The Australian market has recently experienced a downturn, with the ASX200 dropping to its lowest level since September, largely driven by declines in the Financials and Health Care sectors. In such fluctuating conditions, investors often seek opportunities that offer both value and growth potential. Penny stocks, despite being an older term, continue to capture attention due to their affordability and potential for significant returns when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.805 | A$281.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$828.23M | ★★★★★☆ |

| Joyce (ASX:JYC) | A$4.35 | A$124.48M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$63.17M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.175 | A$1.08B | ★★★★★★ |

| SRG Global (ASX:SRG) | A$1.12 | A$682.42M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dusk Group (ASX:DSK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dusk Group Limited is an Australian retailer specializing in scented and unscented candles, home decor, home fragrances, and gift solutions, with a market cap of A$73.79 million.

Operations: The company generates revenue from retail sales in the home fragrances and accessories segment, amounting to A$126.73 million.

Market Cap: A$73.79M

Dusk Group Limited, with a market cap of A$73.79 million, faces challenges as its earnings have declined by 9.5% annually over the past five years and experienced a significant drop in net income to A$4.27 million from A$11.59 million last year. Despite being debt-free and having high-quality earnings, its return on equity is low at 11.4%, and profit margins have decreased to 3.4%. The company is trading below estimated fair value but has seen negative growth compared to industry averages. Recent activities include plans for store expansions ahead of the Christmas period despite delisting from OTC Equity due to inactivity.

- Click here and access our complete financial health analysis report to understand the dynamics of Dusk Group.

- Gain insights into Dusk Group's outlook and expected performance with our report on the company's earnings estimates.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$319.07 million.

Operations: The company's revenue is primarily derived from its advertising segment, which generated A$972.82 million.

Market Cap: A$319.07M

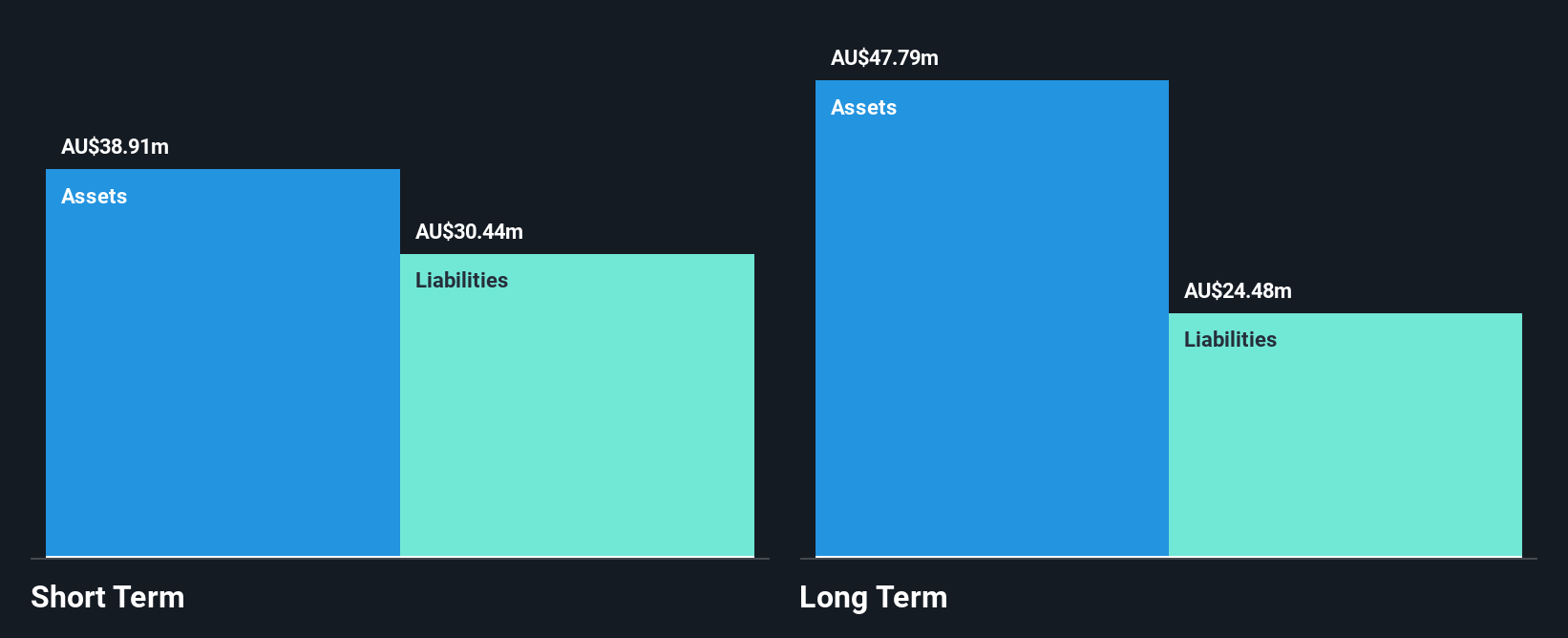

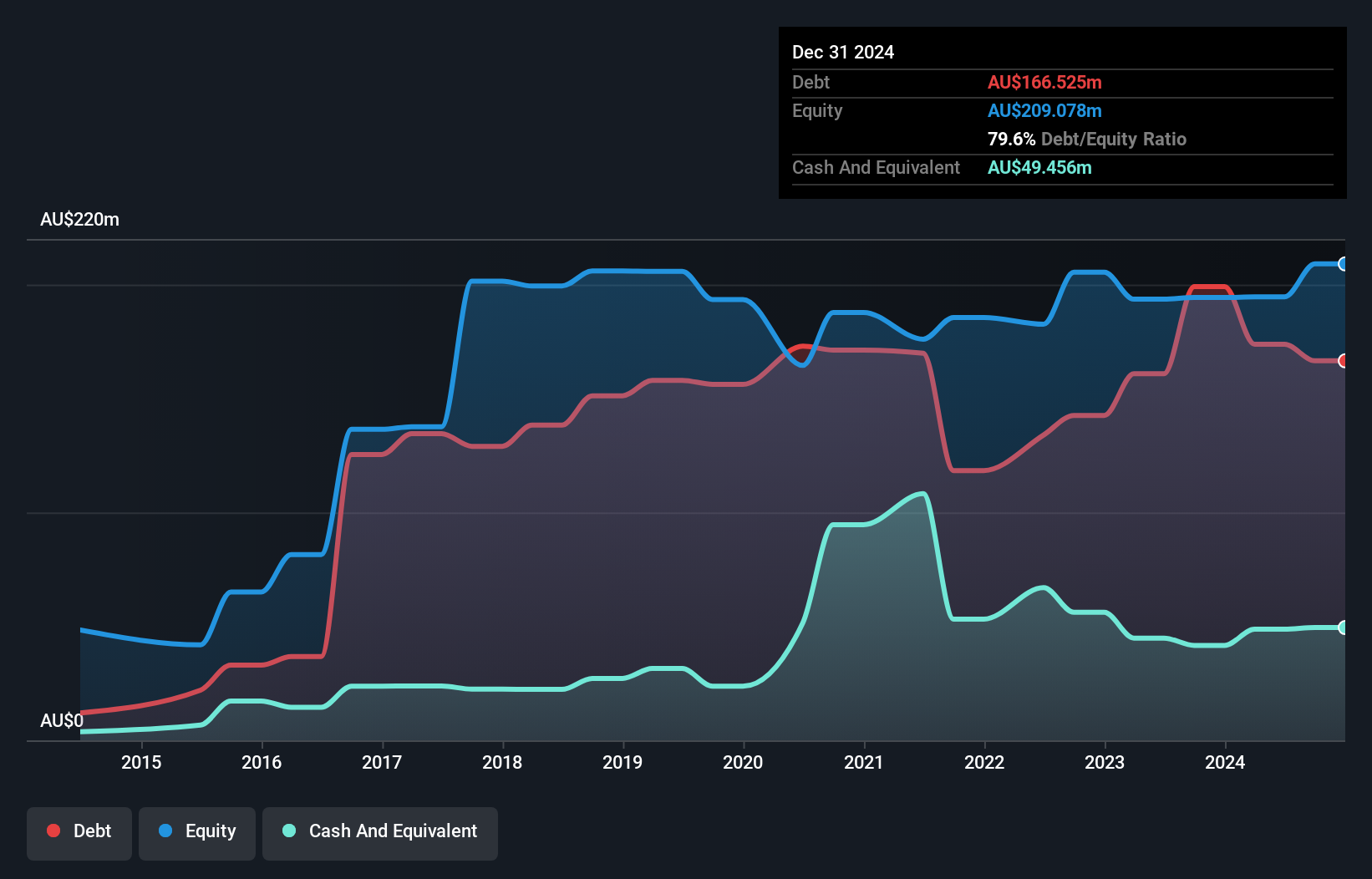

IVE Group Limited, with a market cap of A$319.07 million, has shown strong financial performance in the marketing sector. The company reported revenue of A$972.82 million and net income of A$27.61 million for the year ending June 2024, reflecting significant earnings growth of 61% over the past year. Despite a high net debt to equity ratio at 64.2%, its interest payments are well-covered by EBIT (3.4x). Short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. However, its dividend yield of 8.45% is not fully supported by earnings, highlighting potential sustainability concerns in dividend payouts.

- Click here to discover the nuances of IVE Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into IVE Group's future.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

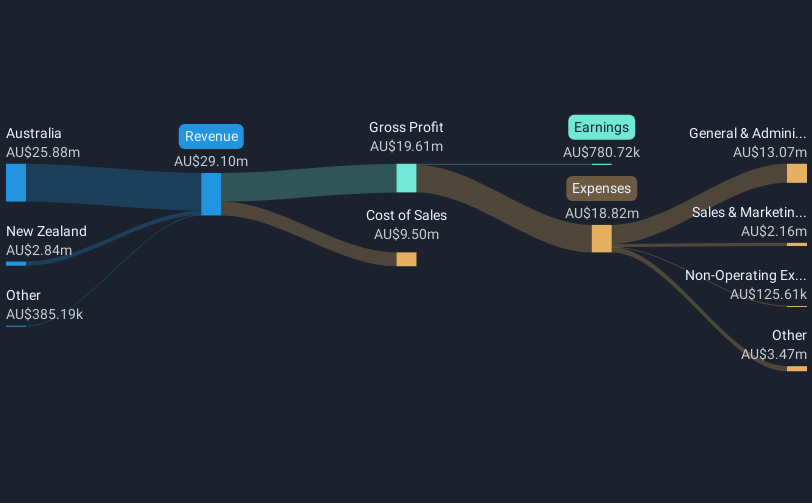

Overview: Kinatico Ltd operates in Australia and New Zealand, offering screening, verification, and SaaS-based workforce management and compliance technology systems, with a market cap of A$56.37 million.

Operations: The company generates revenue of A$29.10 million from its screening and verification checks segment.

Market Cap: A$56.37M

Kinatico Ltd, with a market cap of A$56.37 million, has experienced impressive earnings growth of 230% over the past year, far outpacing the IT industry average. The company's recent quarterly revenue reached A$8 million, marking a record high and reflecting a 10% increase from the previous period. Despite being debt-free and having short-term assets exceeding both short and long-term liabilities, shareholder dilution occurred last year. Kinatico's return on equity remains low at 3%, but its net profit margins have improved to 2.7%. The management team and board are considered experienced with average tenures over three years.

- Unlock comprehensive insights into our analysis of Kinatico stock in this financial health report.

- Examine Kinatico's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Unlock our comprehensive list of 1,033 ASX Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Undervalued with solid track record and pays a dividend.