Here's Why We're Not Too Worried About Avita Medical's (ASX:AVH) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. Indeed, Avita Medical (ASX:AVH) stock is up 478% in the last year, providing strong gains for shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky Avita Medical's cash burn is. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business's cash, relative to its cash burn.

Check out our latest analysis for Avita Medical

Does Avita Medical Have A Long Cash Runway?

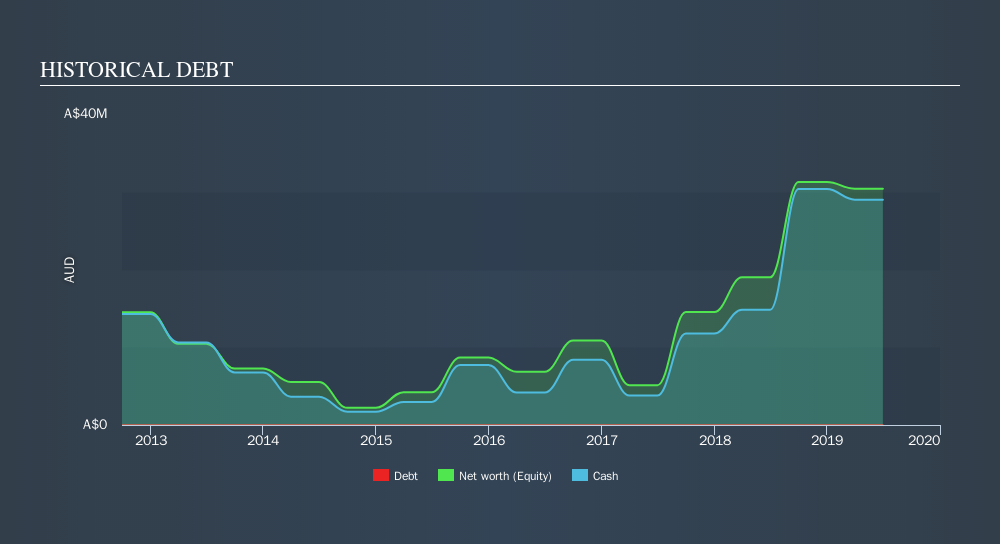

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2019, Avita Medical had AU$29m in cash, and was debt-free. Importantly, its cash burn was AU$29m over the trailing twelve months. So it had a cash runway of approximately 12 months from June 2019. Notably, analysts forecast that Avita Medical will break even (at a free cash flow level) in about 2 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. You can see how its cash balance has changed over time in the image below.

How Well Is Avita Medical Growing?

Avita Medical actually ramped up its cash burn by a whopping 74% in the last year, which shows it is boosting investment in the business. Given that operating revenue was up a stupendous 366% over the last year, there's a good chance the investment will pay off. Considering the factors above, the company seems have some good growth. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Avita Medical Raise More Cash Easily?

While Avita Medical seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Avita Medical has a market capitalisation of AU$965m and burnt through AU$29m last year, which is 3.0% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Avita Medical's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Avita Medical's cash burn. For example, we think its revenue growth suggests that the company is on a good path. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. One real positive is that analysts are forecasting that the company will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Notably, our data indicates that Avita Medical insiders have been trading the shares. You can discover if they are buyers or sellers by clicking on this link.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:AVH

AVITA Medical

Operates as a therapeutic acute wound care company in the United States, Japan, the European Union, Australia, and the United Kingdom.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives