Take Care Before Jumping Onto Medical Developments International Limited (ASX:MVP) Even Though It's 27% Cheaper

The Medical Developments International Limited (ASX:MVP) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

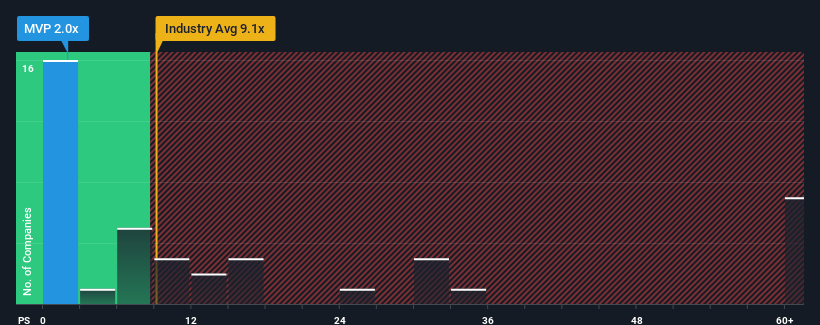

Following the heavy fall in price, Medical Developments International may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2x, considering almost half of all companies in the Pharmaceuticals industry in Australia have P/S ratios greater than 9.1x and even P/S higher than 31x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Medical Developments International

How Has Medical Developments International Performed Recently?

With revenue growth that's inferior to most other companies of late, Medical Developments International has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Medical Developments International's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Medical Developments International's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 71% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 14% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 13% per year, which is not materially different.

With this in consideration, we find it intriguing that Medical Developments International's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Medical Developments International's P/S Mean For Investors?

Having almost fallen off a cliff, Medical Developments International's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Medical Developments International's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Medical Developments International (2 can't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MVP

Medical Developments International

Manufactures and distributes emergency medical solutions in Australia, Asia, Europe, the United States, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives