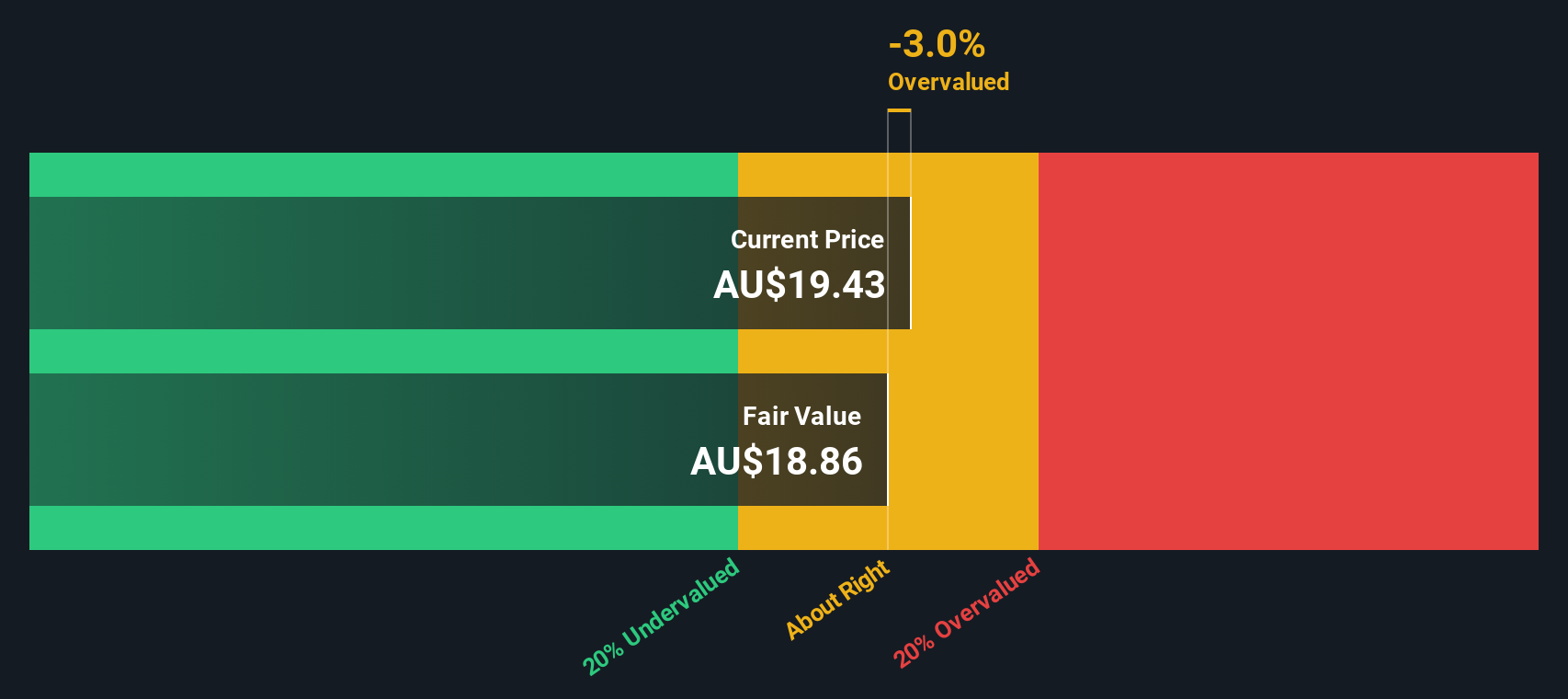

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Codan is a company specializing in metal detection and communications equipment, with a market cap of approximately A$1.28 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with the former contributing A$326.91 million and the latter A$219.85 million. The company has seen fluctuations in its net income margin, which was 0.14847% as of June 30, 2023.

PE: 34.5x

Codan Limited, a small cap in Australia, reported strong financial results for the fiscal year ending June 30, 2024. Sales reached A$550.46 million, up from A$456.5 million the previous year, while net income rose to A$81.39 million from A$67.7 million. Basic earnings per share increased to A$0.45 from A$0.375 a year ago. Notably, insider confidence is evident with recent share purchases by executives in August 2024, signaling potential growth and value recognition within the company’s operations and market position.

- Get an in-depth perspective on Codan's performance by reading our valuation report here.

Gain insights into Codan's past trends and performance with our Past report.

Where To Now?

- Delve into our full catalog of 23 Undervalued ASX Small Caps With Insider Buying here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military groups, government departments, individuals, and small-scale miners.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives