Medlab Clinical (ASX:MDC) Share Prices Have Dropped 69% In The Last Three Years

Medlab Clinical Limited (ASX:MDC) shareholders should be happy to see the share price up 23% in the last quarter. Meanwhile over the last three years the stock has dropped hard. Indeed, the share price is down a tragic 69% in the last three years. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Check out our latest analysis for Medlab Clinical

Medlab Clinical recorded just AU$2,848,395 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Medlab Clinical comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. It certainly is a dangerous place to invest, as Medlab Clinical investors might realise.

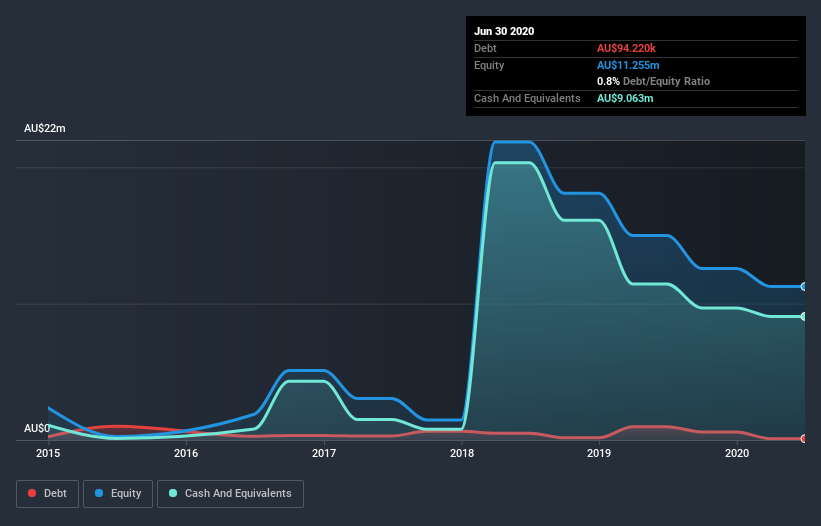

Medlab Clinical only just had cash in excess of all liabilities when it last reported. So it is a good thing that the company has looked to remedy the situation by raising more capital recently. With that in mind, you can imagine there may be other factors that caused the share price to drop 19% per year, over 3 years. You can see in the image below, how Medlab Clinical's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

While the broader market gained around 6.0% in the last year, Medlab Clinical shareholders lost 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Medlab Clinical is showing 4 warning signs in our investment analysis , you should know about...

But note: Medlab Clinical may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Medlab Clinical, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MDC

Medlab Clinical

Medlab Clinical Limited, a biotechnology company, researches, develops, and pre-commercializes pharmaceutical and nutraceutical products in Australia.

Adequate balance sheet and fair value.

Market Insights

Community Narratives