How the SEC Subpoena and Legal Probe May Influence Telix (ASX:TLX) Investor Risk Perceptions

Reviewed by Sasha Jovanovic

- Telix Pharmaceuticals disclosed that it received a subpoena from the U.S. Securities and Exchange Commission regarding its disclosures about prostate cancer therapeutic candidates, with the Rosen Law Firm investigating potential securities claims and preparing a class action on behalf of shareholders.

- This development highlights the critical impact regulatory scrutiny and legal actions can have on investor confidence and corporate transparency in the biotech sector.

- We’ll examine how the SEC investigation into Telix’s disclosures shapes the company’s investment narrative and risk outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Telix Pharmaceuticals' Investment Narrative?

For shareholders in Telix Pharmaceuticals, the big picture usually revolves around belief in the company’s clinical pipeline and ability to commercialize precision oncology products, particularly in prostate cancer imaging and therapeutics. Prior to the SEC subpoena and potential class action, the focus was firmly on catalysts like the Gozellix U.S. reimbursement win, regulatory resubmissions, and pivotal trial progress, key drivers underpinning both near-term sentiment and longer-term earnings growth. Now, regulatory scrutiny introduces a fresh layer of risk and may temporarily distract management or impact market confidence, even if it doesn't immediately threaten product launches or financial stability. Close attention is warranted, especially as past analysis assumed a clear regulatory path. Short-term volatility is not uncommon when regulatory or legal events arise, but if progress continues on product approvals and reimbursement, the business fundamentals may remain resilient.

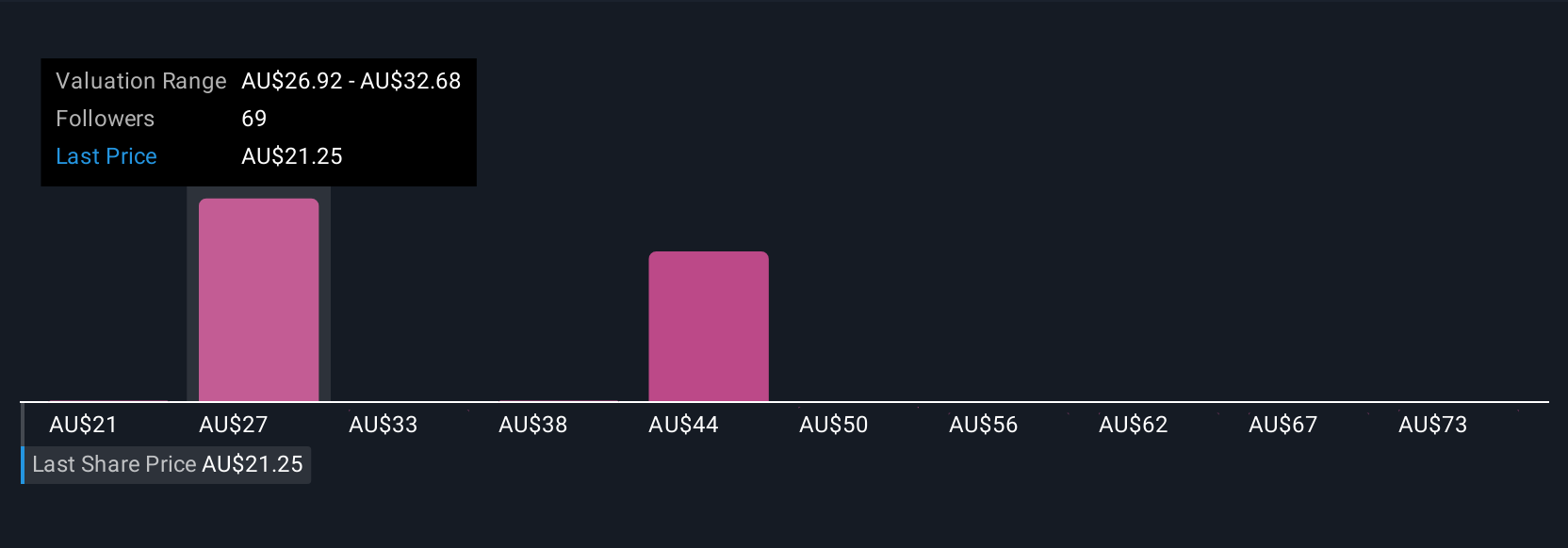

On the other hand, the SEC action introduces a level of headline risk that cannot be overlooked. Despite retreating, Telix Pharmaceuticals' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 39 other fair value estimates on Telix Pharmaceuticals - why the stock might be worth over 4x more than the current price!

Build Your Own Telix Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telix Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telix Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives