- Australia

- /

- Specialized REITs

- /

- ASX:NSR

We Ran A Stock Scan For Earnings Growth And National Storage REIT (ASX:NSR) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in National Storage REIT (ASX:NSR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for National Storage REIT

National Storage REIT's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. National Storage REIT's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

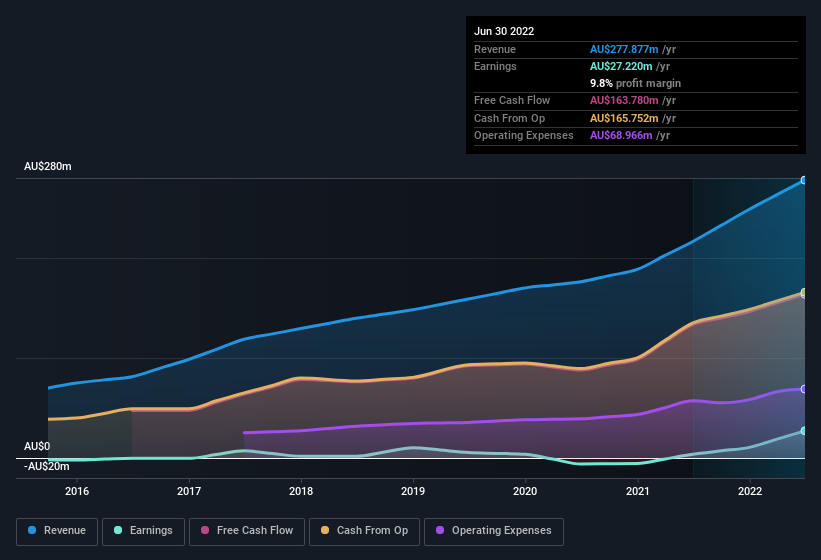

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that National Storage REIT's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. National Storage REIT maintained stable EBIT margins over the last year, all while growing revenue 28% to AU$278m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for National Storage REIT?

Are National Storage REIT Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

National Storage REIT top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Non-Executive Director, Scott Smith, paid AU$243k to buy shares at an average price of AU$2.43. Purchases like this clue us in to the to the faith management has in the business' future.

Along with the insider buying, another encouraging sign for National Storage REIT is that insiders, as a group, have a considerable shareholding. To be specific, they have AU$49m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.6% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does National Storage REIT Deserve A Spot On Your Watchlist?

National Storage REIT's earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe National Storage REIT deserves timely attention. Before you take the next step you should know about the 2 warning signs for National Storage REIT that we have uncovered.

The good news is that National Storage REIT is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 275 locations providing tailored storage solutions to more than 94,500 residential and commercial customers.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026