3 ASX Stocks Estimated To Be Up To 22.1% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it has risen 8.0% over the past 12 months with earnings expected to grow by 13% per annum over the next few years. In this context, identifying undervalued stocks can be crucial for investors looking to capitalize on potential gains while navigating a relatively stable yet promising market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Regal Partners (ASX:RPL) | A$3.25 | A$6.36 | 48.9% |

| Shine Justice (ASX:SHJ) | A$0.70 | A$1.32 | 46.9% |

| Nanosonics (ASX:NAN) | A$2.99 | A$5.85 | 48.9% |

| Infomedia (ASX:IFM) | A$1.62 | A$3.07 | 47.2% |

| HMC Capital (ASX:HMC) | A$7.50 | A$13.79 | 45.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Life360 (ASX:360) | A$15.17 | A$28.27 | 46.3% |

| Lovisa Holdings (ASX:LOV) | A$30.94 | A$57.21 | 45.9% |

| Little Green Pharma (ASX:LGP) | A$0.097 | A$0.17 | 42.7% |

| Sandfire Resources (ASX:SFR) | A$8.42 | A$16.79 | 49.8% |

Let's dive into some prime choices out of the screener.

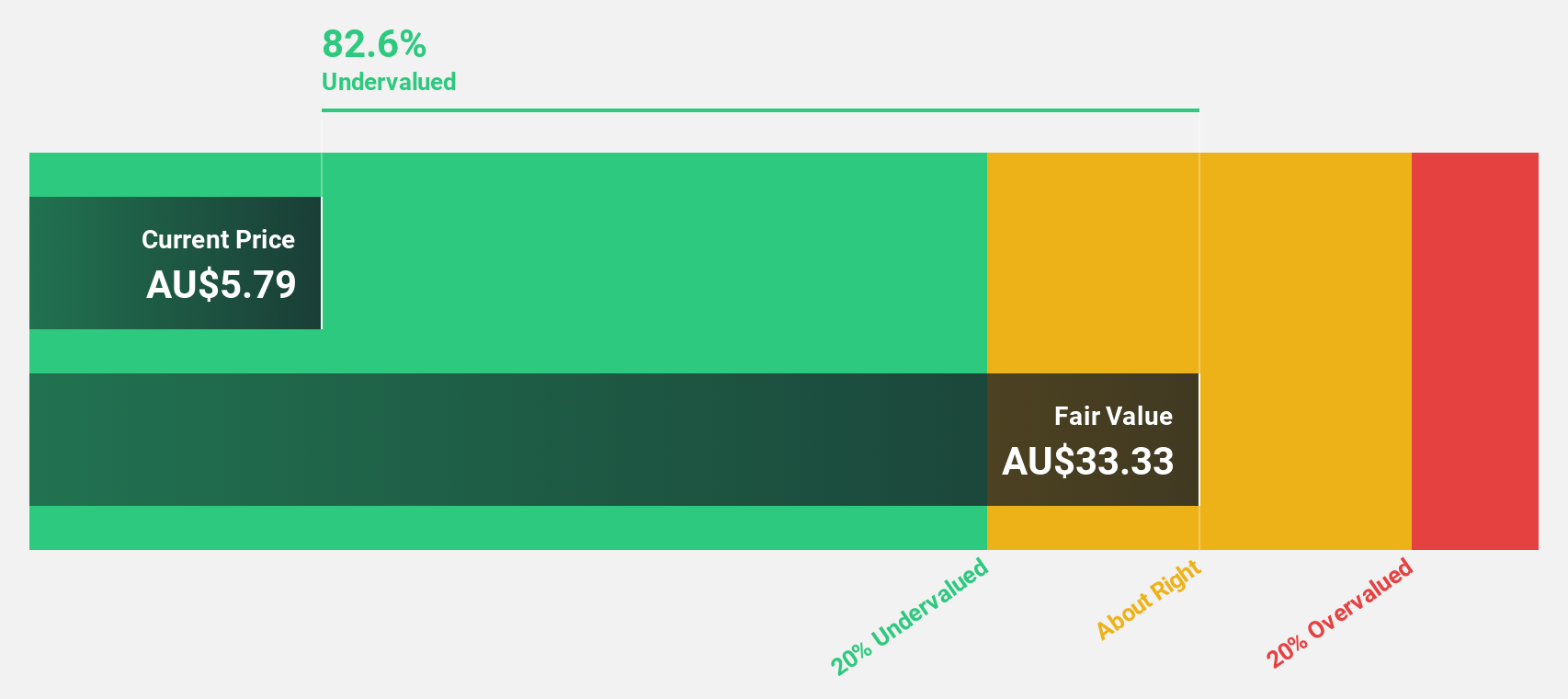

Aussie Broadband (ASX:ABB)

Overview: Aussie Broadband Limited (ASX:ABB) offers telecommunications services to residential and business customers in Australia, with a market cap of A$883.60 million.

Operations: Aussie Broadband's revenue segments include Business (A$94.21 million), Wholesale (A$125.25 million), Residential (A$549.59 million), and Enterprise and Government (A$85.85 million).

Estimated Discount To Fair Value: 10.4%

Aussie Broadband appears undervalued based on discounted cash flow analysis, trading at A$2.99 against a fair value estimate of A$3.34. Despite recent shareholder dilution, the company’s earnings grew by 83.8% last year and are forecasted to grow 23.69% annually over the next three years, outpacing the Australian market's growth rate. Recent activities include a $120 million equity raise for acquisitions or further investments in its fibre assets and residential revenue streams remaining dominant.

- According our earnings growth report, there's an indication that Aussie Broadband might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Aussie Broadband.

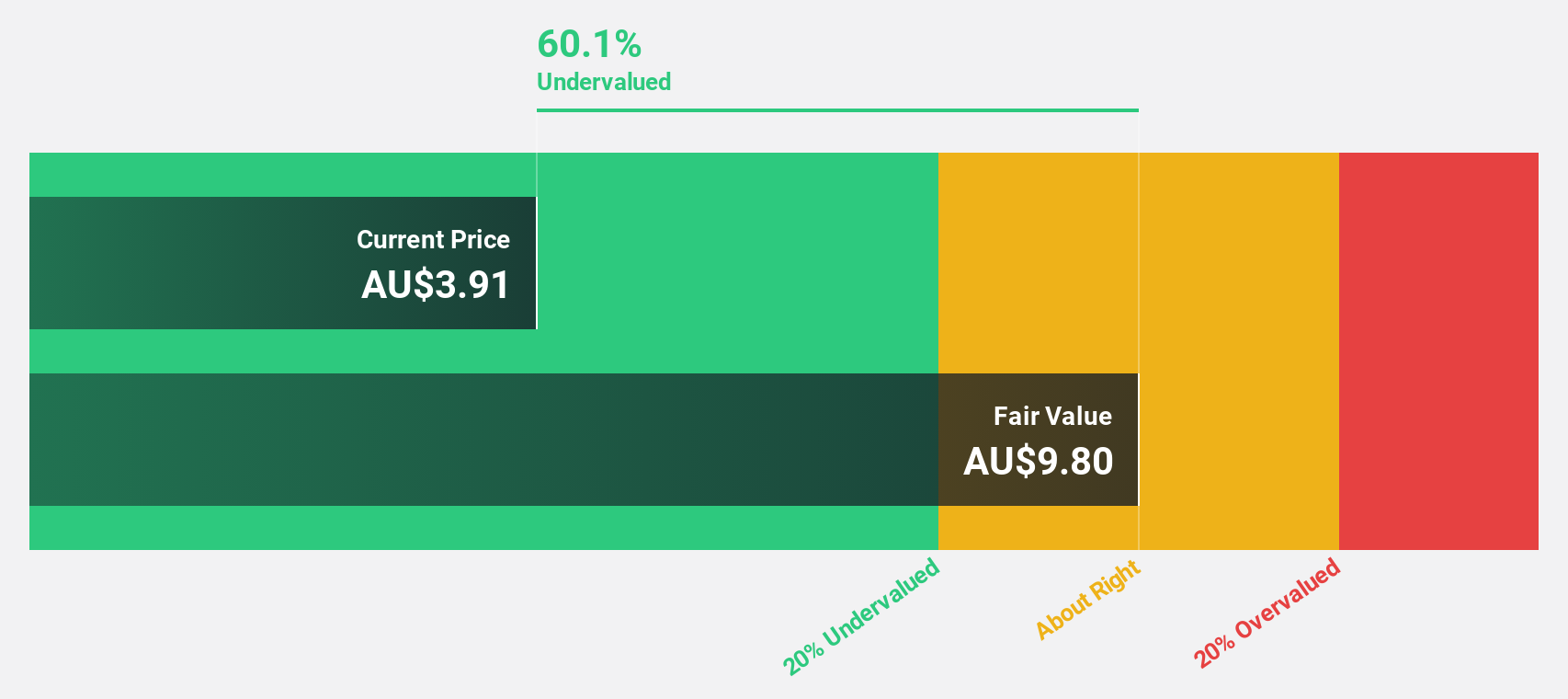

Navigator Global Investments (ASX:NGI)

Overview: Navigator Global Investments (ASX:NGI), formerly HFA Holdings Limited, operates as a fund management company in Australia with a market cap of A$816.04 million.

Operations: Navigator Global Investments generates revenue primarily from its Lighthouse segment, which accounts for $120.49 million.

Estimated Discount To Fair Value: 22.1%

Navigator Global Investments is trading at A$1.67, significantly below its estimated fair value of A$2.14, suggesting it may be undervalued based on cash flows. Despite a recent decline in profit margins from 55.4% to 11.1% and substantial shareholder dilution over the past year, NGI's earnings are forecast to grow significantly at 34.7% annually, faster than the Australian market's average of 13.3%. Revenue growth is expected at 14.6% per year, outpacing the market's 5.1%.

- Our expertly prepared growth report on Navigator Global Investments implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Navigator Global Investments here with our thorough financial health report.

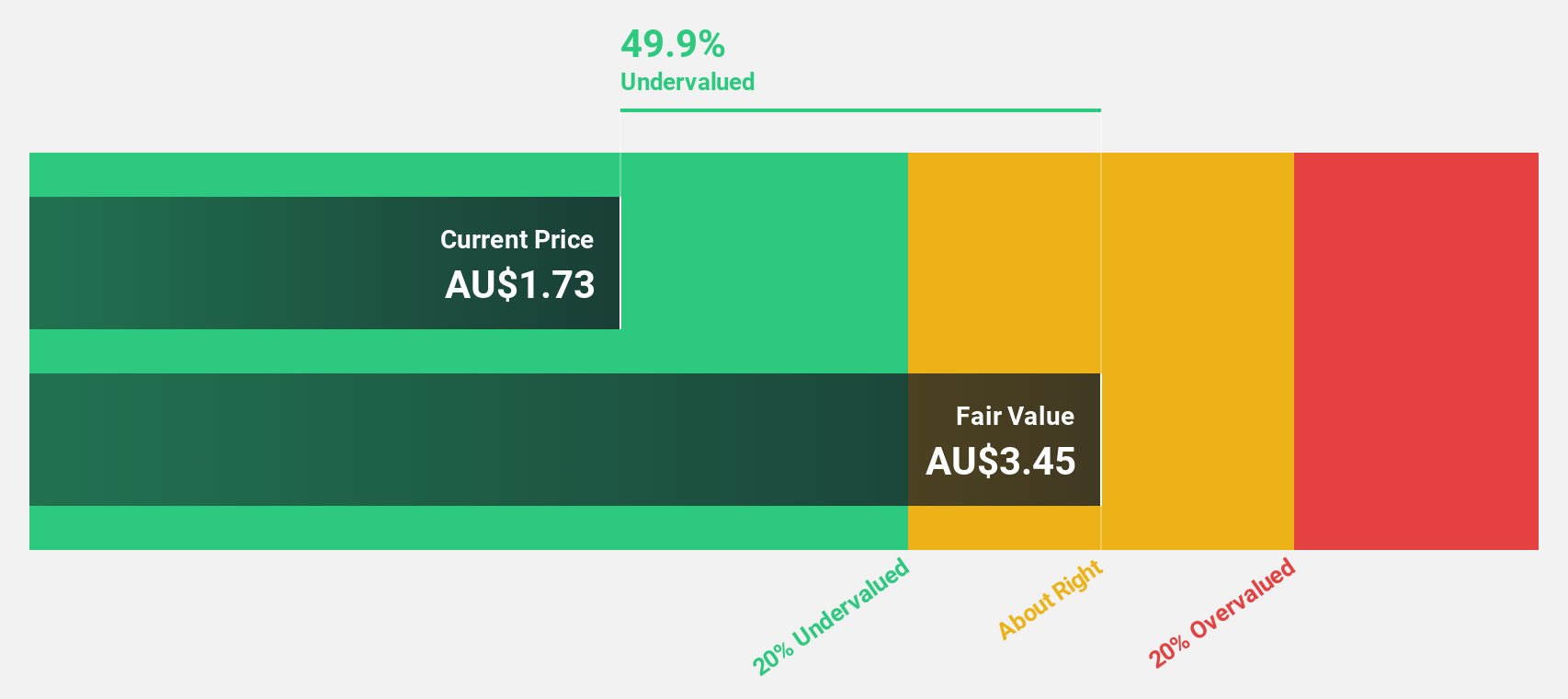

Servcorp (ASX:SRV)

Overview: Servcorp Limited (ASX:SRV) offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$412.38 million.

Operations: Revenue from real estate rentals for the company is A$305.15 million.

Estimated Discount To Fair Value: 13.2%

Servcorp (A$4.19) is trading 13.2% below its estimated fair value of A$4.82, indicating it may be undervalued based on cash flows. Despite a decline in profit margins from 10.6% to 5.2%, SRV's earnings are expected to grow significantly at 28.3% annually, outpacing the Australian market's average growth rate of 13.3%. However, revenue growth is forecasted at a modest 4.2% per year, slower than the market's 5.1%.

- The growth report we've compiled suggests that Servcorp's future prospects could be on the up.

- Navigate through the intricacies of Servcorp with our comprehensive financial health report here.

Key Takeaways

- Click here to access our complete index of 37 Undervalued ASX Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives