How Investors May Respond To Telix Pharmaceuticals (ASX:TLX) Returning to Losses Despite Surging Sales

Reviewed by Simply Wall St

- Telix Pharmaceuticals Limited, in its recently released half-year earnings for the period ended June 30, 2025, reported sales of US$390.36 million, rising from US$239.61 million a year earlier, while recording a net loss of US$2.29 million after previously reporting net income.

- The transition from profitability to a modest net loss despite very large revenue growth signals material changes in the company’s cost structure or investments.

- We'll explore how Telix Pharmaceuticals' move from profit to loss, amid increasing sales, shapes the company's current investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Telix Pharmaceuticals' Investment Narrative?

To remain confident as a Telix Pharmaceuticals shareholder, you need to believe the company’s strong revenue growth and ongoing product launches can offset the recent switch from profit to a modest loss. The latest half-year results paint a more complex picture: while sales soared to US$390.36 million, a US$2.29 million net loss now sits in stark contrast to prior profits. This may have immediate implications for short-term catalysts, particularly as key regulatory wins for Gozellix and Illuccix, as well as expanded manufacturing, were previously expected to drive both top- and bottom-line performance. The primary risk now is whether higher expenses or unforeseen one-off items, which impacted these results, could persist and overshadow the momentum from market expansions or product approvals. Investors should closely monitor upcoming quarters to see if profitability stabilizes or continued margin pressures weigh on the recovery story.

Yet, with much of the focus on pipeline success, expense control is now just as critical for investors to watch.

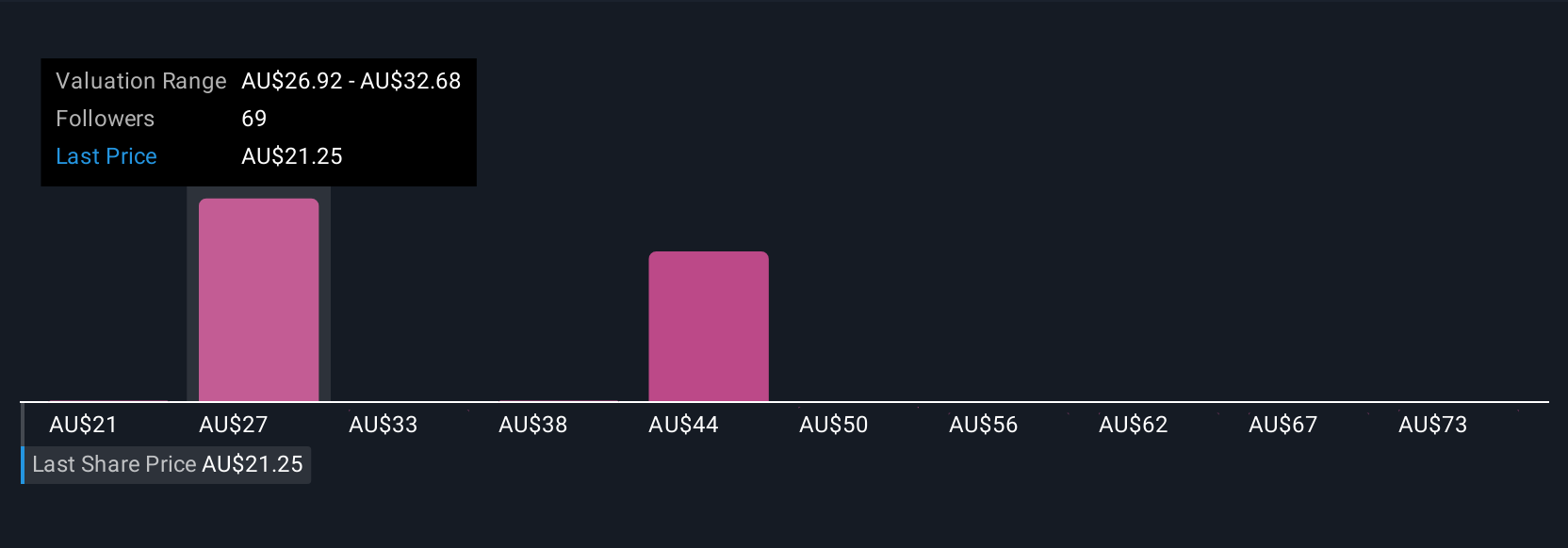

Telix Pharmaceuticals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 32 other fair value estimates on Telix Pharmaceuticals - why the stock might be worth just A$17.43!

Build Your Own Telix Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telix Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telix Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telix Pharmaceuticals' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telix Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLX

Telix Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the development and commercialization of therapeutic and diagnostic radiopharmaceuticals.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives