Mesoblast (ASX:MSB) Valuation in Focus After Ryoncil Secures U.S. Reimbursement Milestone

Reviewed by Kshitija Bhandaru

Mesoblast (ASX:MSB) shares have drawn attention after the company announced that its Ryoncil therapy received a permanent J-Code from U.S. Centers for Medicare & Medicaid Services, effective October 1. This update simplifies reimbursement and billing for providers.

See our latest analysis for Mesoblast.

Mesoblast’s latest breakthrough with Ryoncil arrives as investor optimism has been building steadily. After lagging earlier in the year, the share price has surged 75% in the past three months, and the one-year total shareholder return now stands at an impressive 99%. These gains suggest momentum is returning, supported by regulatory milestones and hopes for broader adoption.

If you’re curious about discovering other promising healthcare stocks riding similar waves of innovation, simply check out our See the full list for free..

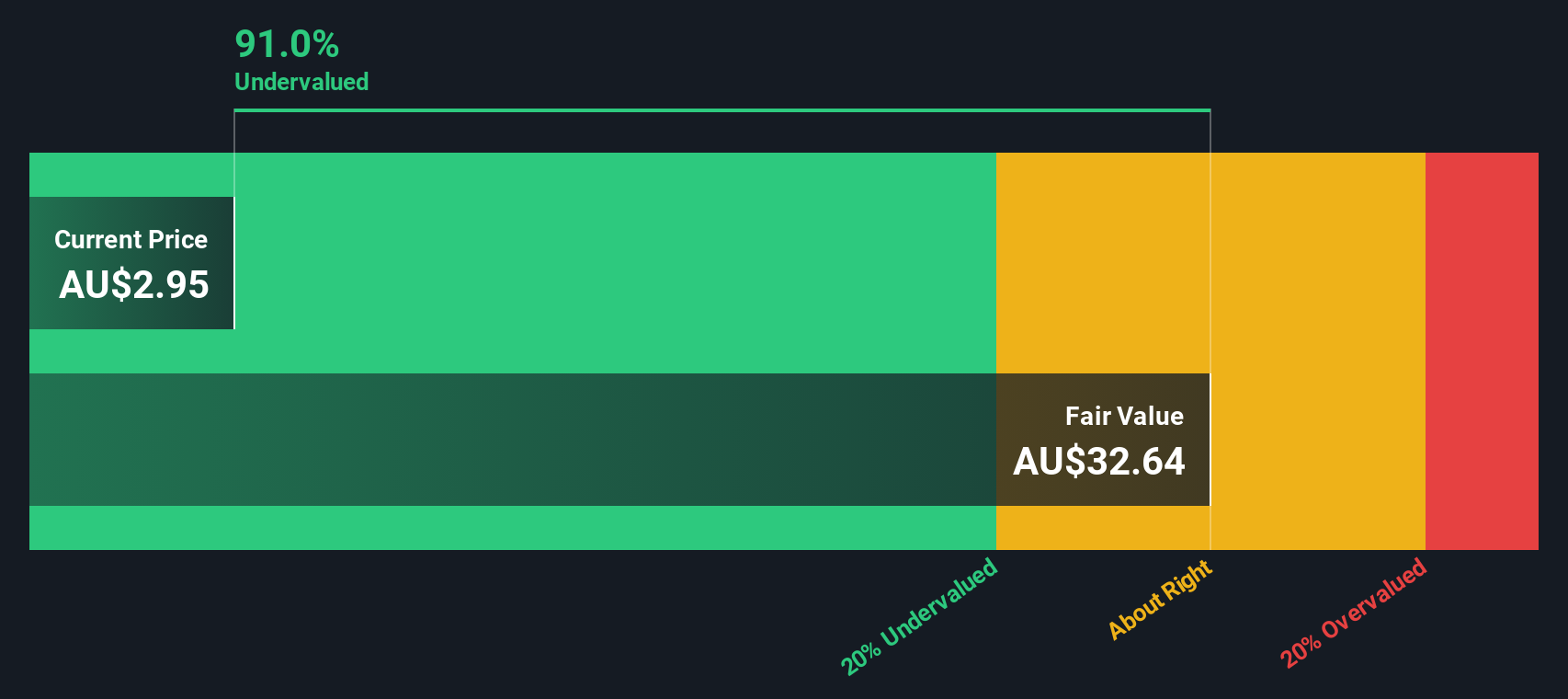

But with such a sharp rally and investor excitement running high, the big question now is whether Mesoblast shares remain undervalued, or if the market has already baked in the next chapter of growth.

Price-to-Book Ratio of 4x: Is it justified?

Mesoblast's price-to-book ratio stands at 4x, noticeably lower than both the Australian Biotechs industry average of 4.9x and the peer average of 4.4x. This suggests the shares offer relative value at the last close of A$2.89.

The price-to-book ratio tells investors how much they are paying for each dollar of net assets the company holds. In the biotech sector, where future profits are often speculative, the price-to-book can indicate market confidence in a company’s innovation pipeline or highlight a disconnect between tangible assets and market expectations.

With Mesoblast trading below its peer group and sector on this ratio, the market could be underestimating the company’s growth outlook or built-in optionality from its therapy approvals. If the broader market moves closer to its fair ratio, there may be further upside ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 4x (UNDERVALUED)

However, investors should note that Mesoblast’s consistent net losses and reliance on breakthrough approvals could limit share price gains if clinical or regulatory setbacks occur.

Find out about the key risks to this Mesoblast narrative.

Another View: DCF Suggests Even Deeper Value

Looking at Mesoblast through the lens of our DCF model presents an even more bullish picture. The SWS DCF model estimates the fair value to be A$32.65 per share, meaning the current price is trading around 91% below that benchmark. But can this long-term view withstand the uncertainties of biotech?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mesoblast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mesoblast Narrative

If you’d rather chart your own path or want to dig deeper into the numbers, you can shape your own Mesoblast story in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mesoblast.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. Leverage the Simply Wall Street Screener now to see what your portfolio might be missing out on.

- Uncover potential future giants by browsing these 3583 penny stocks with strong financials, which targets companies with strong fundamentals in overlooked pockets of the market.

- Collect steady income by reviewing these 19 dividend stocks with yields > 3%, which is designed to spotlight businesses offering attractive dividend yields above 3%.

- Get ahead of tomorrow’s breakthroughs by checking out these 26 quantum computing stocks, your gateway into the fast-evolving quantum computing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MSB

Mesoblast

Engages in the development of regenerative medicine products in Australia, the United States, Singapore, and Switzerland.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives