Centaurus Metals And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market has seen some fluctuations recently, with the ASX 200 slightly down due to persistent inflation concerns, although certain sectors like Energy and Industrials have shown resilience. In such a climate, investors often look beyond well-known names to explore opportunities in smaller companies that might offer unique value propositions. While the term "penny stocks" may seem outdated, these investments can still present substantial opportunities when chosen carefully; Centaurus Metals and two other promising stocks on the ASX exemplify this potential by combining strong financials with growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| IVE Group (ASX:IGL) | A$2.39 | A$370.18M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.05 | A$333.78M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.15 | A$150.9M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.52 | A$102.12M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.435 | A$269.76M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.01 | A$94.82M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.26 | A$1.18B | ★★★★★★ |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.51M | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.80 | A$132.85M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.16 | A$261.46M | ★★★★★★ |

Click here to see the full list of 1,030 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaurus Metals Limited is an exploration company focused on evaluating mineral resource properties in Brazil, with a market cap of A$186.26 million.

Operations: No revenue segments have been reported.

Market Cap: A$186.26M

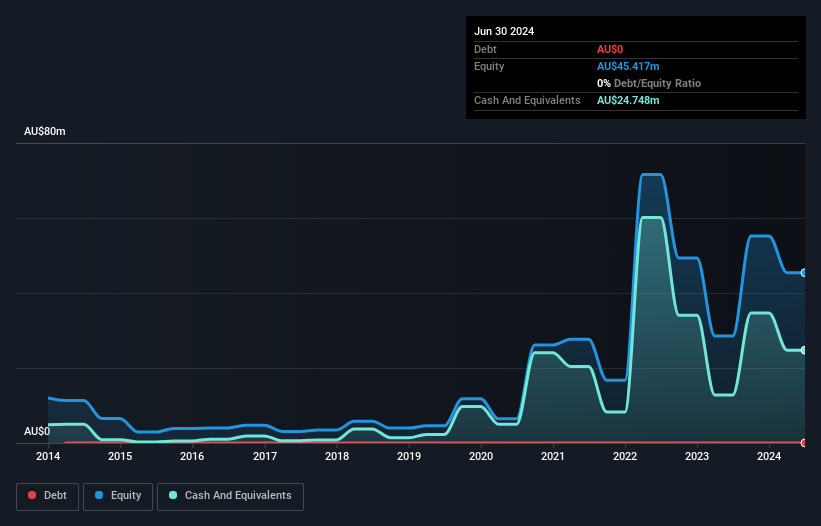

Centaurus Metals, with a market cap of A$186.26 million, is pre-revenue and currently unprofitable, with no significant revenue streams reported. The company benefits from a seasoned board and management team, boasting average tenures of 11.4 years and 5.3 years respectively. Despite its negative return on equity (-56.73%) and increased losses over the past five years at 39% annually, Centaurus remains debt-free with short-term assets (A$27.8M) covering both short- and long-term liabilities comfortably. However, it faces cash runway challenges beyond one year if current free cash flow trends persist without improvement in profitability projections within the next three years.

- Click here to discover the nuances of Centaurus Metals with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Centaurus Metals' future.

Noxopharm (ASX:NOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noxopharm Limited is an Australian biotech company focused on discovering and developing treatments for cancer, inflammation, and mRNA vaccines, with a market cap of A$27.18 million.

Operations: The company's revenue is derived from its activities in the development of treatments in both oncology and non-oncology, amounting to A$2.40 million.

Market Cap: A$27.18M

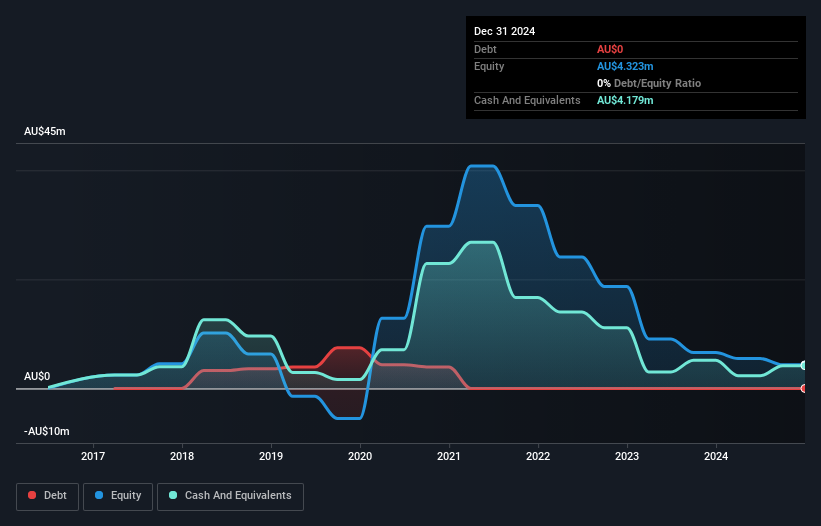

Noxopharm Limited, with a market cap of A$27.18 million, is pre-revenue and unprofitable, reporting a net loss of A$1.24 million for the half year ending December 31, 2024. Despite this, the company maintains a solid financial position with short-term assets (A$4.8M) exceeding liabilities and no debt burden. The management team and board are experienced with average tenures of 4.1 years and 4.9 years respectively. Noxopharm possesses sufficient cash runway for over three years at current free cash flow levels but faces challenges in achieving meaningful revenue growth in its biotech endeavors amidst declining earnings trends over five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Noxopharm.

- Explore historical data to track Noxopharm's performance over time in our past results report.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$288.01 million.

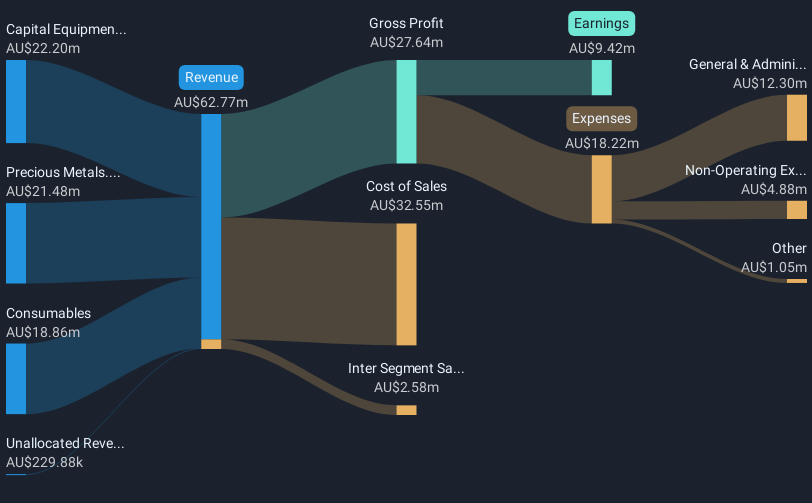

Operations: The company generates revenue through three main segments: Consumables (A$18.86 million), Precious Metals (A$21.48 million), and Capital Equipment (A$22.20 million).

Market Cap: A$288.01M

XRF Scientific Limited, with a market cap of A$288.01 million, demonstrates financial stability through its diverse revenue streams across Consumables, Precious Metals, and Capital Equipment segments. Recent earnings for the half year ended December 31, 2024 show sales at A$28.7 million and net income at A$5.01 million. The company boasts a seasoned management team with an average tenure of 11.5 years and maintains strong financial health with short-term assets exceeding liabilities and cash surpassing total debt. Despite low Return on Equity (18.1%), XRF's earnings growth outpaces the industry average while maintaining high-quality past earnings without significant shareholder dilution.

- Take a closer look at XRF Scientific's potential here in our financial health report.

- Examine XRF Scientific's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Investigate our full lineup of 1,030 ASX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRF

XRF Scientific

Manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries in Australia, Canada, and Europe.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives