Telix Pharmaceuticals (ASX:TLX): Valuation After Upgraded Guidance and Strong Third Quarter Revenue

Reviewed by Kshitija Bhandaru

Telix Pharmaceuticals (ASX:TLX) has raised its 2025 revenue forecast to $800 million to $820 million after reporting third quarter revenue of $206 million, a significant increase from last year’s $135 million.

See our latest analysis for Telix Pharmaceuticals.

Telix’s share price has pulled back sharply over the last three months, but momentum has begun to build again as strong Q3 revenue and upgraded guidance have improved sentiment. Despite a one-year total shareholder return of -34.6%, investors who bought in three or five years ago have still enjoyed spectacular long-term gains, with total shareholder returns of 131% and 745% respectively.

If Telix’s turnaround story has you curious about what else could be next, this is a great time to explore leaders in healthcare. See the full list for free.

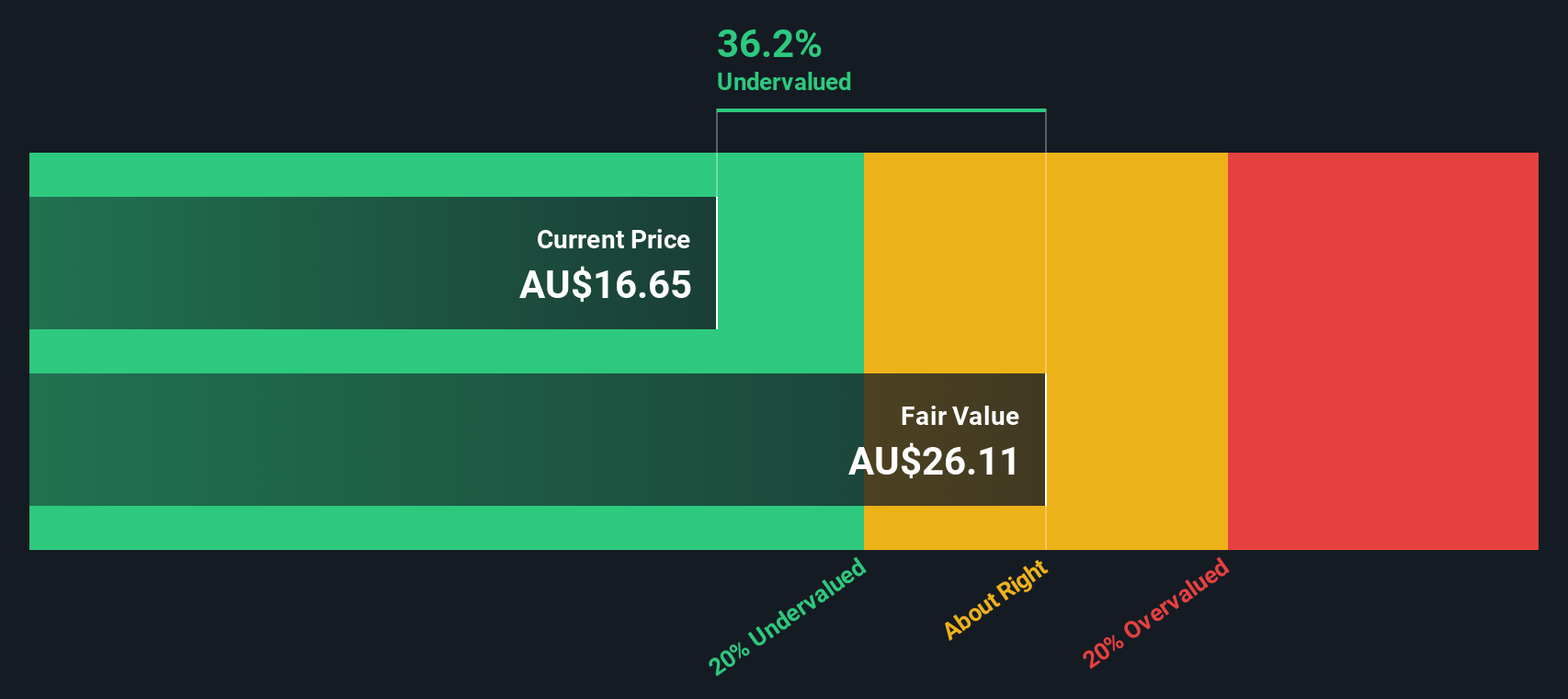

With upgraded guidance and recent momentum despite past share price declines, the key question now is whether Telix remains undervalued at current levels or if the market has already priced in its future growth.

Price-to-Sales of 4.7x: Is it justified?

Telix Pharmaceuticals is currently trading at a price-to-sales ratio of 4.7x, well below the Australian Biotechs industry average of 11x and its peer average of 21.2x. This suggests a potential disconnect between recent performance and how the market is pricing in the company's growth prospects.

The price-to-sales (P/S) ratio is useful for valuing companies in sectors like biotechnology that may have volatile earnings or recent profitability. It measures the market's value of a stock relative to its total sales, and lower P/S ratios can indicate undervaluation if the business is expected to expand revenue or margins significantly.

Telix’s price-to-sales ratio is not only lower than industry and peer averages but also sits slightly below the estimated fair price-to-sales ratio of 5.3x. This points to potential room for a valuation re-rating if the company's growth continues as forecast. The level the market could move towards is supported by the fair ratio benchmark.

Explore the SWS fair ratio for Telix Pharmaceuticals

Result: Price-to-Sales of 4.7x (UNDERVALUED)

However, weaker long-term returns and the risk of growth slowing could challenge the bullish outlook if Telix faces unexpected operational or market setbacks.

Find out about the key risks to this Telix Pharmaceuticals narrative.

Another Perspective: DCF Valuation Shows Significant Discount

While the price-to-sales ratio suggests Telix is undervalued compared to industry benchmarks, our DCF model offers a sharply different take. According to this approach, Telix is trading at a striking 74.3% below our estimate of fair value. This dramatic gap raises important questions: Has the market missed something, or is there hidden risk ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Telix Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Telix Pharmaceuticals Narrative

Whether you want to dig deeper or challenge this view, you can quickly analyze the numbers and build your own perspective on Telix Pharmaceuticals in just a few minutes. Do it your way.

A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit your strategy to just one sector. There are exciting opportunities you could be missing out on. Use the Simply Wall Street Screener to uncover stocks uniquely suited to your goals:

- Grow your passive income by tapping into standout opportunities among these 18 dividend stocks with yields > 3% offering attractive yields and strong fundamentals.

- Ride the wave of intelligent automation when you target trailblazers by reviewing these 25 AI penny stocks transforming industries with next-generation technology.

- Seize the chance to uncover hidden value by acting early with these 881 undervalued stocks based on cash flows that are trading below their true worth based on cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives