- Australia

- /

- Capital Markets

- /

- ASX:HM1

Unveiling 3 Undiscovered Gems in Australia with Strong Potential

Reviewed by Simply Wall St

Amidst a turbulent Australian market, with headline inflation climbing to 3% and mixed performances across sectors, investors are navigating a landscape where utilities and energy show resilience while financials face downward pressure. In such an environment, identifying stocks with strong potential often involves finding companies that can thrive despite broader economic challenges, making them true undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Carlton Investments | 0.02% | 9.10% | 8.68% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cedar Woods Properties (ASX:CWP)

Simply Wall St Value Rating: ★★★★★★

Overview: Cedar Woods Properties Limited is an Australian company focused on property development and investment, with a market capitalization of A$641.29 million.

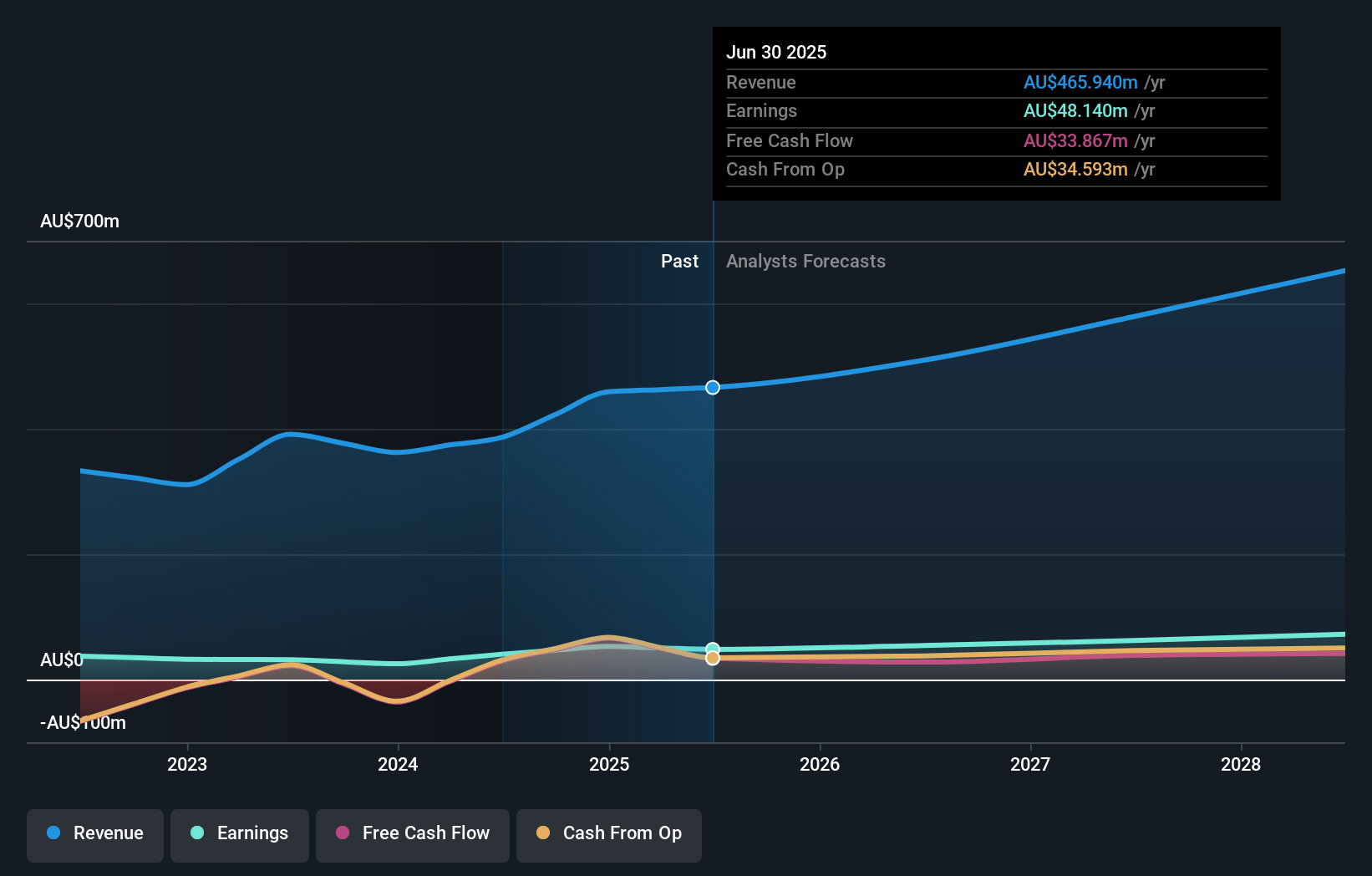

Operations: Cedar Woods Properties generates revenue primarily from its property development and investment activities, amounting to A$465.94 million. The company's financial performance is influenced by its ability to manage costs associated with these operations, impacting its overall profitability.

Cedar Woods Properties, a notable player in the Australian property market, is trading at 18.7% below its estimated fair value, offering potential for investors seeking undervalued opportunities. With earnings growing at 12.1% annually over the past five years and a net debt to equity ratio of 25.8%, Cedar Woods demonstrates financial prudence and growth potential. The company's EBIT covers interest payments 7.2 times over, indicating strong financial health despite not outpacing industry growth last year. Recent strategic acquisitions across four states further bolster its future prospects while maintaining a focus on sustainability initiatives within the real estate sector.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian investment company with a market cap of A$792.28 million, focusing on generating long-term capital growth by investing in a concentrated portfolio of high-conviction ideas from leading fund managers.

Operations: Hearts and Minds generates revenue primarily through investment activities, amounting to A$161.68 million. The company's net profit margin reflects its profitability from these activities.

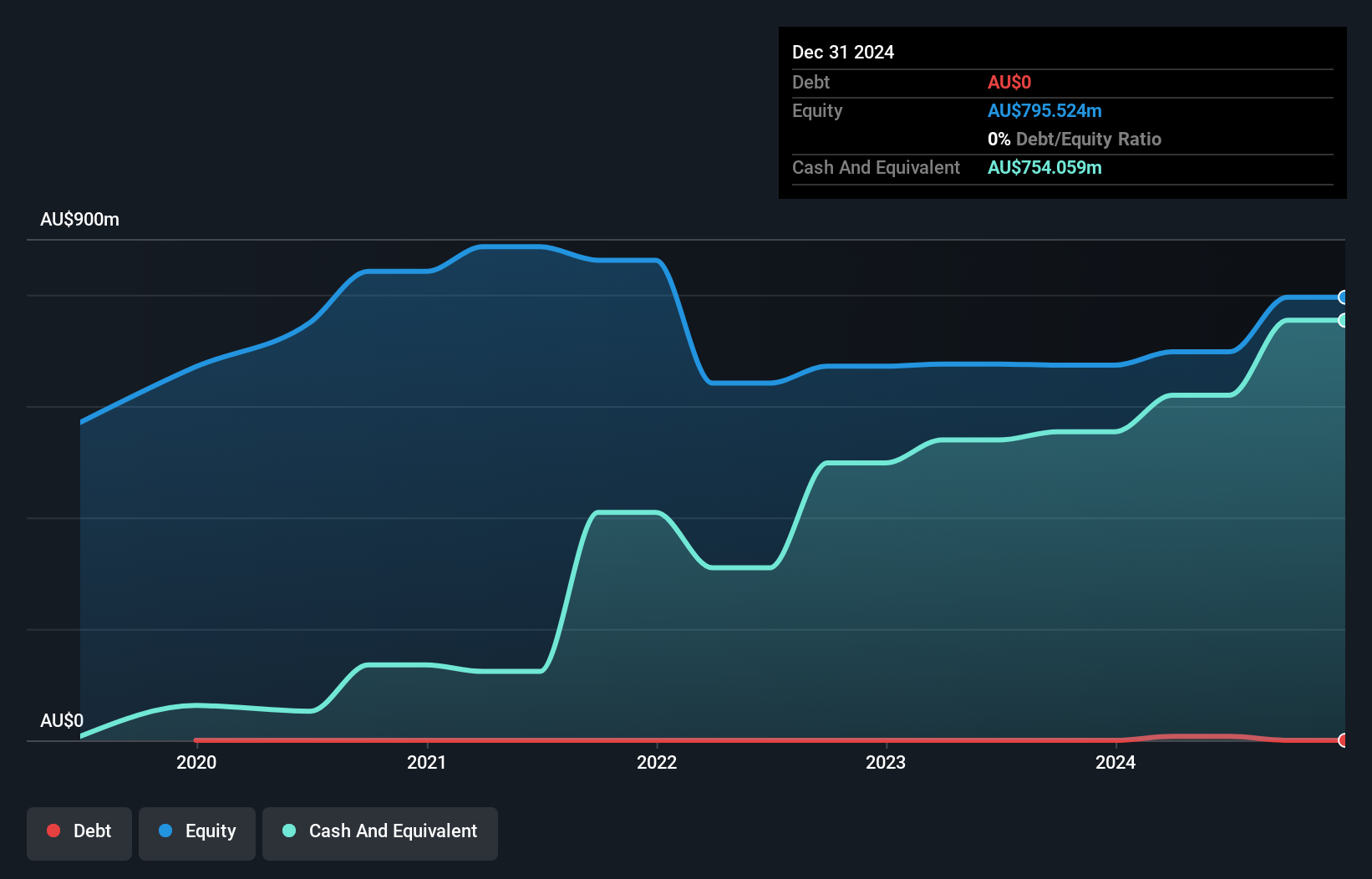

Hearts and Minds Investments, a nimble player in the Australian market, showcases strong financial health with a debt-free status for five years. Its earnings surged by 109.7% over the past year, outpacing the Capital Markets industry average of 5.9%. The company reported impressive revenue growth to A$165.48 million from A$83.37 million last year, with net income climbing to A$106.82 million from A$50.93 million previously. Despite not being free cash flow positive recently, its price-to-earnings ratio of 7.4x suggests potential value compared to the broader market's 20.5x benchmark.

- Click to explore a detailed breakdown of our findings in Hearts and Minds Investments' health report.

Understand Hearts and Minds Investments' track record by examining our Past report.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Navigator Global Investments, trading as HFA Holdings Limited, operates as a fund management company in Australia with a market capitalization of A$1.01 billion.

Operations: HFA Holdings Limited generates revenue primarily from its Lighthouse segment, amounting to $122.84 million. The company's market capitalization is approximately A$1.01 billion.

Navigator Global Investments, a dynamic player in Australia's fund management scene, has shown remarkable growth with earnings surging 80% over the past year. The company reported net income of US$119 million for the year ending June 2025, reflecting its robust performance. Despite a one-off gain of A$29.6 million impacting recent results, Navigator's strategic partnerships and innovative Lighthouse platform are likely to bolster revenue further. However, its reliance on variable performance fees introduces potential volatility in earnings. Trading at 51% below estimated fair value and boasting a debt-to-equity ratio of just 0.7%, Navigator presents an intriguing investment opportunity amidst industry challenges.

Turning Ideas Into Actions

- Get an in-depth perspective on all 51 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hearts and Minds Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HM1

Hearts and Minds Investments

Flawless balance sheet with solid track record.

Market Insights

Community Narratives