- Australia

- /

- Specialized REITs

- /

- ASX:ASK

Did Surging Earnings and a Full Payout Target Just Shift Abacus Storage King's (ASX:ASK) Investment Narrative?

Reviewed by Simply Wall St

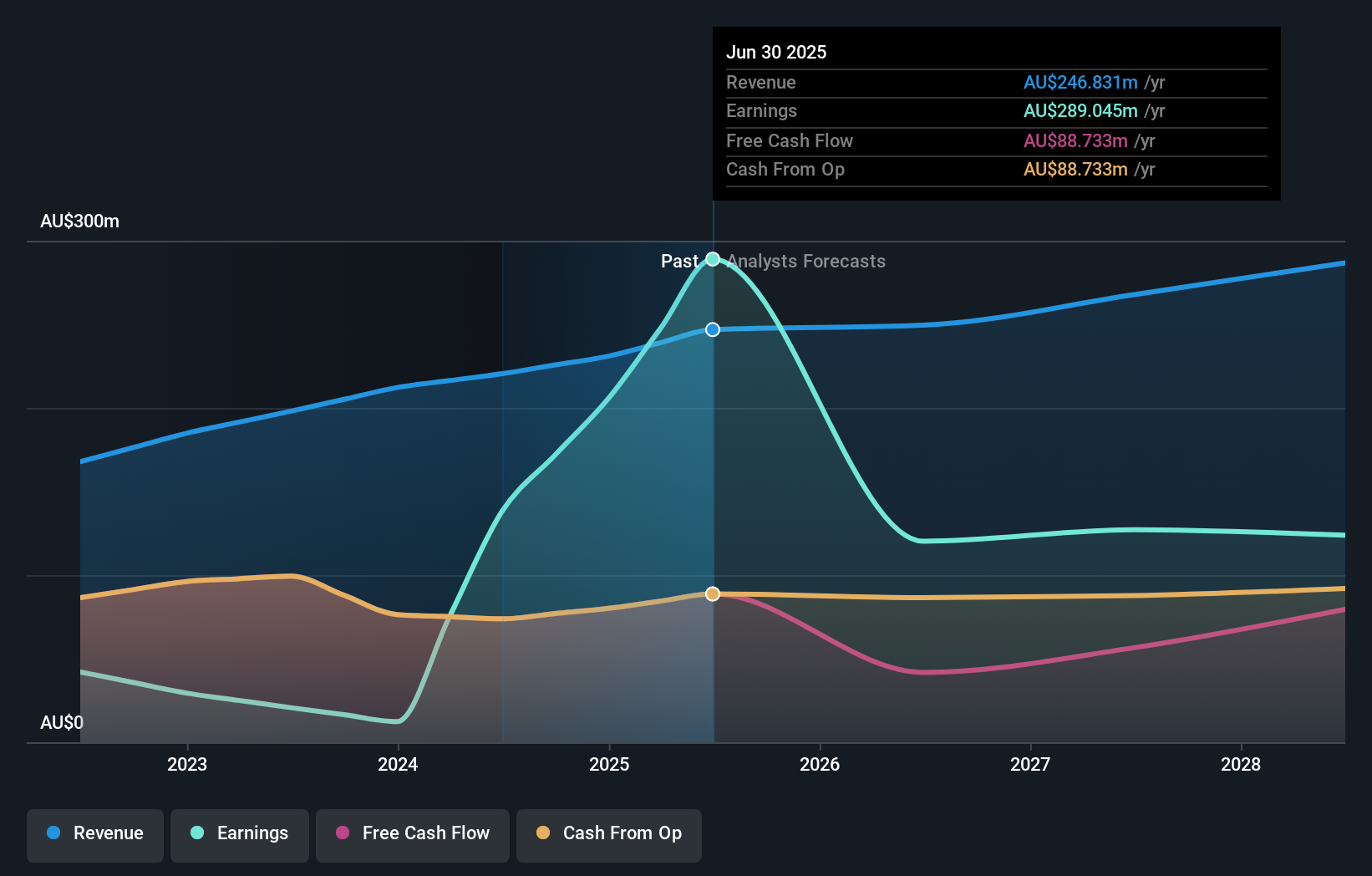

- Abacus Storage King recently reported its results for the year ended June 30, 2025, with revenue rising to A$225.36 million and net income growing to A$289.05 million, along with updated fiscal year 2026 distribution guidance targeting a 90%-100% payout of funds from operations and a fully franked dividend component.

- This combination of significant earnings growth and an ambitious payout target underscores management's confidence in the business’s current cash flow sustainability and shareholder return strategy.

- With management committing to a near full payout of funds from operations, we’ll assess how this shapes Abacus Storage King’s investment narrative amid evolving sector trends.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Abacus Storage King Investment Narrative Recap

To own Abacus Storage King stock, you need to believe in the long-term resilience of self-storage demand, sustained cash flows, and management’s ability to maintain strong occupancy and pricing power. The latest results, substantial earnings growth and a near-total funds from operations payout, support confidence in income returns, but do not change the immediate risks of earnings volatility from one-off gains and future sector oversupply, which remain the most important catalyst and risk in the short term. The impact of this news is material for distribution expectations, yet the sustainability of payouts depends on core earnings quality and demand stability.

Most relevant is the August 13 announcement of Abacus Storage King’s 2026 distribution guidance, targeting a 90 to 100 percent payout of funds from operations alongside a fully franked component. This guidance directly connects to investor focus on yield sustainability, especially as the company’s reported net income included significant non-recurring items, a factor that may cloud the outlook for recurring cash distributions amid sector supply concerns.

However, investors should be aware that despite upbeat payout targets, the risk of oversupply and suppressed rental growth could...

Read the full narrative on Abacus Storage King (it's free!)

Abacus Storage King’s outlook anticipates A$286.8 million in revenue and A$123.2 million in earnings by 2028. This scenario is based on a 5.0% annual revenue growth rate, but implies a significant decline in earnings, down A$165.8 million from the current A$289.0 million.

Uncover how Abacus Storage King's forecasts yield a A$1.65 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate fair value between A$1.65 and A$1.76 per share. While many count on recurring demand for self-storage, you should consider whether occupancy and rental rates can hold up as sector supply increases.

Explore 2 other fair value estimates on Abacus Storage King - why the stock might be worth as much as 14% more than the current price!

Build Your Own Abacus Storage King Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abacus Storage King research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Abacus Storage King research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abacus Storage King's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASK

Abacus Storage King

Owns, operates, and manages a self-storage operating platform in Australia and New Zealand.

Good value with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion