The Medlab Clinical (ASX:MDC) Share Price Is Down 79% So Some Shareholders Are Rather Upset

As an investor, mistakes are inevitable. But really bad investments should be rare. So spare a thought for the long term shareholders of Medlab Clinical Limited (ASX:MDC); the share price is down a whopping 79% in the last three years. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 51%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 17% in a month.

See our latest analysis for Medlab Clinical

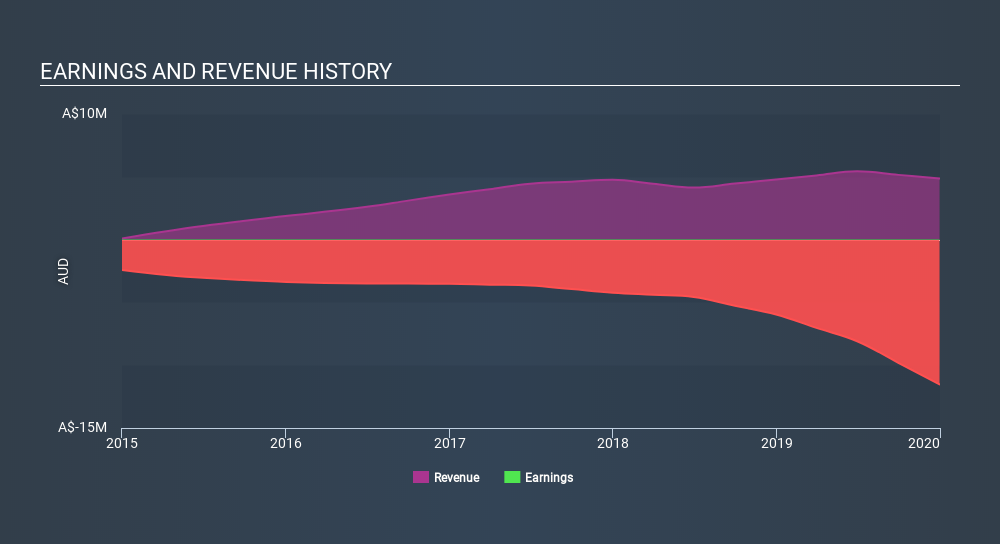

Medlab Clinical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Medlab Clinical grew revenue at 9.0% per year. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 40% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Medlab Clinical's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Medlab Clinical shareholders are down 51% for the year, falling short of the market return. Meanwhile, the broader market slid about 6.2%, likely weighing on the stock. The three-year loss of 40% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 5 warning signs for Medlab Clinical (1 is concerning) that you should be aware of.

Of course Medlab Clinical may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:MDC

Medlab Clinical

Medlab Clinical Limited, a biotechnology company, researches, develops, and pre-commercializes pharmaceutical and nutraceutical products in Australia.

Adequate balance sheet and fair value.

Market Insights

Community Narratives