These 4 Measures Indicate That IVE Group (ASX:IGL) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, IVE Group Limited (ASX:IGL) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for IVE Group

What Is IVE Group's Net Debt?

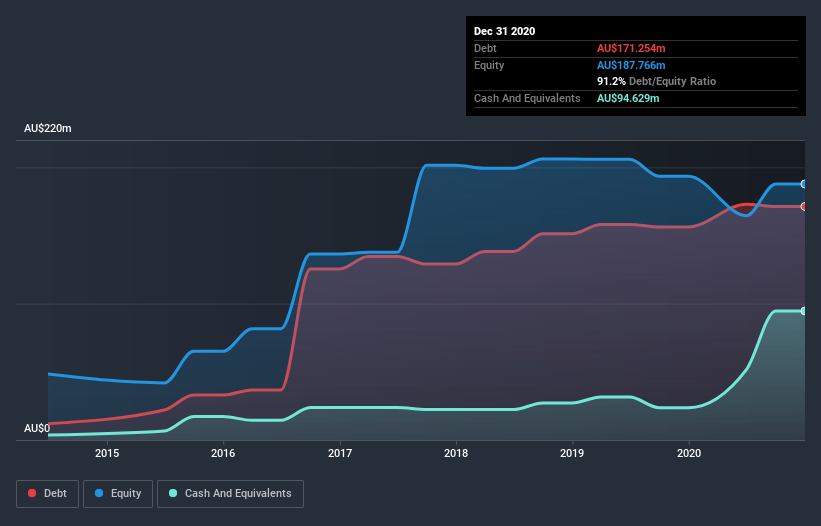

The image below, which you can click on for greater detail, shows that at December 2020 IVE Group had debt of AU$171.3m, up from AU$156.2m in one year. However, because it has a cash reserve of AU$94.6m, its net debt is less, at about AU$76.6m.

How Healthy Is IVE Group's Balance Sheet?

The latest balance sheet data shows that IVE Group had liabilities of AU$151.3m due within a year, and liabilities of AU$279.4m falling due after that. Offsetting this, it had AU$94.6m in cash and AU$108.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$227.1m.

Given this deficit is actually higher than the company's market capitalization of AU$206.8m, we think shareholders really should watch IVE Group's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While IVE Group's low debt to EBITDA ratio of 0.98 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.5 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. We note that IVE Group grew its EBIT by 21% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine IVE Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, IVE Group generated free cash flow amounting to a very robust 99% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

When it comes to the balance sheet, the standout positive for IVE Group was the fact that it seems able to convert EBIT to free cash flow confidently. However, our other observations weren't so heartening. To be specific, it seems about as good at staying on top of its total liabilities as wet socks are at keeping your feet warm. Considering this range of data points, we think IVE Group is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that IVE Group is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade IVE Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IGL

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026