How Investors May Respond To CSL (ASX:CSL) Securing NICE Approval and Appointing New CFO

Reviewed by Sasha Jovanovic

- CSL Limited recently appointed Ken Lim as its new Chief Financial Officer, succeeding Joy Linton, while also receiving final NICE guidance for NHS use of CSL Behring’s Andembry to prevent hereditary angioedema attacks in eligible UK patients.

- This regulatory milestone for Andembry signals ongoing diversification and expansion of CSL’s specialty therapies, coinciding with leadership changes at a pivotal phase of the company’s operational transformation.

- We’ll explore how CSL’s NICE approval for Andembry may reinforce its innovation-led investment narrative and future growth prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CSL Investment Narrative Recap

CSL shareholders typically believe in the company's ability to drive long-term value through innovation in specialty therapies and operational transformation. The recent NICE approval for Andembry in the UK strengthens the innovation catalyst, but is unlikely to materially alter the most important short-term catalyst: margin recovery through cost efficiencies. The main near-term risk continues to be increased price competition and slow uptake of new launches, which this news does not significantly reduce.

The highlight among recent announcements most relevant to this development is the FDA and Health Canada approvals for Andembry, reinforcing growing international accessibility for CSL’s new therapies. Together with NICE guidance, this unlocks a broader addressable market but does not lessen the ongoing risk that slow uptake or competitive pressures could limit revenue acceleration from newly launched products.

However, investors should be aware that, despite these approvals, a key risk remains if price competition in key plasma markets intensifies…

Read the full narrative on CSL (it's free!)

CSL's outlook forecasts $18.1 billion in revenue and $4.2 billion in earnings by 2028. This is based on a 5.3% annual revenue growth rate and a $1.2 billion earnings increase from the current $3.0 billion.

Uncover how CSL's forecasts yield a A$280.38 fair value, a 34% upside to its current price.

Exploring Other Perspectives

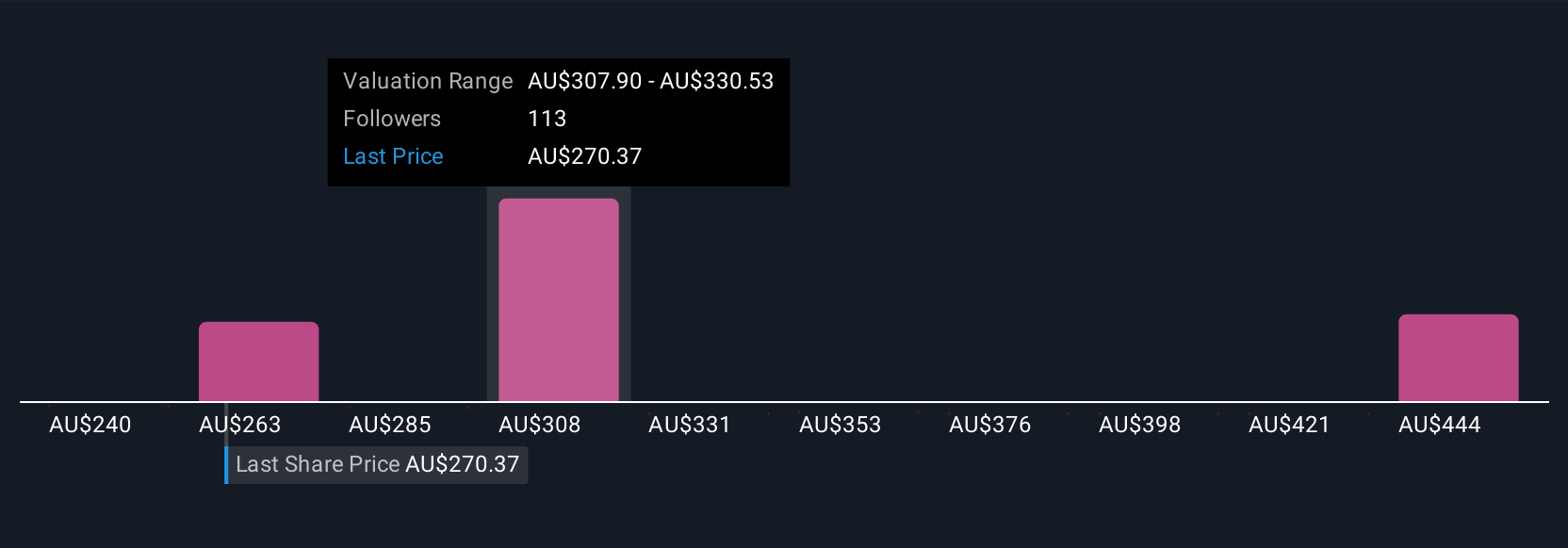

Twenty fair value assessments from the Simply Wall St Community range from A$239.81 to A$325.74 per share, revealing a wide span of market opinions. Some see CSL as a growth opportunity driven by operational efficiencies, while others focus on the persistent risk that slow product uptake could limit upside; explore these diverse viewpoints to inform your own assessment.

Explore 20 other fair value estimates on CSL - why the stock might be worth just A$239.81!

Build Your Own CSL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSL research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CSL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSL's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CSL

CSL

Engages in the research, development, manufacture, market, and distribution of biopharmaceutical products and vaccines in Australia, the United States, Germany, the United Kingdom, Switzerland, China, Hong Kong, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026