- Australia

- /

- Real Estate

- /

- ASX:SRV

GenusPlus Group And 2 Other Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets react to the looming implementation of new U.S. tariffs, Australian shares are poised to end the week on a somber note, with the ASX 200 futures reflecting a dip similar to other major indices worldwide. In this climate of uncertainty and cautious sentiment, identifying small-cap stocks with solid fundamentals and growth potential can offer intriguing opportunities for investors seeking undiscovered gems like GenusPlus Group and others in Australia.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems across Australia, with a market capitalization of A$816.24 million.

Operations: GenusPlus Group generates revenue primarily from its Infrastructure segment, contributing A$372.42 million, followed by the Industrial and Communication segments at A$187.56 million and A$86.02 million respectively.

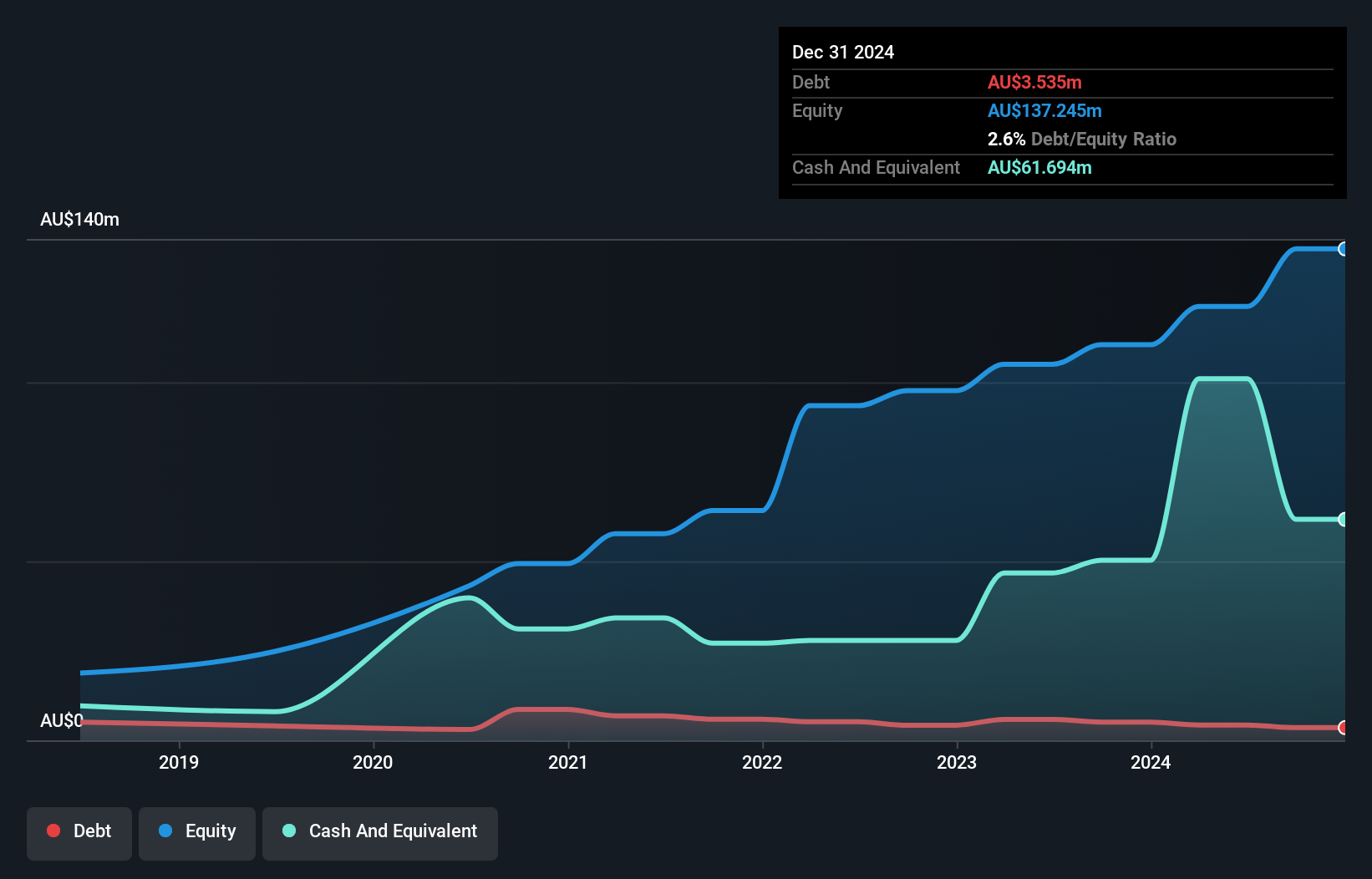

GenusPlus Group, a dynamic player in Australia's construction sector, has seen its earnings grow by 48.7% over the past year, outpacing the industry average of 28.7%. The company’s debt to equity ratio improved significantly from 10.3% to 2.6% over five years, reflecting prudent financial management. Strategic acquisitions like HumeLink and CommTel are set to diversify revenue streams and bolster operations. Despite significant insider selling recently, GenusPlus remains profitable with high-quality earnings and robust interest coverage, suggesting resilience against potential challenges such as acquisition costs and infrastructure investments impacting profit margins currently at 3.8%.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market capitalization of A$594.65 million.

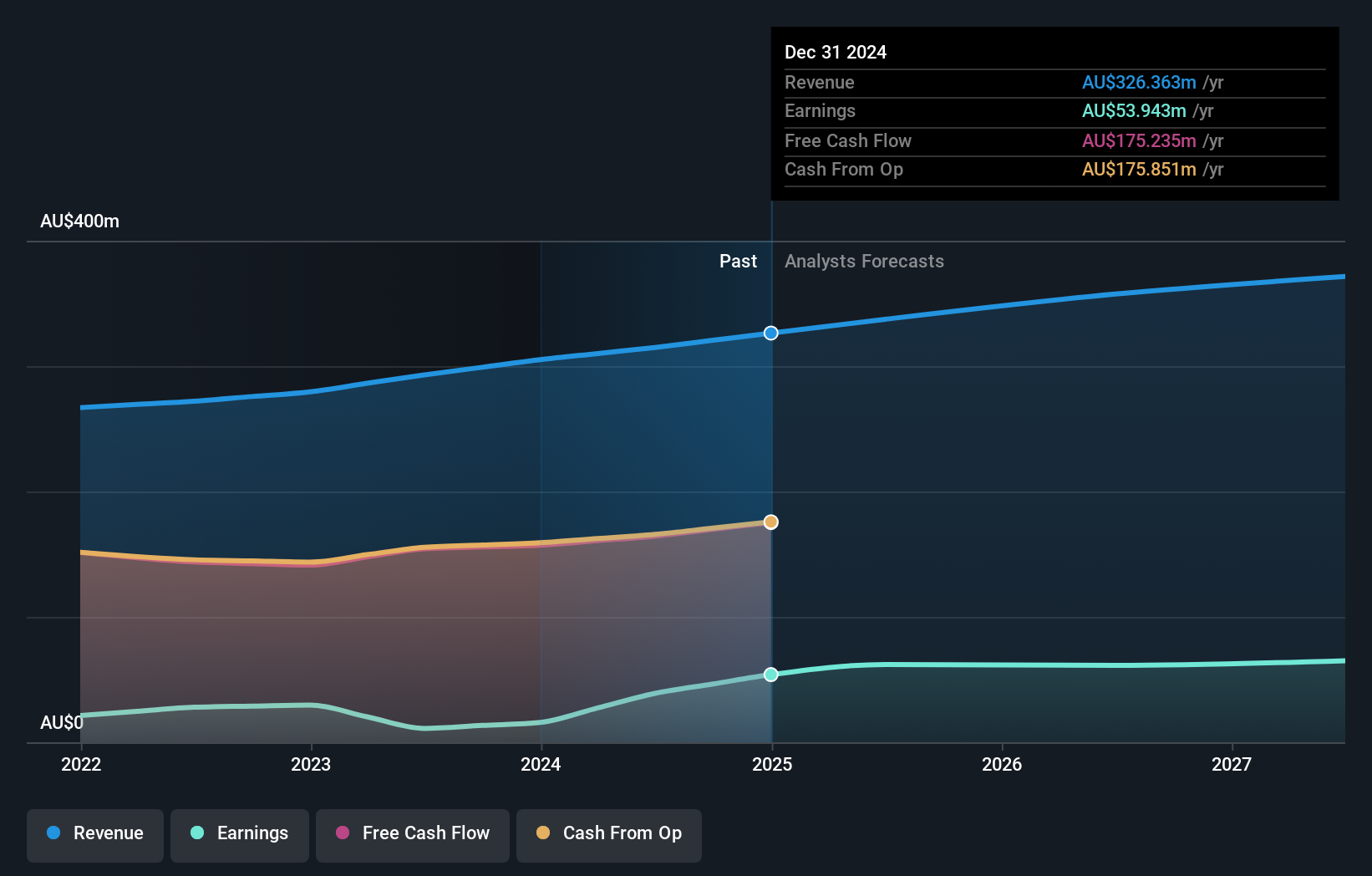

Operations: Servcorp Limited generates revenue primarily from real estate rental, amounting to A$326.36 million. The company's net profit margin is 12%.

Servcorp, a nimble player in the serviced office space, showcases impressive financial metrics with earnings surging 241% last year, far outpacing the real estate industry's -8.3%. The company operates debt-free, which simplifies its financial structure and enhances flexibility. Trading at 81.9% below estimated fair value suggests potential for significant upside. Strategic expansions in Japan and the Middle East alongside investments in AI and IT aim to bolster client retention and operational efficiency. Yet, challenges like high costs and market saturation loom large. Analysts predict a 5.5% annual revenue growth with profit margins inching up to 17.4%.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★★

Overview: United Overseas Australia Ltd, along with its subsidiaries, operates in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia with a market capitalization of A$1.10 billion.

Operations: United Overseas Australia's primary revenue streams are derived from the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia. The company's market capitalization stands at A$1.10 billion.

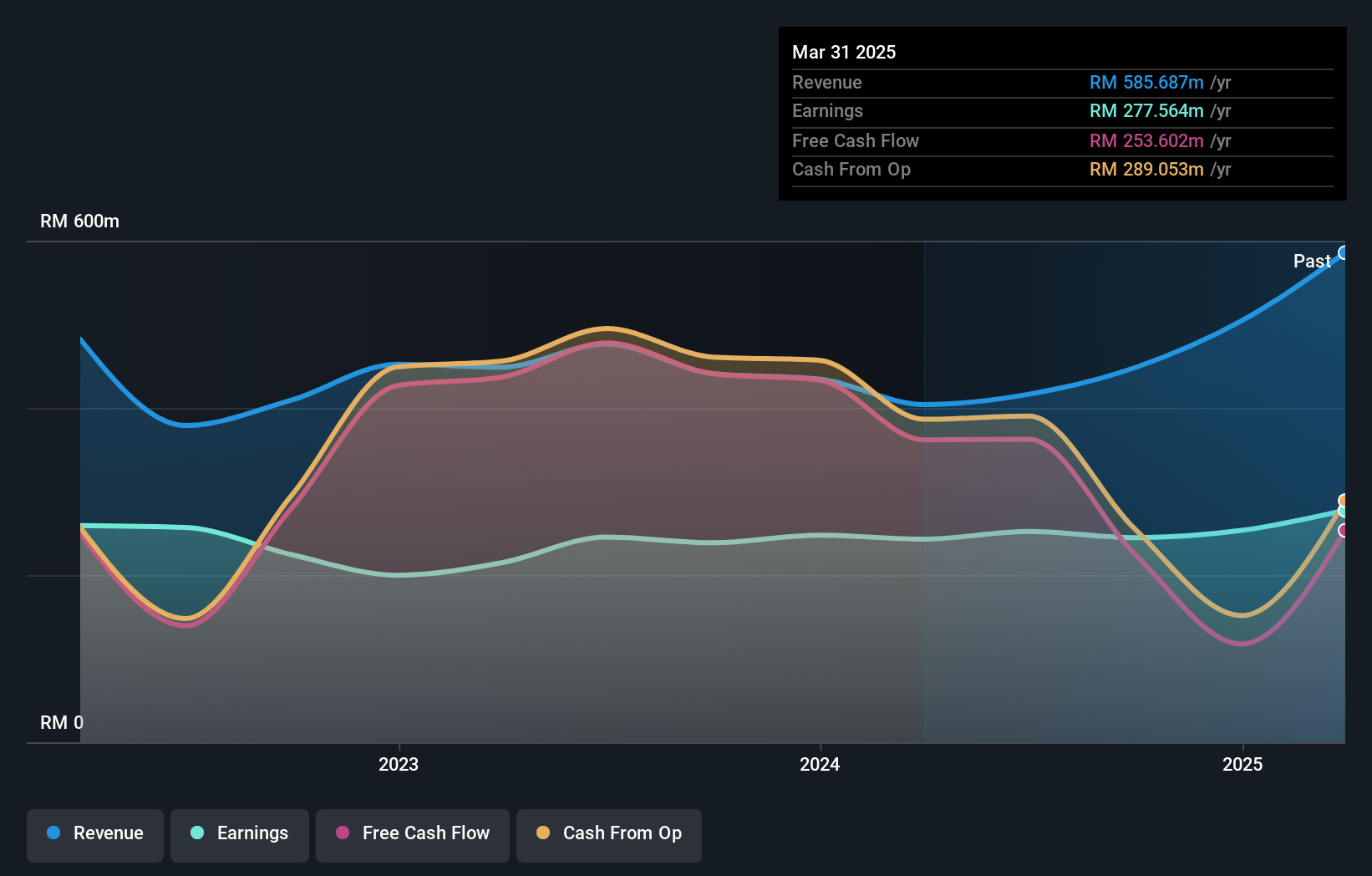

United Overseas Australia stands out with a robust performance, showcasing a debt-to-equity ratio drop from 5.5% to zero over five years, highlighting financial discipline. The company's earnings surged by 14.2%, outpacing the real estate sector's -8.3%. With a price-to-earnings ratio of 11x against the Australian market's 18.9x, it suggests potential undervaluation in A$ terms. Recent earnings reveal sales of MYR 152 million and net income at MYR 74 million for Q1, marking significant growth from last year’s figures of MYR 70 million and MYR 50 million respectively, indicating strong operational momentum in its niche market space.

- Click here to discover the nuances of United Overseas Australia with our detailed analytical health report.

Gain insights into United Overseas Australia's past trends and performance with our Past report.

Key Takeaways

- Click this link to deep-dive into the 49 companies within our ASX Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services in Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and internationally.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion