Why We Think RooLife Group Ltd's (ASX:RLG) CEO Compensation Is Not Excessive At All

Key Insights

- RooLife Group's Annual General Meeting to take place on 29th of November

- Salary of AU$273.8k is part of CEO Bryan Carr's total remuneration

- Total compensation is 56% below industry average

- Over the past three years, RooLife Group's EPS grew by 44% and over the past three years, the total loss to shareholders 85%

Performance at RooLife Group Ltd (ASX:RLG) has been rather uninspiring recently and shareholders may be wondering how CEO Bryan Carr plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 29th of November. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for RooLife Group

How Does Total Compensation For Bryan Carr Compare With Other Companies In The Industry?

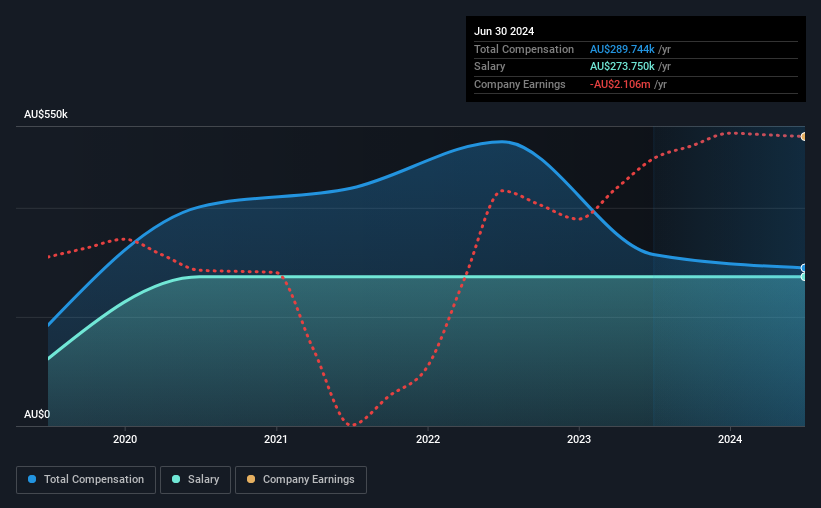

According to our data, RooLife Group Ltd has a market capitalization of AU$3.5m, and paid its CEO total annual compensation worth AU$290k over the year to June 2024. We note that's a small decrease of 7.9% on last year. In particular, the salary of AU$273.8k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Australian Media industry with market capitalizations below AU$308m, reported a median total CEO compensation of AU$660k. In other words, RooLife Group pays its CEO lower than the industry median. Moreover, Bryan Carr also holds AU$98k worth of RooLife Group stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$274k | AU$274k | 94% |

| Other | AU$16k | AU$41k | 6% |

| Total Compensation | AU$290k | AU$314k | 100% |

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. RooLife Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at RooLife Group Ltd's Growth Numbers

Over the past three years, RooLife Group Ltd has seen its earnings per share (EPS) grow by 44% per year. Its revenue is down 23% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has RooLife Group Ltd Been A Good Investment?

With a total shareholder return of -85% over three years, RooLife Group Ltd shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders are sitting on a loss is certainly disheartening. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key focus for the board and management will be how to align the share price with fundamentals. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 3 warning signs for RooLife Group that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RLG

RooLife Group

Operates integrated digital marketing and eCommerce platform in Australia, China, the United Kingdom, South-east Asia, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026