The Australian market has experienced a downward trend recently, influenced by the Reserve Bank of Australia's cautious stance on interest rate cuts and uncertainties surrounding upcoming U.S. tariffs. In this environment, identifying high-growth tech stocks requires careful consideration of their resilience to economic shifts and their potential to capitalize on emerging technological trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pro Medicus | 20.17% | 22.26% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| WiseTech Global | 24.60% | 23.18% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| Wrkr | 55.92% | 116.30% | ★★★★★★ |

| Immutep | 70.84% | 42.55% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| Mesoblast | 45.03% | 57.42% | ★★★★★★ |

| SiteMinder | 18.78% | 55.56% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Audinate Group Limited specializes in developing and selling digital audio visual networking solutions both in Australia and internationally, with a market capitalization of A$521.02 million.

Operations: Audinate Group Limited generates revenue primarily through its Contract Electronics Manufacturing Services, amounting to A$73.60 million.

Audinate Group, amidst a dynamic tech landscape, is navigating through substantial transformations and strategic acquisitions, notably the recent Iris acquisition. With an impressive annual revenue growth rate of 16%, the company outpaces the Australian market average of 5.6%. However, its earnings have seen a sharp contrast with a decline of 79.2% over the past year compared to the industry average growth of 8.9%. On a positive note, Audinate's forecasted earnings growth stands at an annual rate of 38.7%, significantly higher than the market's 11%. The leadership transition with Alison Ledger stepping in as Chair following David Krall’s retirement could steer fresh perspectives on governance and strategy moving forward, leveraging her extensive experience in digital transformation and strategy development within tech sectors.

- Unlock comprehensive insights into our analysis of Audinate Group stock in this health report.

Understand Audinate Group's track record by examining our Past report.

Immutep (ASX:IMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Immutep Limited is a late-stage biotechnology company focused on developing innovative LAG-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market capitalization of A$379.70 million.

Operations: Immutep generates revenue primarily from its immunotherapy segment, amounting to A$4.88 million. The company is focused on advancing LAG-3 related treatments for cancer and autoimmune diseases in the Australian market.

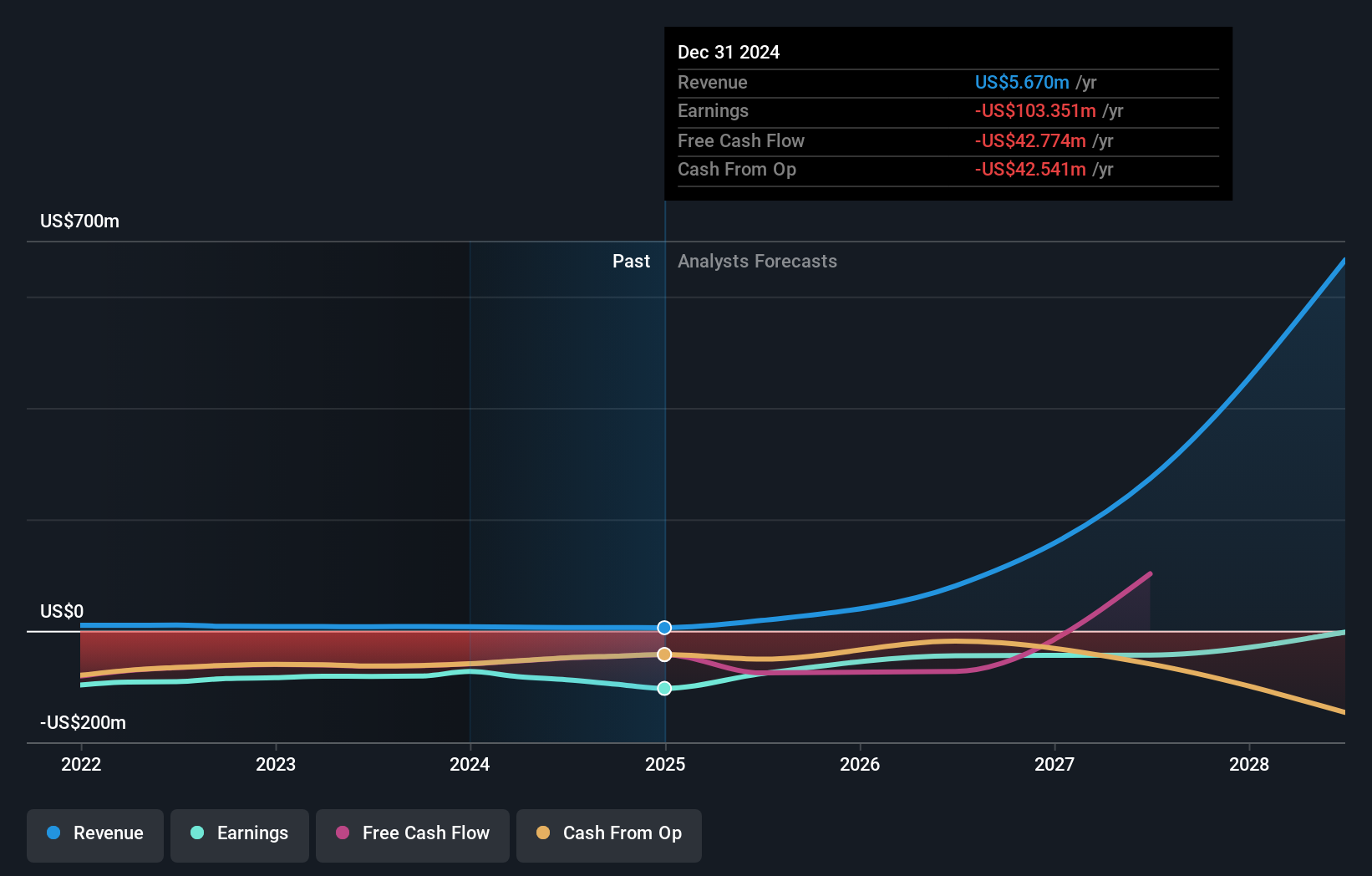

Immutep stands out in the high-growth tech landscape of Australia, particularly within the biotechnology sector, driven by its robust pipeline of immunotherapy treatments. With an annual revenue growth forecast at 70.8%, Immutep significantly surpasses the broader Australian market average of 5.6%. Despite current unprofitability, projections indicate a shift towards profitability within three years, supported by an anticipated earnings growth rate of 42.6% per annum. The company's commitment to innovation is underscored by its R&D focus; recent trials like the Phase I study for IMP761 show promising results with no adverse events at higher doses and substantial inhibition of T cell infiltration—an indicator of potential breakthroughs in autoimmune treatments. These developments not only enhance Immutep’s portfolio but also position it as a pivotal player in addressing complex autoimmune and cancer challenges through advanced therapeutic approaches.

- Click to explore a detailed breakdown of our findings in Immutep's health report.

Gain insights into Immutep's historical performance by reviewing our past performance report.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Mesoblast Limited is focused on developing regenerative medicine products across Australia, the United States, Singapore, and Switzerland, with a market capitalization of A$3.30 billion.

Operations: Mesoblast Limited focuses on the development of cell technology platforms for commercialization, generating revenue of $5.67 million.

Mesoblast, an emerging force in Australia's high-growth tech sector, particularly in biotechnology, is navigating toward profitability with expectations of becoming profitable within the next three years. With a remarkable projected annual revenue growth rate of 45% and earnings anticipated to surge by 57.42% annually, the company's strategic focus on R&D is evident from its alignment with FDA requirements for Revascor® aimed at treating ischemic heart failure. Recent FDA interactions underscore Mesoblast's proactive approach in regulatory compliance and innovation, positioning it well amidst competitors despite current unprofitability. These developments not only propel Mesoblast forward but also highlight its potential pivotal role in advancing regenerative medicine.

- Dive into the specifics of Mesoblast here with our thorough health report.

Evaluate Mesoblast's historical performance by accessing our past performance report.

Where To Now?

- Navigate through the entire inventory of 47 ASX High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IMM

Immutep

A biotechnology company, engages in developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives