- Canada

- /

- Capital Markets

- /

- TSX:CVG

Undervalued Small Caps With Insider Buying In Global For March 2025

Reviewed by Simply Wall St

Amidst a backdrop of declining consumer confidence and persistent inflation concerns, global markets have faced volatility, with U.S. small-cap indices like the Russell 2000 experiencing notable declines. As economic uncertainties continue to weigh on investor sentiment, identifying small-cap stocks with strong fundamentals and potential for growth can be crucial in navigating these challenging conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.6x | 5.0x | 24.04% | ★★★★★★ |

| Speedy Hire | NA | 0.2x | 23.97% | ★★★★★☆ |

| Chorus Aviation | NA | 0.4x | 0.24% | ★★★★★☆ |

| Gamma Communications | 22.6x | 2.3x | 35.18% | ★★★★☆☆ |

| 4imprint Group | 16.8x | 1.4x | 33.54% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.9x | 1.9x | 22.04% | ★★★★☆☆ |

| Franchise Brands | 38.6x | 2.0x | 26.08% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.44% | ★★★★☆☆ |

| Yixin Group | 9.0x | 0.9x | -276.32% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.5x | 12.31% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

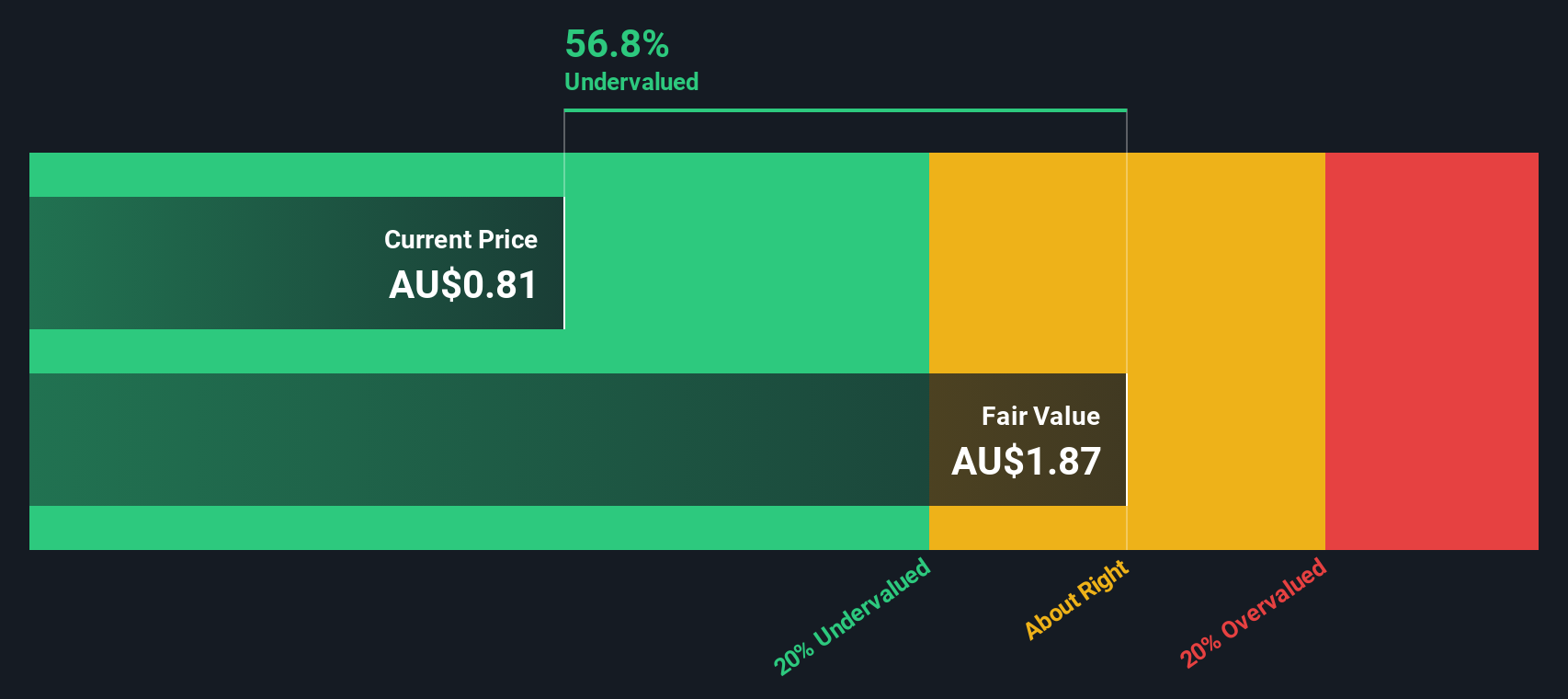

HealthCo Healthcare and Wellness REIT (ASX:HCW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HealthCo Healthcare and Wellness REIT focuses on investing in healthcare and wellness real estate assets, with a market cap of A$0.91 billion.

Operations: HCW generates revenue primarily through its healthcare and wellness real estate investments. The company experienced fluctuations in net income margin, reaching a peak of 1.70% on June 30, 2022, before declining to -5.77% by March 4, 2025. Operating expenses remained relatively stable around A$2.8 million to A$2.9 million over recent periods, while non-operating expenses have significantly impacted net income outcomes across the timeline provided.

PE: -140.0x

HealthCo Healthcare and Wellness REIT, part of the smaller capitalization sector, recently reported a challenging half-year with sales dropping to A$28.3 million from A$39.6 million year-over-year and a net loss widening to A$15.4 million. Despite these hurdles, insider confidence is evident as an individual purchased 100,000 shares for approximately A$101,701 in late 2024, reflecting potential optimism about future growth prospects amidst current financial strains and reliance on external borrowing.

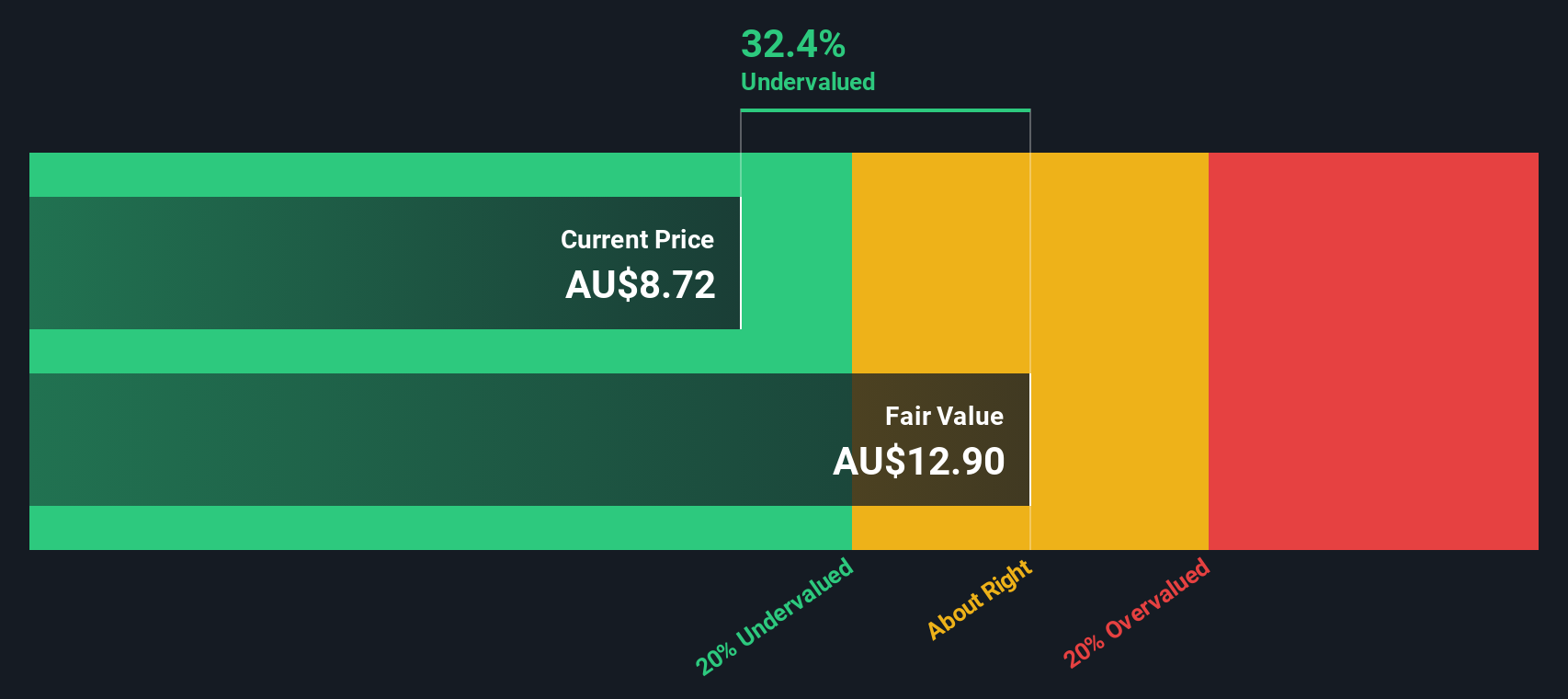

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management firm specializing in global equities and infrastructure strategies, with a market capitalization of A$4.57 billion.

Operations: Fund Investments and Segment Adjustments are the primary revenue streams, contributing significantly to total revenues. The company experienced fluctuations in net income margin, peaking at 69.63% and dipping to 36.83%, reflecting changes in profitability over time. Operating expenses include notable allocations for General & Administrative and Sales & Marketing expenses, impacting overall financial performance.

PE: 6.4x

Magellan Financial Group, known for its dynamic leadership team and strategic growth plans, recently completed a share buyback of 6.9 million shares for A$70.6 million. This reflects insider confidence in the company's potential despite a forecasted earnings decline of 12.3% annually over the next three years. The company reported half-year revenue of A$178.61 million but saw net income dip to A$94.01 million from last year’s A$104.06 million, indicating challenges amidst its evolving executive landscape and investment strategies.

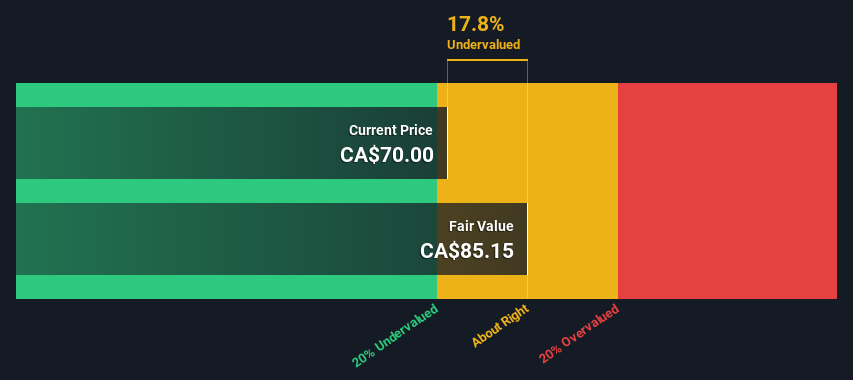

Clairvest Group (TSX:CVG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clairvest Group is a Canadian private equity management firm with a focus on investing in and partnering with entrepreneurial businesses, and it has a market cap of CA$1.16 billion.

Operations: Clairvest Group's revenue model primarily revolves around venture capital activities, generating significant income from its investments. The company consistently achieves a gross profit margin of 100%, indicating that it incurs no cost of goods sold. Operating expenses and non-operating expenses are notable costs impacting net income, with general and administrative expenses being a major component. Over recent periods, the net income margin has shown variability, reflecting fluctuations in profitability due to changing operating conditions and financial strategies.

PE: 7.7x

Clairvest Group, a smaller company in its sector, recently showcased insider confidence with share purchases over the past year. Despite earnings declining by 10.8% annually over five years, the latest quarter saw a turnaround with revenue at C$52.48 million and net income of C$38.45 million compared to losses previously reported. Their reliance on external borrowing poses risk, yet recent financial results suggest potential for recovery and growth in the near term.

- Unlock comprehensive insights into our analysis of Clairvest Group stock in this valuation report.

Evaluate Clairvest Group's historical performance by accessing our past performance report.

Taking Advantage

- Reveal the 114 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Clairvest Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CVG

Clairvest Group

A private equity firm specializing in mid-market, growth equity investments, growth capital, buyouts, and consolidating industries and add-on acquisitions.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives