REA Group (ASX:REA) Reports 23% Dividend Increase Despite High Valuation and Financial Challenges

Reviewed by Simply Wall St

REA Group(ASX:REA) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a 24% increase in group revenue and innovative product launches, juxtaposed against a 15% drop in earnings and inflationary pressures. In the discussion that follows, we will delve into REA Group's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on REA Group.

Strengths: Core Advantages Driving Sustained Success For REA Group

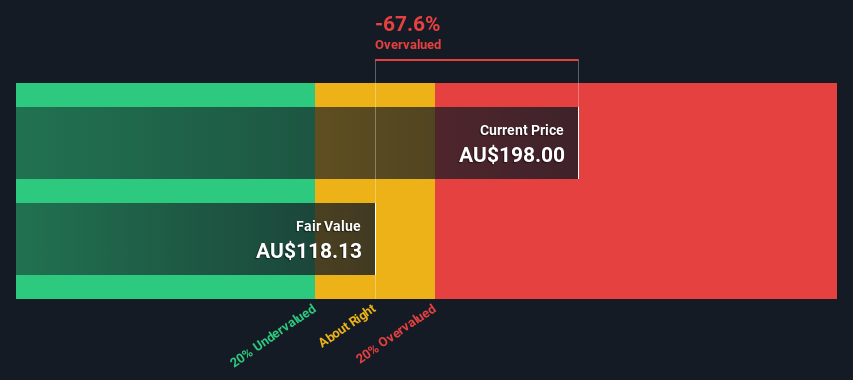

REA Group has demonstrated strong financial performance, with group revenue increasing by 24% to $334 million in the third quarter, as highlighted by CFO Janelle Hopkins in the latest earnings call. The company's flagship site, realestate.com.au, continues to dominate the Australian property market, reaching 11.2 million people on average each month, according to CEO Owen Wilson. This high engagement is complemented by innovative products like the AI-powered listing strength check, which enhances consumer experience. Leadership plays a crucial role, with REA's seasoned board and management team driving strategic goals effectively. However, despite these strengths, REA's valuation metrics reveal that the company is trading above its fair value estimate of A$118.15, with a Price-To-Earnings Ratio of 87.1x, significantly higher than the industry average of 19.8x.

Weaknesses: Critical Issues Affecting REA Group's Performance and Areas For Growth

REA Group faces several financial challenges, particularly in its Financial Services segment, which continues to struggle with soft lending conditions, as noted by Owen Wilson. The rental market remains subdued, with vacancies at decade lows. Additionally, group core operating expenses have increased by 18%, excluding the impact of the CampaignAgent acquisition, as reported by Janelle Hopkins. These challenges are compounded by the company's high Price-To-Earnings Ratio of 87.1x, making it expensive compared to its peers and the industry average. Furthermore, REA had negative earnings growth of -15% over the past year, contrasting sharply with the industry average growth of 11.9%. For a more comprehensive look at how these weaknesses could impact REA Group's financial stability, explore our section on REA Group's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

REA Group has several strategic opportunities to enhance its market position. The company is poised for strategic expansion, with plans to invest prudently to drive future growth into FY '25 and beyond, as stated by Janelle Hopkins. The potential for market recovery is also on the horizon, with interest rates expected to trend down next year and incoming tax cuts likely to boost economic activity. Additionally, REA India continues to show strong momentum, with a 31% year-on-year revenue increase. These opportunities, coupled with a forecasted earnings growth of 17% per year, position REA Group well to capitalize on emerging market trends. Learn more about how these opportunities could impact REA Group's future growth by reviewing our analysis of REA Group's Future Performance.

Threats: Key Risks and Challenges That Could Impact REA Group's Success

Despite its strong market position, REA Group faces significant threats. Market volatility remains a concern, with listings being notoriously hard to predict, as noted by Owen Wilson. The competitive landscape is also challenging, although REA has managed to widen the audience gap between realestate.com.au and its nearest competitor to almost 5 million people. Economic factors, such as potential significant interest rate increases, could also impact the market negatively. Furthermore, the company has faced substantial insider selling over the past three months, which could indicate potential concerns among insiders. These external factors could threaten REA Group's growth and market share in the long term.

Conclusion

REA Group's impressive financial performance, driven by strong engagement on its flagship site and innovative product offerings, underscores its dominant position in the Australian property market. However, the company's high Price-To-Earnings Ratio of 87.1x, well above the industry average of 19.8x, suggests that the stock is currently expensive. This premium valuation, coupled with challenges in the Financial Services segment and increased operating expenses, could impact its short-term financial stability. Nevertheless, strategic opportunities such as market recovery, expansion plans, and growth in REA India provide a promising outlook for future performance. Investors should weigh these factors carefully, considering both the potential for long-term growth and the immediate financial hurdles.

Make It Happen

- Is REA Group part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:REA

REA Group

Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives