Orthocell (ASX:OCC) spikes 12% this week, taking five-year gains to 231%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Orthocell Limited (ASX:OCC) stock is up an impressive 231% over the last five years. It's even up 12% in the last week.

Since it's been a strong week for Orthocell shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Orthocell

Orthocell recorded just AU$4,243,069 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Orthocell has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Of course, if you time it right, high risk investments like this can really pay off, as Orthocell investors might know.

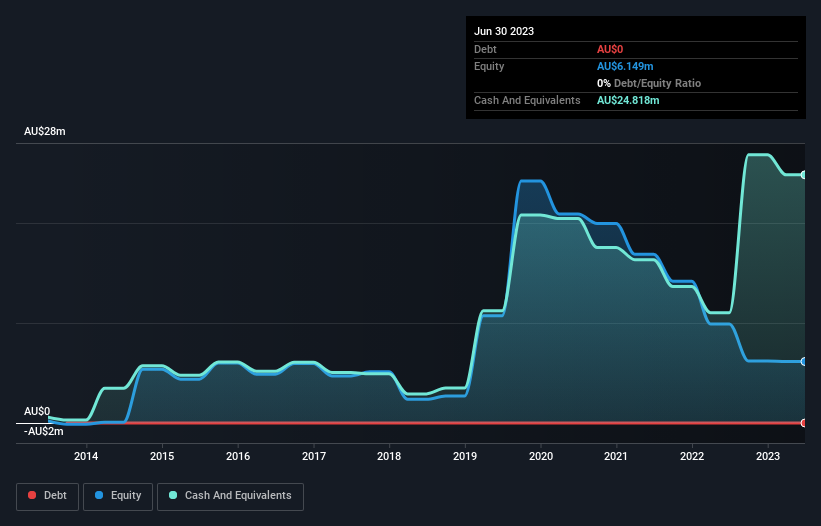

When it reported in June 2023 Orthocell had minimal cash in excess of all liabilities consider its expenditure: just AU$1.4m to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. Given how low on cash it got, investors must really like its potential for the share price to be up 68% per year, over 5 years. You can see in the image below, how Orthocell's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

We're pleased to report that Orthocell shareholders have received a total shareholder return of 10% over one year. Having said that, the five-year TSR of 27% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Orthocell (of which 1 makes us a bit uncomfortable!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:OCC

Orthocell

A regenerative medicine company, develops and commercializes cell therapies and biological medical devices for the repair of various bone and soft tissue injuries in Australia, the United States, the United Kingdom, and the European Union.

Flawless balance sheet slight.