ASX Undervalued Small Caps With Insider Buying To Watch In January 2025

Reviewed by Simply Wall St

The Australian market has recently experienced a mixed performance, with the ASX200 closing slightly down by 0.12% at 8,399 points amid sector-specific fluctuations driven by external factors such as the rise of Chinese AI company DeepSeek. While sectors like Discretionary and Telecommunication have shown resilience, others like Real Estate and Utilities faced downward pressure, reflecting broader market sentiment that can impact small-cap stocks differently based on their sector exposure and growth potential. In this context, identifying small-cap companies with strong fundamentals and insider buying activity can offer insights into potentially undervalued opportunities amidst current market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 41.1x | 3.7x | 37.29% | ★★★★★☆ |

| Collins Foods | 17.0x | 0.6x | 12.94% | ★★★★★☆ |

| SHAPE Australia | 15.4x | 0.3x | 26.05% | ★★★★☆☆ |

| Dicker Data | 19.6x | 0.7x | -62.55% | ★★★★☆☆ |

| Centuria Capital Group | 20.6x | 4.6x | 49.27% | ★★★★☆☆ |

| Autosports Group | 5.8x | 0.1x | -53.76% | ★★★★☆☆ |

| Abacus Group | NA | 5.4x | 27.93% | ★★★★☆☆ |

| Cromwell Property Group | NA | 4.8x | 23.83% | ★★★★☆☆ |

| Healius | NA | 0.6x | 8.04% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.6x | -4.96% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

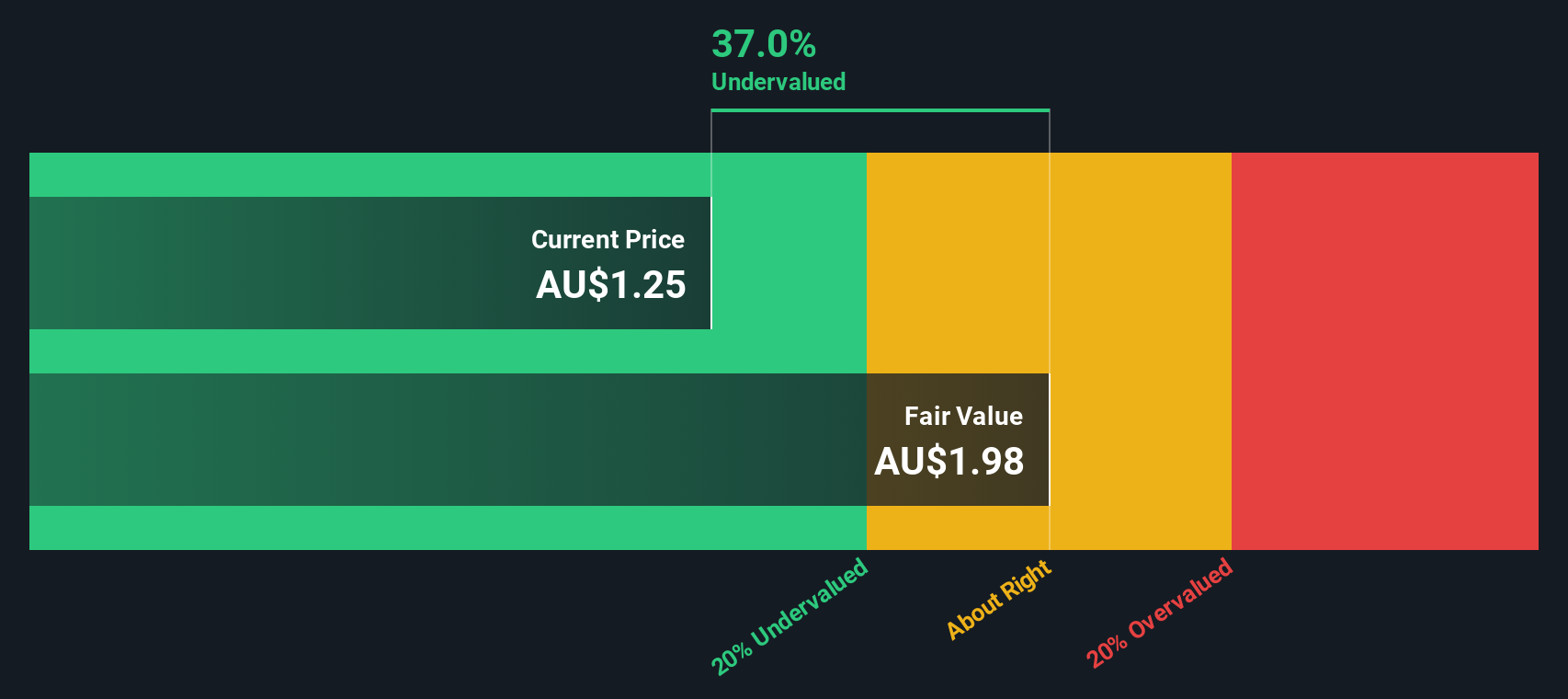

HealthCo Healthcare and Wellness REIT (ASX:HCW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HealthCo Healthcare and Wellness REIT is a real estate investment trust focused on owning, developing, and managing healthcare and wellness properties in Australia, with a market cap of A$1.05 billion.

Operations: HealthCo Healthcare and Wellness REIT generates revenue primarily from its operations, with a notable increase in gross profit margin to 74.58% by mid-2024. The cost of goods sold has seen fluctuations, impacting the company's profitability, while operating expenses have remained relatively stable around A$2.9 million in recent periods. Net income margin has shown a declining trend, reaching 9.58% by early 2025 due to rising non-operating expenses.

PE: 73.1x

HealthCo Healthcare and Wellness REIT, a small cap in Australia, shows insider confidence with recent share purchases by an insider who acquired 100,000 shares for A$101,701. Despite challenges like lower profit margins at 9.6% compared to last year's 42.3%, the company forecasts earnings growth of 39% annually. Recent dividend affirmations indicate stability with a cash dividend of A$0.021 payable in February 2025, suggesting potential for future value appreciation amidst higher-risk external funding sources.

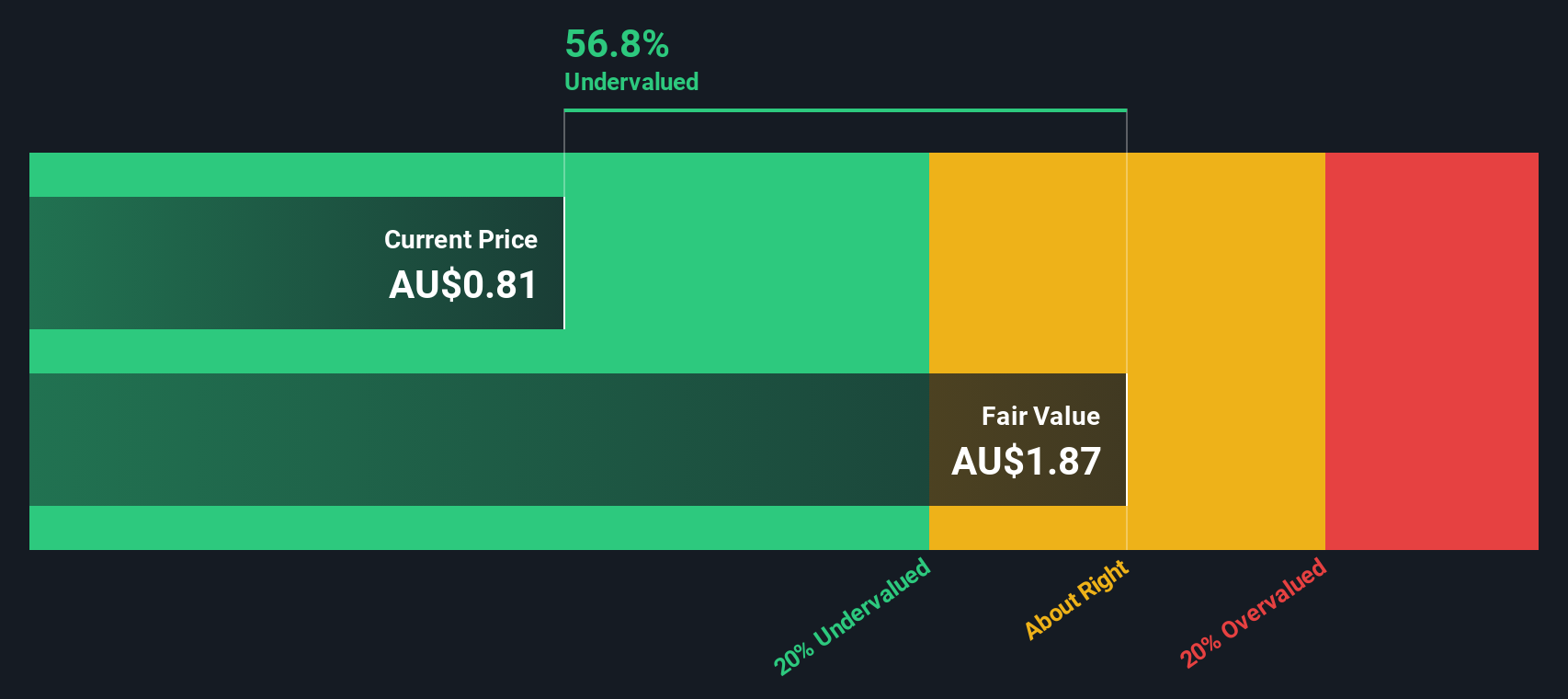

Infomedia (ASX:IFM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Infomedia is a company that specializes in providing software solutions and data analytics to the automotive industry, with a market capitalization of A$0.65 billion.

Operations: Revenue primarily stems from publishing periodicals, with a gross profit margin consistently around 95.41%. Operating expenses include significant allocations to general and administrative costs, which recently reached A$74.38 million. Net income margin has shown variability, currently at 9.01%.

PE: 41.1x

Infomedia, a player in the Australian market, is exploring mergers and acquisitions to enhance shareholder value. Their focus on M&A aligns with a strategy for long-term growth. Despite relying solely on external borrowing for funding, which carries certain risks, Infomedia's earnings are forecasted to grow by 21% annually. Recent insider confidence is evident as they have increased their holdings over the past year. The company's pursuit of strategic investments signals potential future expansion opportunities in its sector.

- Click to explore a detailed breakdown of our findings in Infomedia's valuation report.

Assess Infomedia's past performance with our detailed historical performance reports.

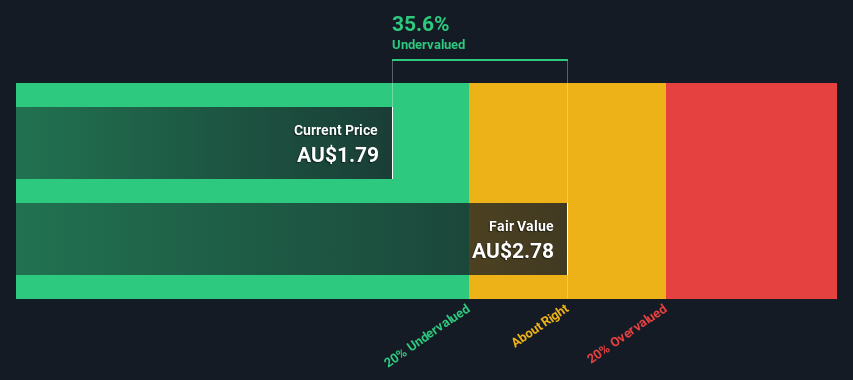

Rural Funds Group (ASX:RFF)

Simply Wall St Value Rating: ★★★★★★

Overview: Rural Funds Group is an agricultural real estate investment trust that operates across various sectors including cattle, almonds, macadamias, vineyards, cropping, and other activities with a market capitalization of A$1.13 billion.

Operations: Rural Funds Group generates revenue primarily from cattle (A$34.97 million) and almonds (A$30.18 million), with additional contributions from macadamias, vineyards, and cropping. The company's gross profit margin has shown a declining trend, reaching 67.02% in the most recent period. Operating expenses have increased over time, impacting net income margins which peaked at 2.47% before decreasing to 0.74%.

PE: 7.6x

Rural Funds Group, a player in the agricultural sector, is currently trading at prices that may not fully reflect its intrinsic value. Despite a forecasted average earnings decline of 6.5% annually over the next three years and profit margins dropping to 74%, insider confidence remains strong with recent share purchases indicating potential belief in future prospects. However, reliance on external borrowing increases financial risk, and earnings are affected by significant one-off items. Recent dividend announcements suggest stable cash flow management amidst these challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Rural Funds Group.

Understand Rural Funds Group's track record by examining our Past report.

Next Steps

- Explore the 22 names from our Undervalued ASX Small Caps With Insider Buying screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives