Assessing GPT Group (ASX:GPT) Valuation After Strong Half-Year Earnings Recovery and Share Price Rally

Reviewed by Simply Wall St

GPT Group (ASX:GPT) just released its half-year earnings, and there is a lot for investors to consider. The headline figure is clear enough, with revenue rising sharply and net income shifting from a loss last year to a solid profit. That kind of turnaround, along with stronger earnings per share, has energized the market and prompted questions about whether this real estate heavyweight is entering a new phase.

This is not simply a one-off increase. GPT Group’s share price has climbed nearly 25% this year, surpassing the broader sector, and the stock is up more than 17% over the past month. The momentum is notable, especially following a challenging period not too long ago. With both sales and profit significantly higher and last year's loss fading from memory, investors are now facing a very different risk profile compared to twelve months ago.

The question remains whether this marks the beginning of a sustained recovery that could make GPT appear attractively valued, or if the market has already priced in expectations for future growth. Let’s examine the numbers to get a clearer sense of where the value may lie.

Most Popular Narrative: 0.5% Undervalued

According to community narrative, GPT Group is viewed as slightly undervalued, with the consensus outlook pointing to near-term fair pricing but long-term upside potential. This assessment brings together analyst forecasts for earnings, revenue growth, and risk factors to estimate today’s fair value.

Forward population growth and ongoing urbanisation in Australia's key cities are likely to support continued strong demand for logistics and prime commercial assets. This would underpin high occupancy rates and rental income growth, ultimately benefiting GPT's recurring revenue and long-term earnings. Surging e-commerce and the associated need for last-mile logistics are driving robust leasing spreads (37% achieved in logistics deals) and maintaining exceptionally low vacancy (2.8%). These trends are expected to deliver continued above-average top-line revenue growth and improved net margins as rent-paying occupancy rises.

Behind this valuation, bold financial projections and sharply higher future margins are creating buzz. Is analyst optimism justified, or do the forecasts hide surprise twists? The real story fueling this price target is more than just headline growth. It is a blend of aggressive profitability and major market trends that investors can't afford to miss.

Result: Fair Value of $5.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, higher costs for office assets and ongoing exposure to the Australian market could challenge GPT Group’s prospects if macroeconomic headwinds intensify.

Find out about the key risks to this GPT Group narrative.Another View: Market Ratio Method Tells a Cautionary Tale

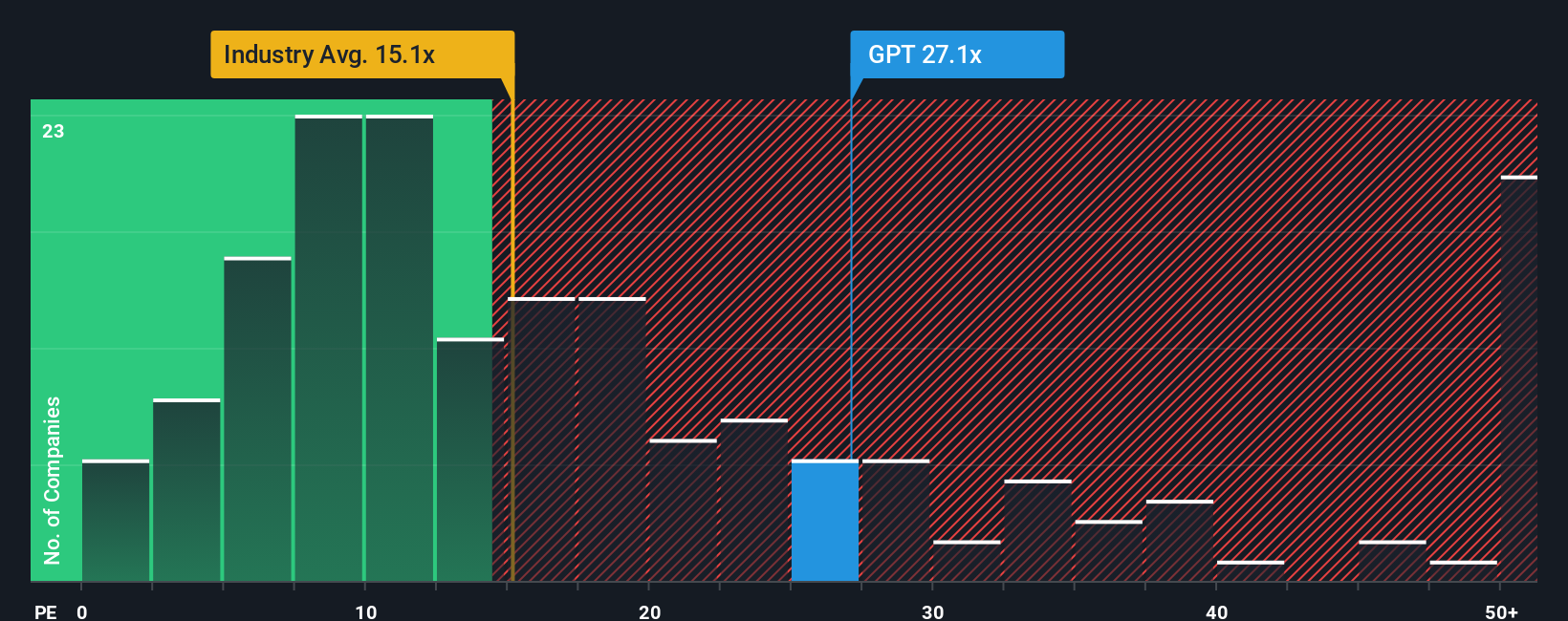

Looking at valuation from a different angle, the market comparison using the price-to-earnings ratio points to GPT trading at a premium relative to the global sector average. This method suggests caution and raises doubts about the stock's current pricing. Is the market overly optimistic, or does growth justify the valuation? The answer may not be clear.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GPT Group Narrative

If you have a different perspective or want to dive deeper into the figures yourself, it's easy to shape your own analysis in just a few minutes. do it your way.

A great starting point for your GPT Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing horizons and stay ahead of the market by tapping into unconventional opportunities and sectors poised for growth. Don’t let these ideas pass you by. Smart moves today could define your returns tomorrow. Check out these handpicked strategies you might be overlooking:

- Unlock steady passive income when you search for dividend stocks with yields > 3% to find companies offering strong yields and sustainable payouts that help your portfolio work harder for you.

- Spot the rising stars of tomorrow by using AI penny stocks to identify companies driving innovation and delivering cutting-edge artificial intelligence solutions across industries.

- Capture the best value for your money by hunting for undervalued stocks based on cash flows that could present rare market opportunities and solid long-term potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GPT

GPT Group

GPT is one of Australia’s leading property groups, with assets under management of $34.1 billion across a portfolio of high quality retail, office and logistics assets.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)