The Australian market has recently seen a downturn, with the ASX200 closing down 0.47% as investors lock in profits and the Australian dollar experiences fluctuations amid expectations of an earlier RBA rate cut. Despite these broader market movements, there remains interest in exploring opportunities beyond the major indices. Penny stocks, often representing smaller or newer companies, continue to capture attention for their potential value and growth prospects. By focusing on those with solid financial foundations and clear growth strategies, investors can uncover promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$316.27M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$320.75M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.715 | A$92.24M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.605 | A$830.68M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$233.81M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$222.46M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.92 | A$109.1M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

E&P Financial Group (ASX:EP1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E&P Financial Group Limited operates in the financial services sector across Australia, the United States, and Hong Kong with a market capitalization of A$109.94 million.

Operations: The company generates revenue through its segments: E&P Funds (A$19.79 million), E&P Wealth (A$94.23 million), and E&P Capital (A$32.96 million).

Market Cap: A$109.94M

E&P Financial Group is navigating significant challenges, including its decision to delist from the ASX following shareholder approval. This move comes amid claims of undervaluation due to regulatory and legal issues, notably involving the Dixon Advisory collapse. Despite being unprofitable with declining earnings over five years, E&P maintains a strong cash position exceeding its debt and liabilities, providing a stable runway for over three years. The company has initiated a share buyback program aimed at restructuring capital efficiently post-delistment. Its management and board are experienced, but ongoing inquiries may impact future operations.

- Dive into the specifics of E&P Financial Group here with our thorough balance sheet health report.

- Understand E&P Financial Group's track record by examining our performance history report.

First Au (ASX:FAU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: First Au Limited is a company engaged in the exploration of gold and base metal deposits in Western Australia and Victoria, with a market cap of A$5.44 million.

Operations: The company's revenue segment is primarily focused on exploration and mining activities, reporting A$-0.08 million.

Market Cap: A$5.44M

First Au Limited, focused on gold and base metal exploration in Australia, remains a pre-revenue entity with a market cap of A$5.44 million. The company recently completed a follow-on equity offering worth A$0.325 million to bolster its cash runway, currently estimated at four months based on free cash flow estimates. Despite no debt and short-term assets exceeding liabilities, First Au faces challenges with shareholder dilution and increased volatility over the past year. Recent board changes bring new expertise in finance and mining operations, potentially aiding strategic direction amidst its unprofitable status and volatile share price history.

- Get an in-depth perspective on First Au's performance by reading our balance sheet health report here.

- Assess First Au's previous results with our detailed historical performance reports.

Starpharma Holdings (ASX:SPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Starpharma Holdings Limited is a biopharmaceutical company focused on the research, development, and commercialization of dendrimer products for pharmaceutical and life science applications globally, with a market cap of A$50.17 million.

Operations: The company generates revenue of A$9.76 million from the discovery, development, and commercialization of dendrimers.

Market Cap: A$50.17M

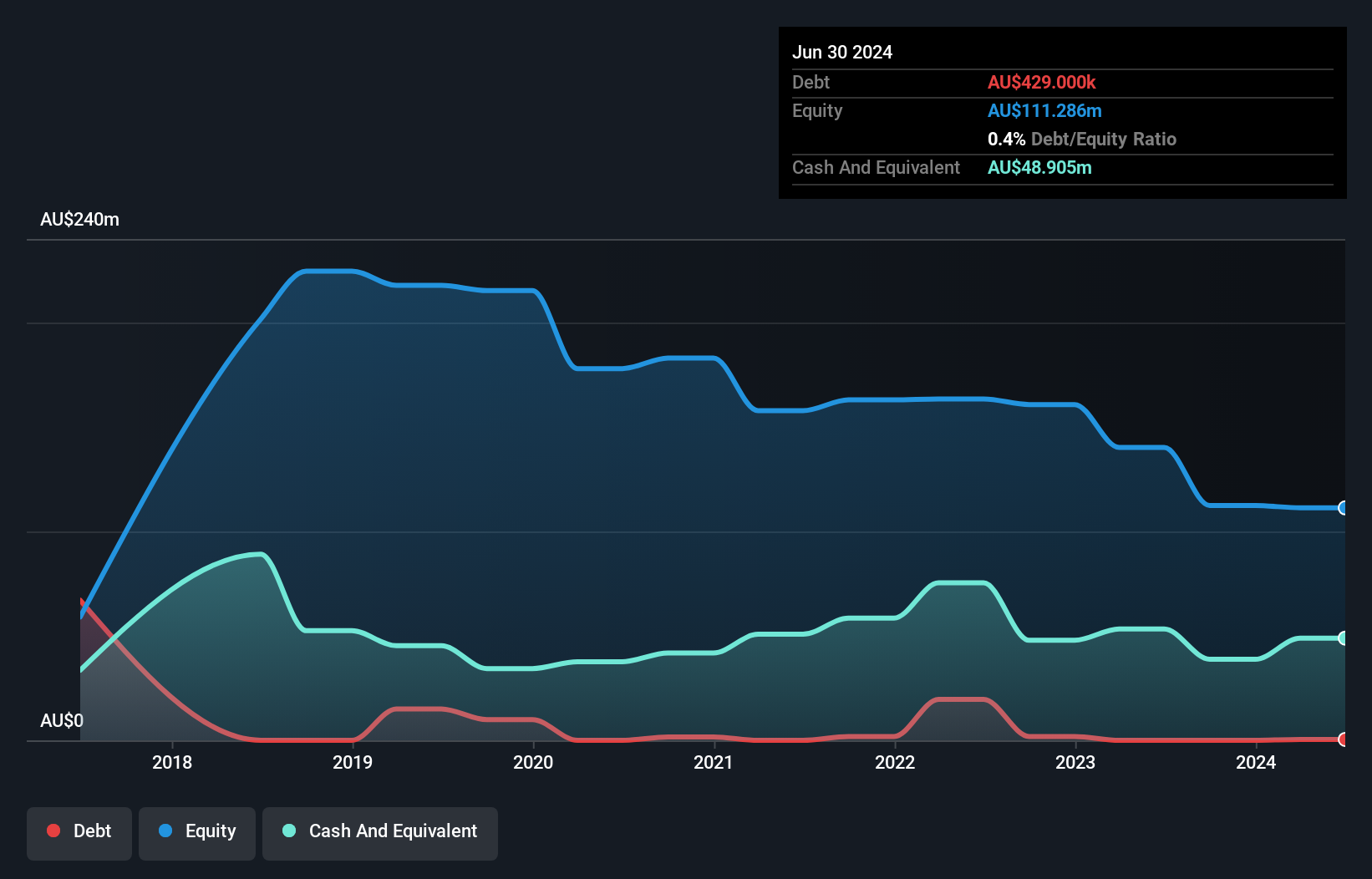

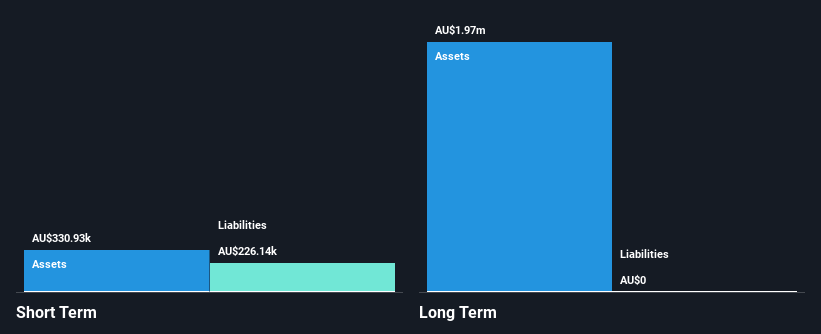

Starpharma Holdings Limited, with a market cap of A$50.17 million, remains unprofitable but has reduced losses by 6.5% annually over the past five years. The company maintains a strong cash position, with short-term assets of A$32.9 million exceeding both short and long-term liabilities, providing a cash runway for more than three years under stable conditions. Despite increased debt levels to 2.8% over five years and negative return on equity at -29.04%, shareholders have not faced significant dilution recently. Recent presentations at industry conferences highlight ongoing engagement with investors amid its pre-revenue status in the biopharmaceutical sector.

- Unlock comprehensive insights into our analysis of Starpharma Holdings stock in this financial health report.

- Explore historical data to track Starpharma Holdings' performance over time in our past results report.

Where To Now?

- Discover the full array of 1,047 ASX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SPL

Starpharma Holdings

A biopharmaceutical company, engages in the research, development, and commercialization of dendrimer products for pharmaceutical, life science, and other applications worldwide.

Excellent balance sheet and overvalued.