- Australia

- /

- Metals and Mining

- /

- ASX:AMI

Aurelia Metals And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian market is facing a cautious start today, with the ASX 200 expected to open down by 0.89% amid concerns stemming from U.S. trade issues and recent volatility in global markets. In such uncertain times, investors might find opportunities in penny stocks—smaller or newer companies that can offer unique value propositions despite being an older term for investment areas. This article explores three penny stocks on the ASX that stand out for their financial resilience and potential growth, making them intriguing options for those looking to diversify beyond established names.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.69 | A$218.85M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.905 | A$1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.56 | A$73.59M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.605 | A$115.6M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.57 | A$169.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.725 | A$845.39M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.90 | A$673.74M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 999 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aurelia Metals Limited is involved in the exploration and production of mineral properties in Australia, with a market cap of A$524.70 million.

Operations: The company's revenue is primarily derived from its mining operations, with A$5.98 million from the Hera Mine, A$245.13 million from the Peak Mine, and A$73.90 million from the Dargues Mine.

Market Cap: A$524.7M

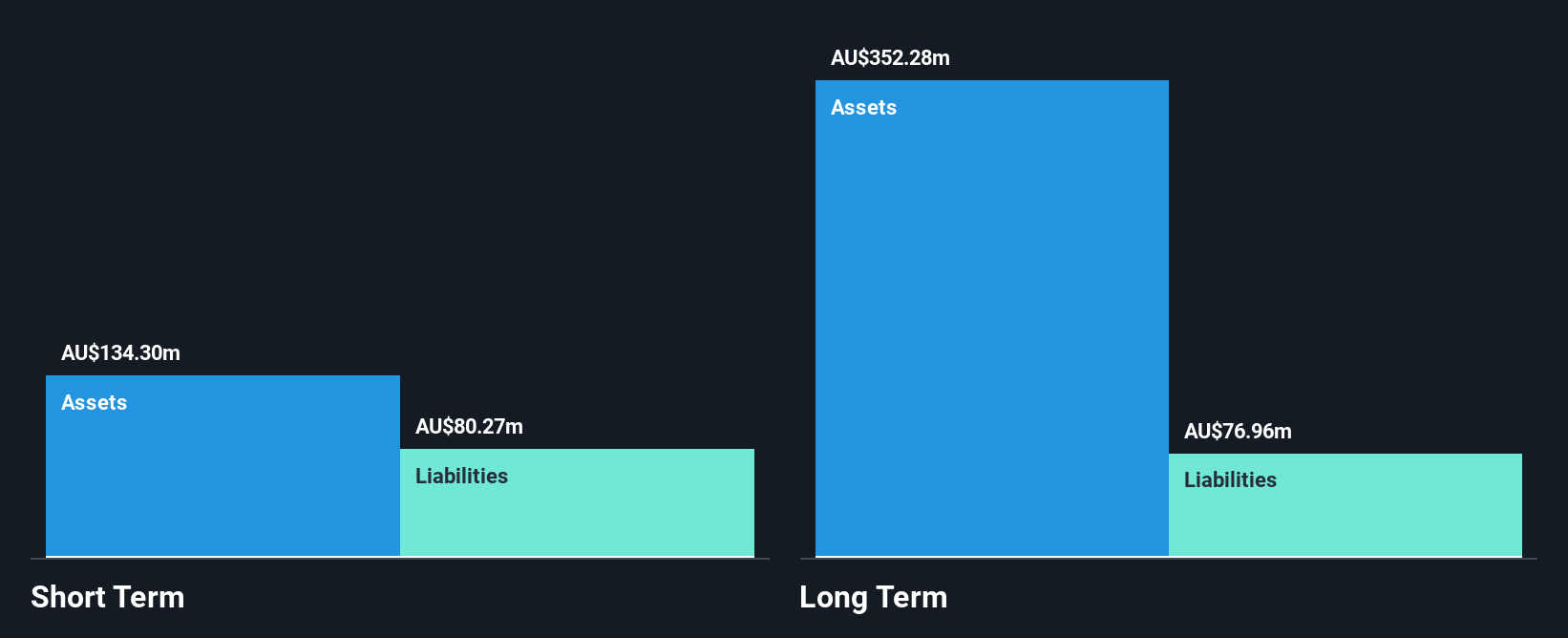

Aurelia Metals has shown a significant turnaround by becoming profitable recently, with net income of A$17.95 million for the half year ending December 2024, compared to a prior net loss. The company’s operating cash flow covers its debt well, highlighting strong financial management. However, its Return on Equity remains low at 4.3%, and interest payments are not fully covered by EBIT. Despite these challenges, Aurelia's stock is trading significantly below estimated fair value and has not seen meaningful shareholder dilution recently. Recent presentations at industry events may also enhance investor visibility and confidence in future prospects.

- Unlock comprehensive insights into our analysis of Aurelia Metals stock in this financial health report.

- Gain insights into Aurelia Metals' outlook and expected performance with our report on the company's earnings estimates.

Bravura Solutions (ASX:BVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bravura Solutions Limited develops, licenses, and maintains software applications for the wealth management and funds administration sectors across Australia, the United Kingdom, New Zealand, and internationally, with a market cap of A$959.36 million.

Operations: Bravura Solutions generates revenue from its software applications for wealth management and funds administration, with significant contributions from Australia, the United Kingdom, New Zealand, and other international markets.

Market Cap: A$959.36M

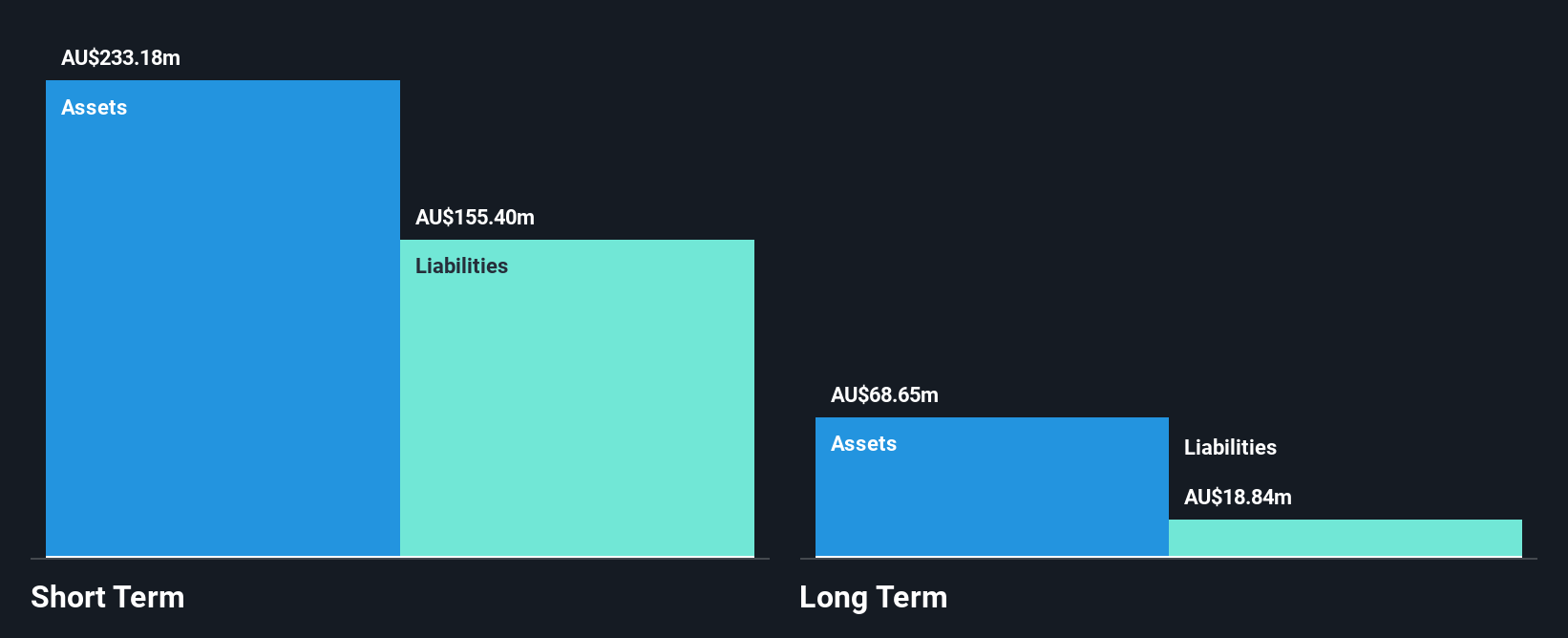

Bravura Solutions has recently become profitable, supported by a strong balance sheet with no debt and short-term assets exceeding liabilities. The company is trading at a favorable value compared to peers, with a Price-to-Earnings ratio of 13.4x versus the broader Australian market's 17.9x. Despite this, earnings are forecast to decline over the next three years by an average of 18.3% annually. The board's inexperience may pose challenges as it adapts to leadership changes following the appointment of an interim CEO in April 2025 after being dropped from the S&P/ASX Emerging Companies Index in March.

- Take a closer look at Bravura Solutions' potential here in our financial health report.

- Learn about Bravura Solutions' future growth trajectory here.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dimerix Limited is an Australian biopharmaceutical company focused on developing and commercializing pharmaceutical products for unmet medical needs, with a market cap of A$339.37 million.

Operations: Dimerix generates revenue primarily from its biotechnology segment, amounting to A$0.74 million.

Market Cap: A$339.37M

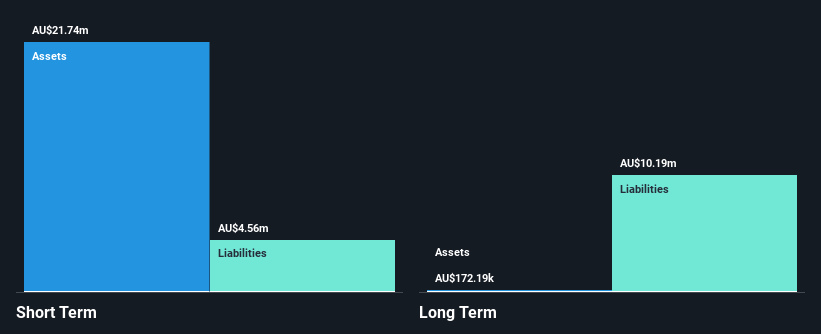

Dimerix is a pre-revenue biopharmaceutical company with a market cap of A$339.37 million, focusing on unmet medical needs. Despite its unprofitability and increased losses over the past five years, Dimerix's recent developments include an exclusive U.S. licensing agreement with Amicus Therapeutics for DMX-200, a Phase 3 drug candidate for FSGS kidney disease. The company's short-term assets cover both short and long-term liabilities, providing some financial stability despite less than one year of cash runway if free cash flow continues to decline at historical rates. The board and management are considered experienced, which may aid in navigating future challenges.

- Get an in-depth perspective on Dimerix's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Dimerix's track record.

Make It Happen

- Click here to access our complete index of 999 ASX Penny Stocks.

- Curious About Other Options? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMI

Aurelia Metals

Engages in the exploration and production of mineral properties in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives