- Australia

- /

- Retail REITs

- /

- ASX:SCG

Scentre Group (ASX:SCG) Reports Strong Earnings and Dividend Growth, Highlighting Robust Financial Health

Reviewed by Simply Wall St

Scentre Group (ASX:SCG) is navigating a period of both promising growth and significant challenges. Recent developments include a 4.2% increase in distributions to security holders and a 3.5% rise in net operating income, contrasted by a substantial AUD 120 million unrealized property revaluation decrease. In the discussion that follows, we will explore Scentre Group's core strengths, financial weaknesses, strategic opportunities, and potential threats to provide a comprehensive overview of the company's current business situation.

Click here and access our complete analysis report to understand the dynamics of Scentre Group.

Strengths: Core Advantages Driving Sustained Success For Scentre Group

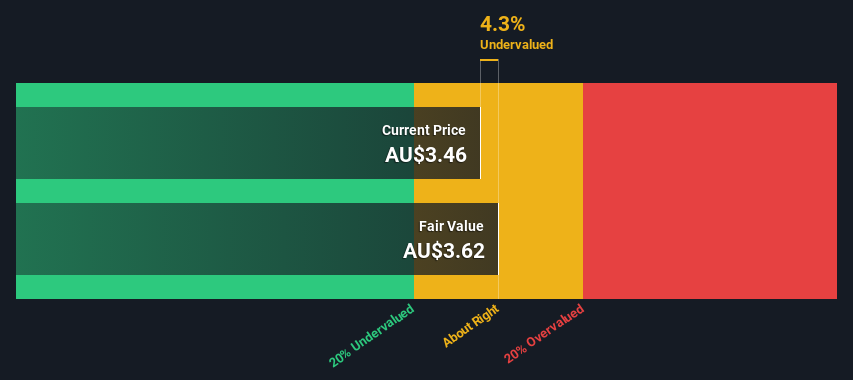

Scentre Group has demonstrated strong financial health, with funds from operations rising to AUD 568 million for the first half, up 2%, and distributions to security holders increasing by 4.2% to AUD 0.086 per security. Net operating income also saw a 3.5% increase, reaching AUD 1.006 billion for the first six months ending June 30, 2024. The company boasts high portfolio occupancy, which improved to 99.3% from 99% a year ago, indicating strong demand from business partners. The strategic land holdings, encompassing over 670 hectares, offer significant long-term growth opportunities. Additionally, Scentre Group is trading below its estimated fair value (AUD 3.65 vs. AUD 3.72), suggesting it is undervalued based on discounted cash flow analysis.

To dive deeper into how Scentre Group's valuation metrics are shaping its market position, check out our detailed analysis of Scentre Group's Valuation.

Weaknesses: Critical Issues Affecting Scentre Group's Performance and Areas For Growth

Scentre Group faces several financial challenges. The increase in property revenue has been partly offset by rising property expenses, primarily due to higher award rates for cleaning and security subcontractors. Project income also declined significantly from AUD 10.6 million to AUD 3 million. The statutory result included an unrealized property revaluation decrease of AUD 120 million, impacting overall profitability. Additionally, while the company is considered a strong performer compared to peers with a Price-To-Earnings Ratio of 44.2x versus 58.5x, it is expensive relative to the Global Retail REITs industry average of 20x.

To gain deeper insights into Scentre Group's historical performance, explore our detailed analysis of past performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Scentre Group has a promising future with several strategic initiatives. The company is progressing a AUD 4 billion pipeline of future retail development opportunities, which could significantly enhance its market position. Joint ventures are also being explored as long-term capital sources. The expansion of the Westfield membership program, now boasting over 4.1 million members, presents additional revenue streams. Sustainability initiatives, such as achieving net zero by 2030 for Scope 1 and 2 emissions, align with global trends and could attract environmentally conscious investors.

Threats: Key Risks and Challenges That Could Impact Scentre Group's Success

Scentre Group faces several external and operational risks. Market challenges and economic factors are impacting investment decisions in retail real estate, as noted by CFO Andrew Clarke. Increased security needs at Westfield destinations pose operational risks and additional costs. Moreover, the potential impact of market conditions on property valuations remains a concern, with recent sales at discounted prices into syndicated funds highlighting this risk. The company's debt is not well covered by operating cash flow, adding to financial vulnerabilities.

Conclusion

Scentre Group's strong financial health, evidenced by rising funds from operations and increased distributions to security holders, underscores its capability to generate consistent income. High portfolio occupancy and strategic land holdings further enhance its long-term growth potential. However, rising property expenses and declining project income present financial challenges that could impact profitability. The company's strategic initiatives, including a substantial retail development pipeline and sustainability efforts, offer promising growth opportunities. Despite its higher Price-To-Earnings Ratio relative to the Global Retail REITs industry average, Scentre Group is considered a strong performer compared to peers and is currently trading below its estimated fair value, suggesting potential for future appreciation. Overall, while there are risks, the company's strategic positioning and financial metrics indicate a favorable outlook for sustained performance.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Scentre Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:SCG

Scentre Group

Owns and operates a leading portfolio of 42 Westfield destinations with 37 located in Australia and five in New Zealand.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives