- Australia

- /

- Real Estate

- /

- ASX:SRV

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market showed resilience today, with the ASX closing around 8,400 points as sectors like discretionary and telecoms led gains. Despite inflation figures sparking little reaction, investor sentiment remains buoyant, particularly in areas like lithium and energy. In this context of cautious optimism, penny stocks—often smaller or newer companies—continue to offer intriguing opportunities for those seeking a blend of affordability and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$147.7M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$67.99M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$322.38M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.64 | A$830.68M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.50 | A$112.83M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$464.71M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Dropsuite (ASX:DSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dropsuite Limited operates a cloud-based software platform globally and has a market capitalization of A$288.06 million.

Operations: The company generates revenue primarily through its provision of backup services, amounting to A$35.46 million.

Market Cap: A$288.06M

Dropsuite Limited, with a market capitalization of A$288.06 million, operates profitably with A$35.46 million in revenue from its cloud-based backup services. Despite being debt-free and having an experienced board, the company faces challenges such as declining net profit margins (2.9% from 7.6% last year) and negative earnings growth over the past year (-48.4%). Recent financial results show a decrease in net income to A$0.273 million for the half-year ending June 2024 compared to A$0.836 million previously, despite increased sales of A$18.9 million from A$14.08 million a year ago.

- Click here and access our complete financial health analysis report to understand the dynamics of Dropsuite.

- Evaluate Dropsuite's prospects by accessing our earnings growth report.

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MotorCycle Holdings Limited operates motorcycle dealerships across Australia and has a market capitalization of A$117.35 million.

Operations: The company's revenue is derived from two primary segments: Retail, contributing A$425.68 million, and Wholesale, accounting for A$156.64 million.

Market Cap: A$117.35M

MotorCycle Holdings, with a market capitalization of A$117.35 million, operates in the motorcycle dealership sector with significant revenue from retail (A$425.68 million) and wholesale (A$156.64 million). Despite experiencing negative earnings growth over the past year (-38.6%), the company has managed to keep its debt well-covered by operating cash flow and interest payments are adequately covered by EBIT at 4.8 times. The recent appointment of Matthew Wiesner as CEO is expected to bring strategic innovation, given his extensive automotive industry experience. However, challenges include high net debt to equity ratio (42.2%) and declining profit margins (2.4% from 4%).

- Take a closer look at MotorCycle Holdings' potential here in our financial health report.

- Gain insights into MotorCycle Holdings' future direction by reviewing our growth report.

Servcorp (ASX:SRV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$464.71 million.

Operations: The company generates revenue from its real estate rental segment, amounting to A$314.89 million.

Market Cap: A$464.71M

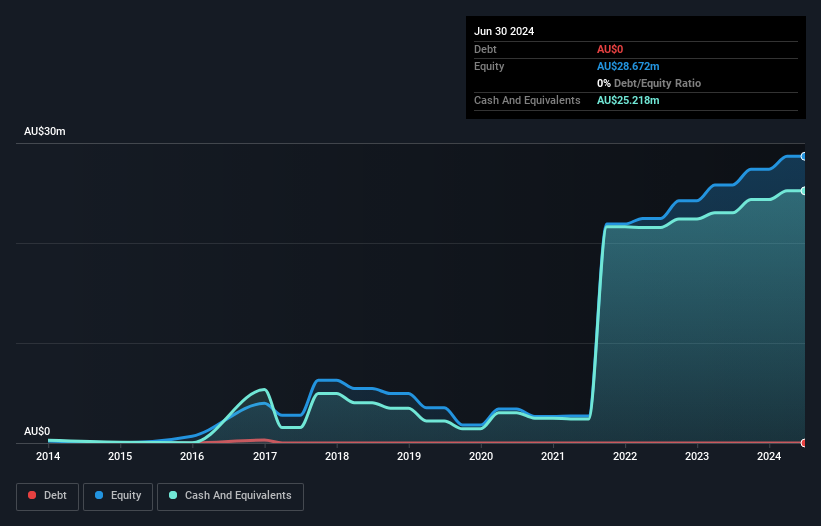

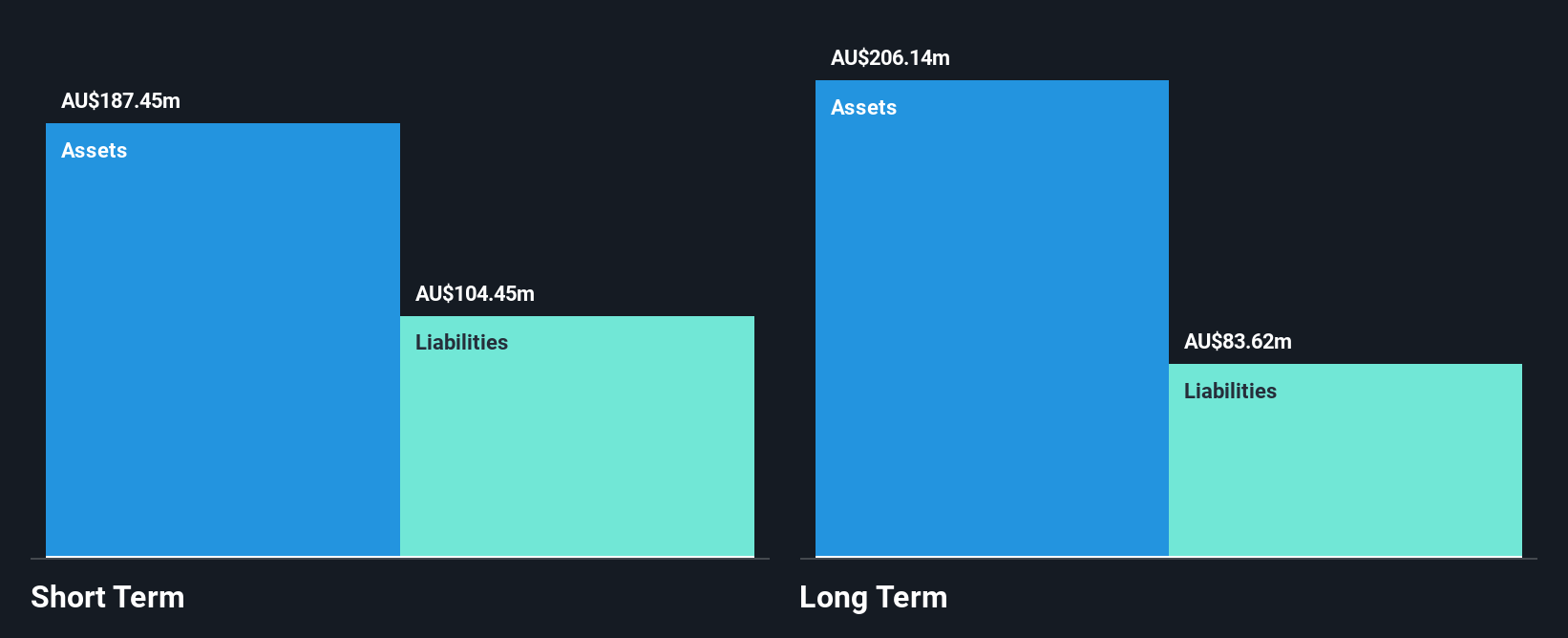

Servcorp Limited, with a market cap of A$464.71 million, stands out in the penny stock arena due to its high-quality earnings and debt-free status. Despite trading at 82.5% below estimated fair value, it faces challenges with short-term assets (A$159.7M) not covering liabilities (A$201.1M). The company has shown impressive earnings growth of 252.7% over the past year, surpassing industry averages, supported by a strong management team with an average tenure of 20 years and a high return on equity at 20.1%. However, its dividend track record remains unstable amidst these dynamics.

- Click here to discover the nuances of Servcorp with our detailed analytical financial health report.

- Assess Servcorp's future earnings estimates with our detailed growth reports.

Where To Now?

- Click through to start exploring the rest of the 1,044 ASX Penny Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRV

Servcorp

Provides executive serviced and virtual offices, coworking and IT, communications, and secretarial services.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives