- Australia

- /

- Metals and Mining

- /

- ASX:LRS

3 ASX Penny Stocks With Market Caps Over A$20M To Watch

Reviewed by Simply Wall St

The Australian sharemarket is poised for a slight retreat, with ASX 200 futures indicating a 0.28% drop following mixed signals from global markets and geopolitical tensions. Amidst these fluctuations, investors often seek opportunities in diverse areas such as penny stocks—an investment category that, despite its historical connotations, remains relevant today. These stocks typically represent smaller or newer companies and can offer compelling growth potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$328.89M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.37 | A$109.39M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$798.83M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.03 | A$114.16M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.96 | A$489.38M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Invion (ASX:IVX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Invion Limited is a clinical-stage life-sciences company in Australia that focuses on researching and developing Photosoft technology for treating cancers, atherosclerosis, and infectious diseases, with a market cap of A$24.74 million.

Operations: The company generates revenue of A$3.69 million from its Clinical-Stage Life Sciences segment.

Market Cap: A$24.74M

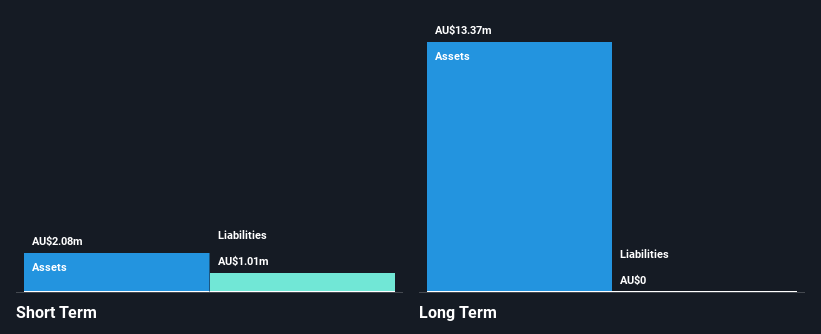

Invion Limited, a clinical-stage life-sciences company focused on Photosoft technology for cancer and disease treatment, operates with a market cap of A$24.74 million and minimal revenue of A$4 million, indicating it is pre-revenue. The company has no long-term liabilities or debt but faces high share price volatility and shareholder dilution. With less than a year of cash runway, financial sustainability is uncertain without additional funding or revenue growth. Recent board changes include the appointment of Ms. Melanie Leydin as Company Secretary amid ongoing strategic decisions like the proposed 100:1 stock split to enhance capital structure flexibility.

- Dive into the specifics of Invion here with our thorough balance sheet health report.

- Understand Invion's track record by examining our performance history report.

Latin Resources (ASX:LRS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Latin Resources Limited is a mining company focused on exploring and developing projects in Australia, Peru, Argentina, and Brazil with a market capitalization of A$476.24 million.

Operations: The company's revenue is derived from the exploration and evaluation of mining projects, amounting to A$0.09 million.

Market Cap: A$476.24M

Latin Resources Limited, with a market cap of A$476.24 million, is pre-revenue, generating only A$0.09 million from its exploration activities. The company remains unprofitable and is not expected to achieve profitability in the next three years, with earnings forecasted to decline by 32.1% annually over this period. Despite having no debt and a seasoned management team with an average tenure of 5.2 years, Latin Resources faces financial challenges due to less than one year of cash runway based on current free cash flow trends. Recent events include presenting at IMARC 2024 and reporting a reduced half-year net loss compared to the previous year.

- Click to explore a detailed breakdown of our findings in Latin Resources' financial health report.

- Understand Latin Resources' earnings outlook by examining our growth report.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited offers online travel booking services across Australia, New Zealand, the United Arab Emirates, the United Kingdom, and other international markets with a market cap of A$1.90 billion.

Operations: The company's revenue is primarily derived from its Business to Business Travel (B2B) segment, which generated A$323.2 million.

Market Cap: A$1.9B

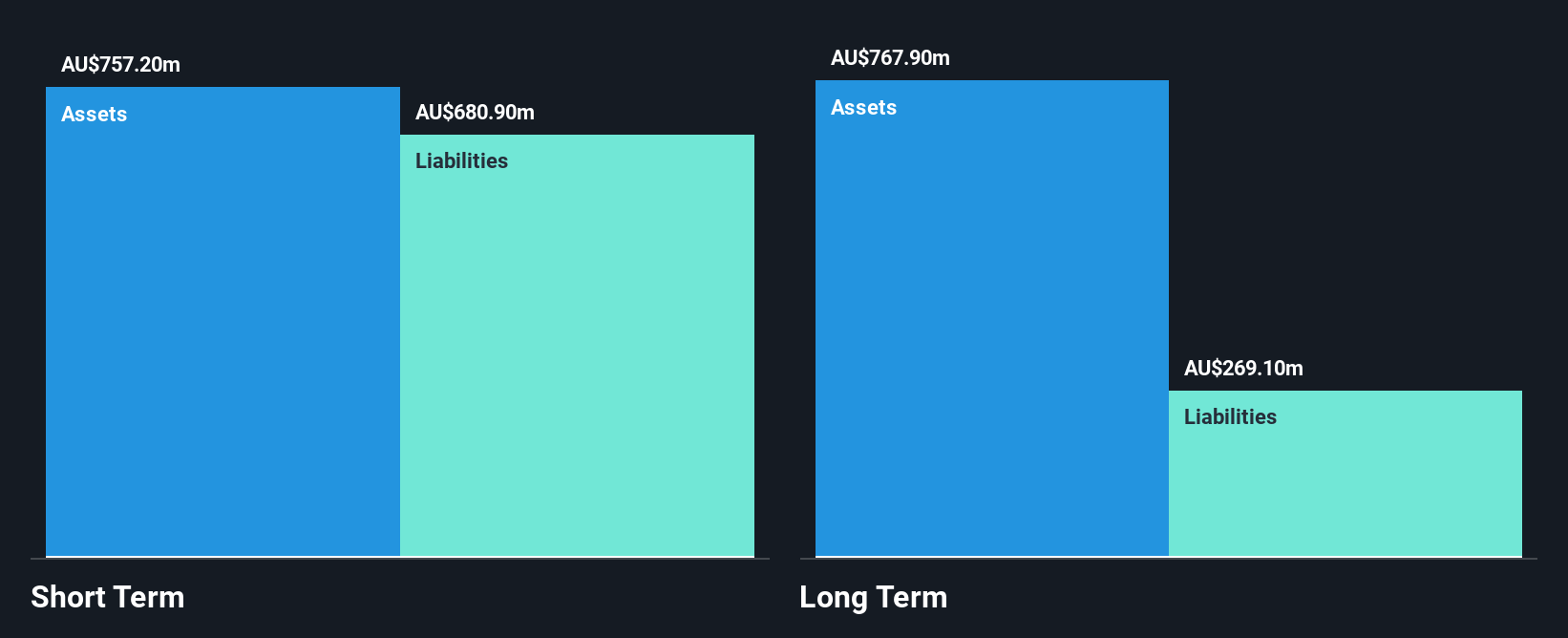

Web Travel Group Limited, with a market cap of A$1.90 billion, has demonstrated strong financial health and growth potential. The company's earnings have grown significantly by 63% over the past year, surpassing its five-year average growth rate of 44.1%. Despite a low return on equity at 10.5%, Web Travel maintains high-quality earnings and robust profit margins that improved from 12.6% to 16%. Its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Recent announcements include a share repurchase program up to A$150 million, reflecting confidence in its financial stability and future prospects.

- Get an in-depth perspective on Web Travel Group's performance by reading our balance sheet health report here.

- Explore Web Travel Group's analyst forecasts in our growth report.

Make It Happen

- Click this link to deep-dive into the 1,044 companies within our ASX Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LRS

Latin Resources

Explores and develops mining projects in Australia, Peru, Argentina, and Brazil.

Moderate with adequate balance sheet.