- Australia

- /

- Metals and Mining

- /

- ASX:FMG

ASX Dividend Stocks Fortescue Plus Two More Top Picks

Reviewed by Simply Wall St

As the Australian market experiences a dip, with the ASX200 down 0.6% to its lowest level in two weeks, investors are navigating a landscape influenced by Wall Street's weak performance and profit-taking activities. In this environment, selecting dividend stocks can be an appealing strategy for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.62% | ★★★★★☆ |

| Perenti (ASX:PRN) | 6.30% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.37% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.99% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.55% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.41% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.16% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.66% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.00% | ★★★★★☆ |

| Grange Resources (ASX:GRR) | 8.33% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

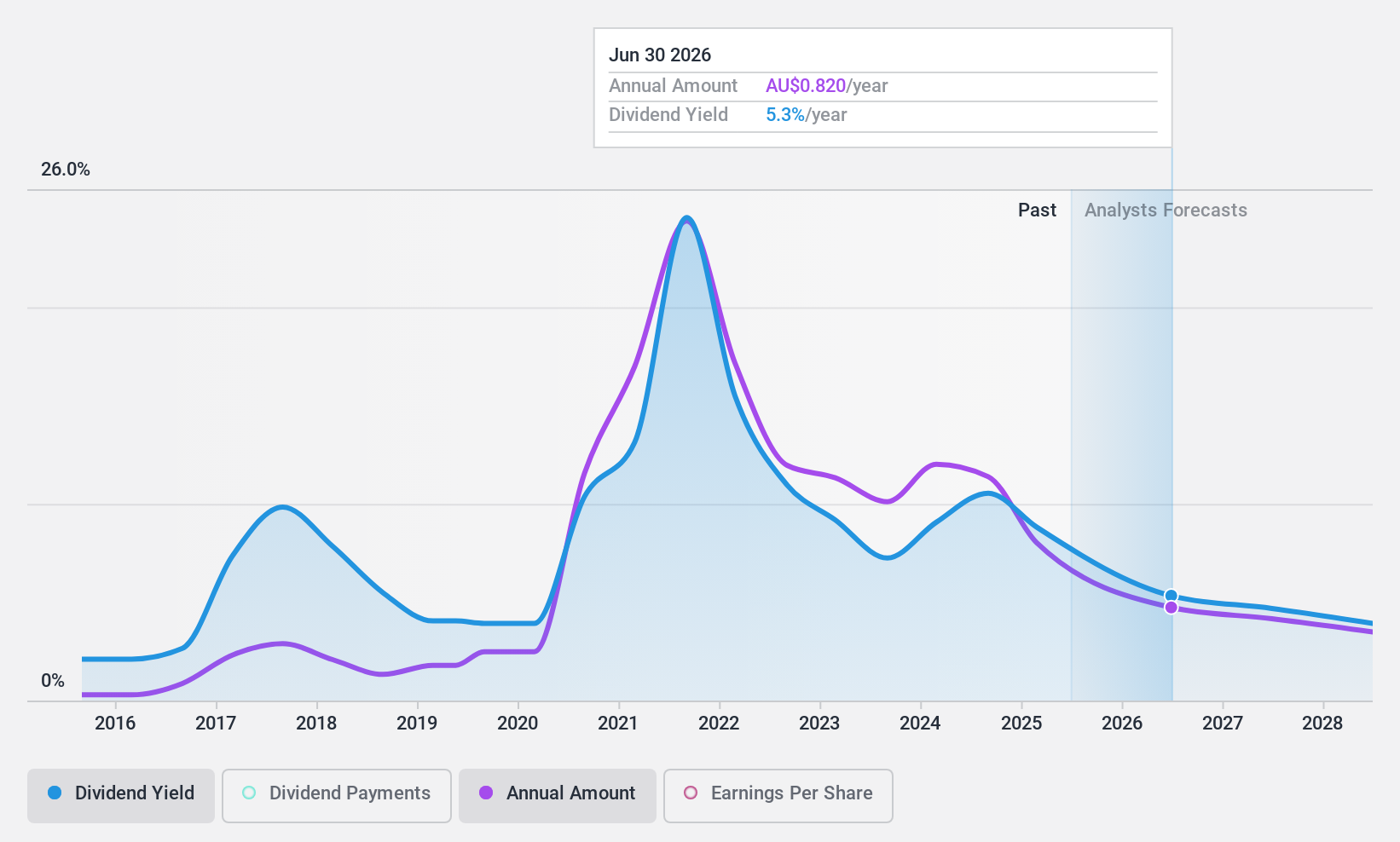

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is involved in the exploration, development, production, processing, and sale of iron ore across Australia, China, and international markets with a market cap of A$62.90 billion.

Operations: Fortescue Ltd generates revenue primarily from its Metals segment, which accounts for $18.13 billion, with an additional contribution of $91 million from its Energy segment.

Dividend Yield: 9.6%

Fortescue offers a high dividend yield of 9.62%, placing it in the top 25% of Australian dividend payers. Its dividends are covered by earnings and cash flows, with payout ratios of 71.1% and 76.1%, respectively, suggesting sustainability despite a volatile past decade marked by significant annual drops over 20%. Trading at an attractive valuation, Fortescue's future earnings are expected to decline, which could impact its ability to maintain current dividend levels.

- Unlock comprehensive insights into our analysis of Fortescue stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Fortescue is priced lower than what may be justified by its financials.

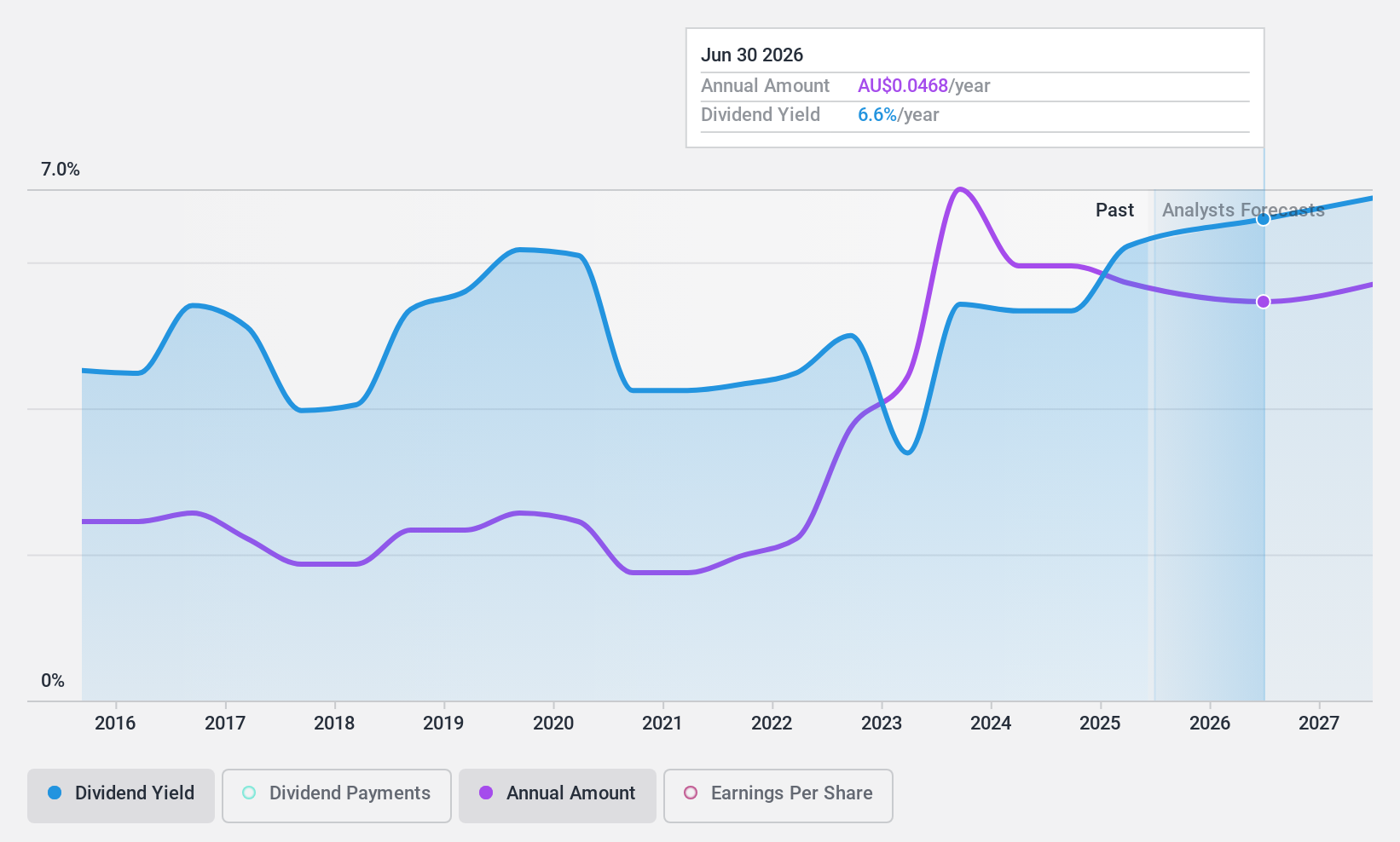

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates as an integrated provider of transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia with a market capitalization of A$277.06 million.

Operations: Lindsay Australia Limited generates revenue through its segments in Transport (A$577.36 million), Rural (A$155.44 million), and Hunters (A$87.44 million).

Dividend Yield: 5.6%

Lindsay Australia's dividend yield of 5.57% is below the top 25% of Australian dividend payers, but its dividends are well covered by earnings and cash flows, with payout ratios of 56% and 18.8%, respectively. Despite a history of volatility in dividend payments over the past decade, recent increases suggest potential stability. Trading at a good value relative to peers and analysts' expectations for stock price growth further bolster its appeal for income-focused investors.

- Take a closer look at Lindsay Australia's potential here in our dividend report.

- Our expertly prepared valuation report Lindsay Australia implies its share price may be lower than expected.

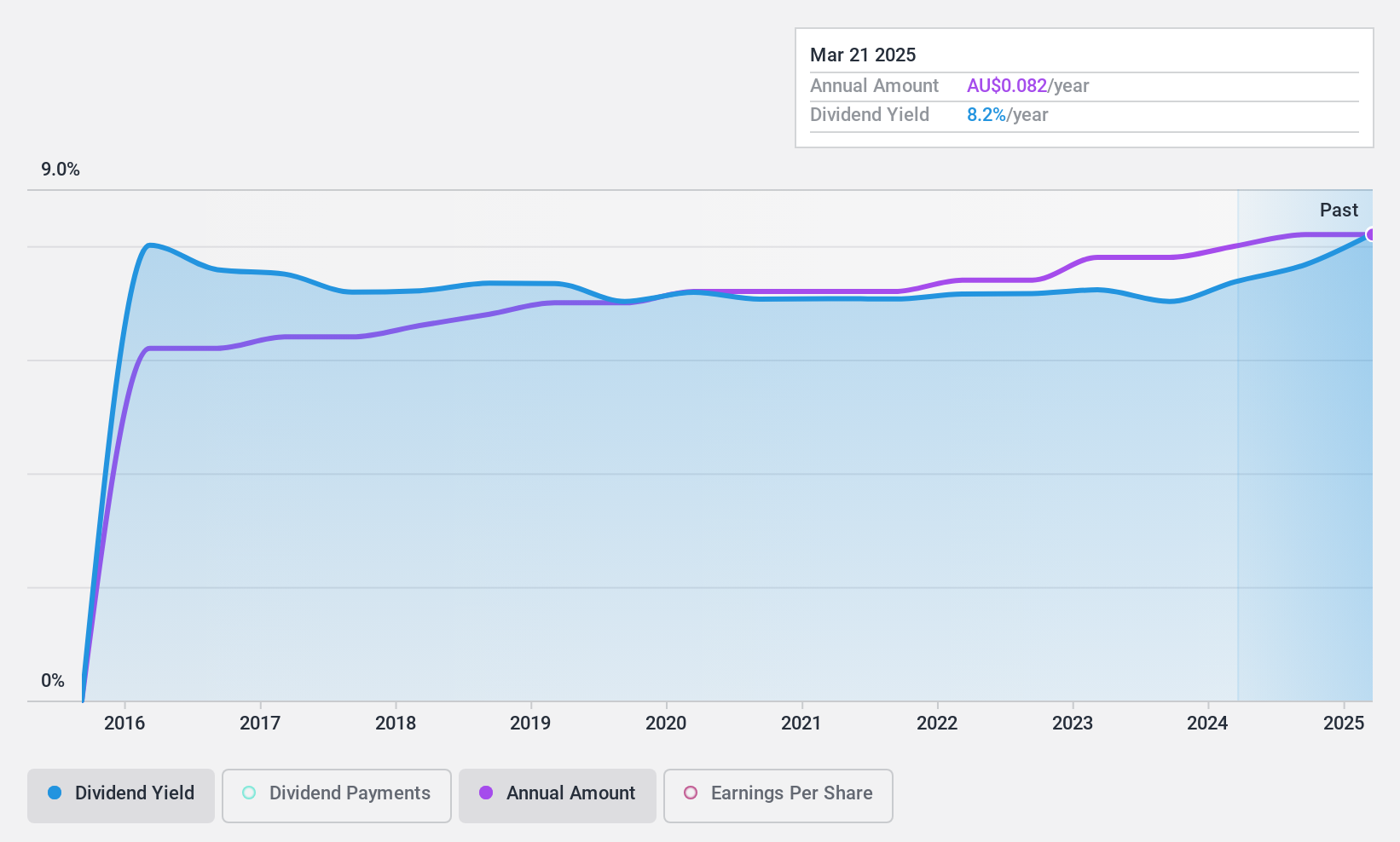

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sugar Terminals Limited offers storage and handling services for bulk sugar and other commodities in Australia, with a market cap of A$397.80 million.

Operations: Sugar Terminals Limited generates revenue of A$115.38 million from the sugar industry segment.

Dividend Yield: 7.4%

Sugar Terminals Limited offers a compelling dividend yield of 7.42%, placing it in the top 25% of Australian dividend payers. Despite having paid dividends for less than a decade, these payments have been stable and reliably growing. The company's payout ratios—89.8% from earnings and 81.8% from cash flows—indicate sustainable coverage, supported by recent earnings growth to A$32.47 million for the year ended June 2024, up from A$29.15 million previously.

- Click to explore a detailed breakdown of our findings in Sugar Terminals' dividend report.

- Our valuation report here indicates Sugar Terminals may be undervalued.

Next Steps

- Click here to access our complete index of 31 Top ASX Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives