Incannex Healthcare (ASX:IHL) Has Rewarded Shareholders With An Exceptional 774% Total Return On Their Investment

It's been a soft week for Incannex Healthcare Limited (ASX:IHL) shares, which are down 12%. But over three years the performance has been really wonderful. In fact, the share price has taken off in that time, up 696%. Arguably, the recent fall is to be expected after such a strong rise. The share price action could signify that the business itself is dramatically improved, in that time.

It really delights us to see such great share price performance for investors.

See our latest analysis for Incannex Healthcare

Incannex Healthcare wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Incannex Healthcare's revenue trended up 16% each year over three years. That's a very respectable growth rate. Arguably the very strong share price gain of 100% a year is very generous when compared to the revenue growth. A hot stock like this is usually well worth taking a closer look at, as long as you don't let the fear of missing out (FOMO) impact your thinking.

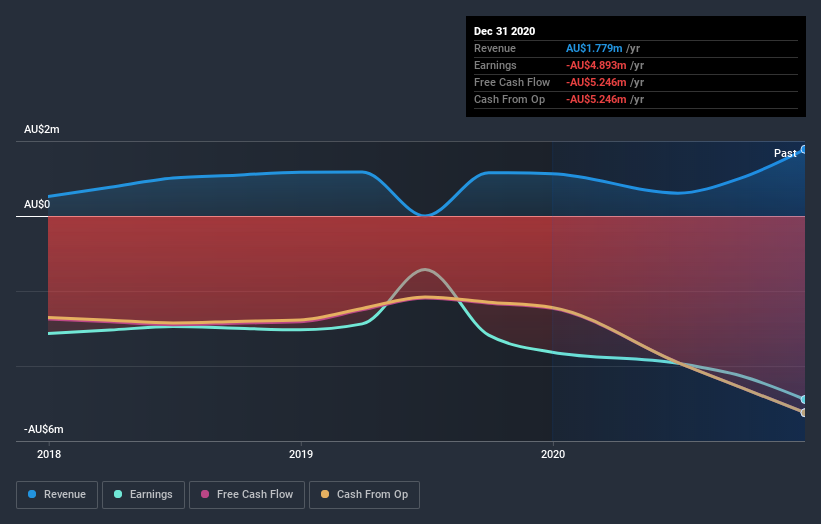

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Incannex Healthcare's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Incannex Healthcare's TSR, at 774% is higher than its share price return of 696%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Pleasingly, Incannex Healthcare's total shareholder return last year was 313%. That gain actually surpasses the 106% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Incannex Healthcare on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Incannex Healthcare .

Of course Incannex Healthcare may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Incannex Healthcare or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Incannex Healthcare, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IHL

Incannex Healthcare

A clinical-stage biopharmaceutical company, engages in the research, development, manufacture, sale, and distribution of psychedelic medicines and therapies for patients with chronic diseases in Australia.

Medium with flawless balance sheet.

Market Insights

Community Narratives