Did Vita Life Sciences' (ASX:VLS) Share Price Deserve to Gain 83%?

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. For example, the Vita Life Sciences Limited (ASX:VLS) share price is up 83% in the last year, clearly besting the market return of around 44% (not including dividends). That's a solid performance by our standards! Looking back further, the stock price is 59% higher than it was three years ago.

View our latest analysis for Vita Life Sciences

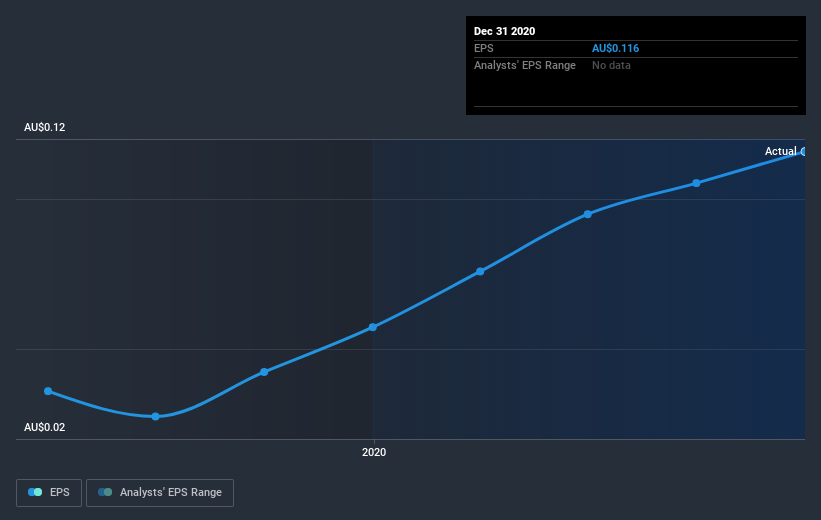

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Vita Life Sciences was able to grow EPS by 102% in the last twelve months. This EPS growth is significantly higher than the 83% increase in the share price. So it seems like the market has cooled on Vita Life Sciences, despite the growth. Interesting. The caution is also evident in the lowish P/E ratio of 10.27.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Vita Life Sciences' key metrics by checking this interactive graph of Vita Life Sciences's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Vita Life Sciences the TSR over the last year was 93%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Vita Life Sciences shareholders have received a total shareholder return of 93% over the last year. And that does include the dividend. That certainly beats the loss of about 4% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Vita Life Sciences better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Vita Life Sciences you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Vita Life Sciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:VLS

Vita Life Sciences

A healthcare company, engages in formulating, packaging, distributing, and selling vitamins and supplements in Australia, Singapore, Malaysia, Thailand, Vietnam, Indonesia, and China.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026