- Australia

- /

- Specialized REITs

- /

- ASX:NSR

With EPS Growth And More, National Storage REIT (ASX:NSR) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like National Storage REIT (ASX:NSR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for National Storage REIT

National Storage REIT's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, National Storage REIT has achieved impressive annual EPS growth of 41%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

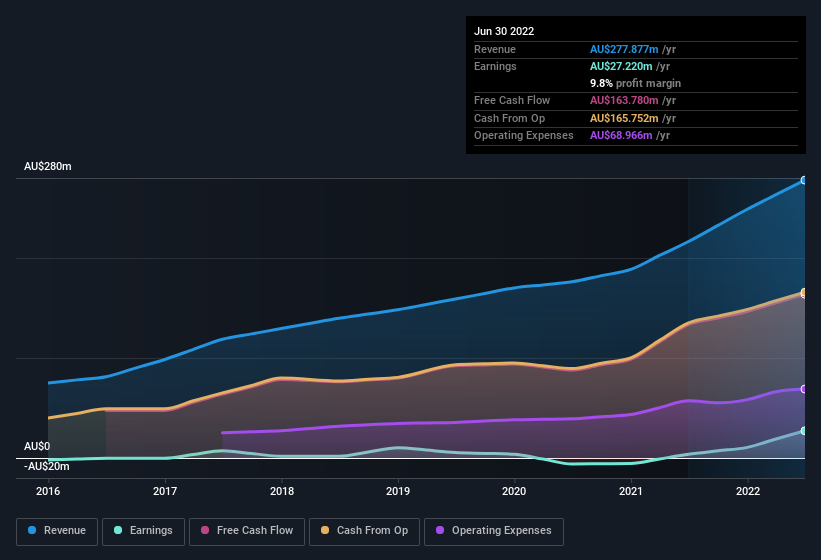

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that National Storage REIT's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note National Storage REIT achieved similar EBIT margins to last year, revenue grew by a solid 28% to AU$278m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of National Storage REIT's forecast profits?

Are National Storage REIT Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in National Storage REIT will be more than happy to see insiders committing themselves to the company, spending AU$304k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Independent Non-Executive Director, Scott Smith, who made the biggest single acquisition, paying AU$243k for shares at about AU$2.43 each.

The good news, alongside the insider buying, for National Storage REIT bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at AU$48m. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 1.7%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is National Storage REIT Worth Keeping An Eye On?

National Storage REIT's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe National Storage REIT deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for National Storage REIT that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, National Storage REIT isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 275 locations providing tailored storage solutions to more than 94,500 residential and commercial customers.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives