- Australia

- /

- Capital Markets

- /

- ASX:DUI

3 ASX Dividend Stocks To Consider With Up To 7.5% Yield

Reviewed by Simply Wall St

As the ASX 200 experiences a slight downturn, influenced by persistent inflationary pressures and sector-specific fluctuations, investors continue to navigate a complex landscape. In such an environment, dividend stocks can offer a potential buffer against volatility, providing steady income streams that may appeal to those seeking stability amidst market uncertainties.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.32% | ★★★★★☆ |

| Perenti (ASX:PRN) | 6.35% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.44% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.48% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.37% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.64% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.62% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.48% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.23% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 6.13% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

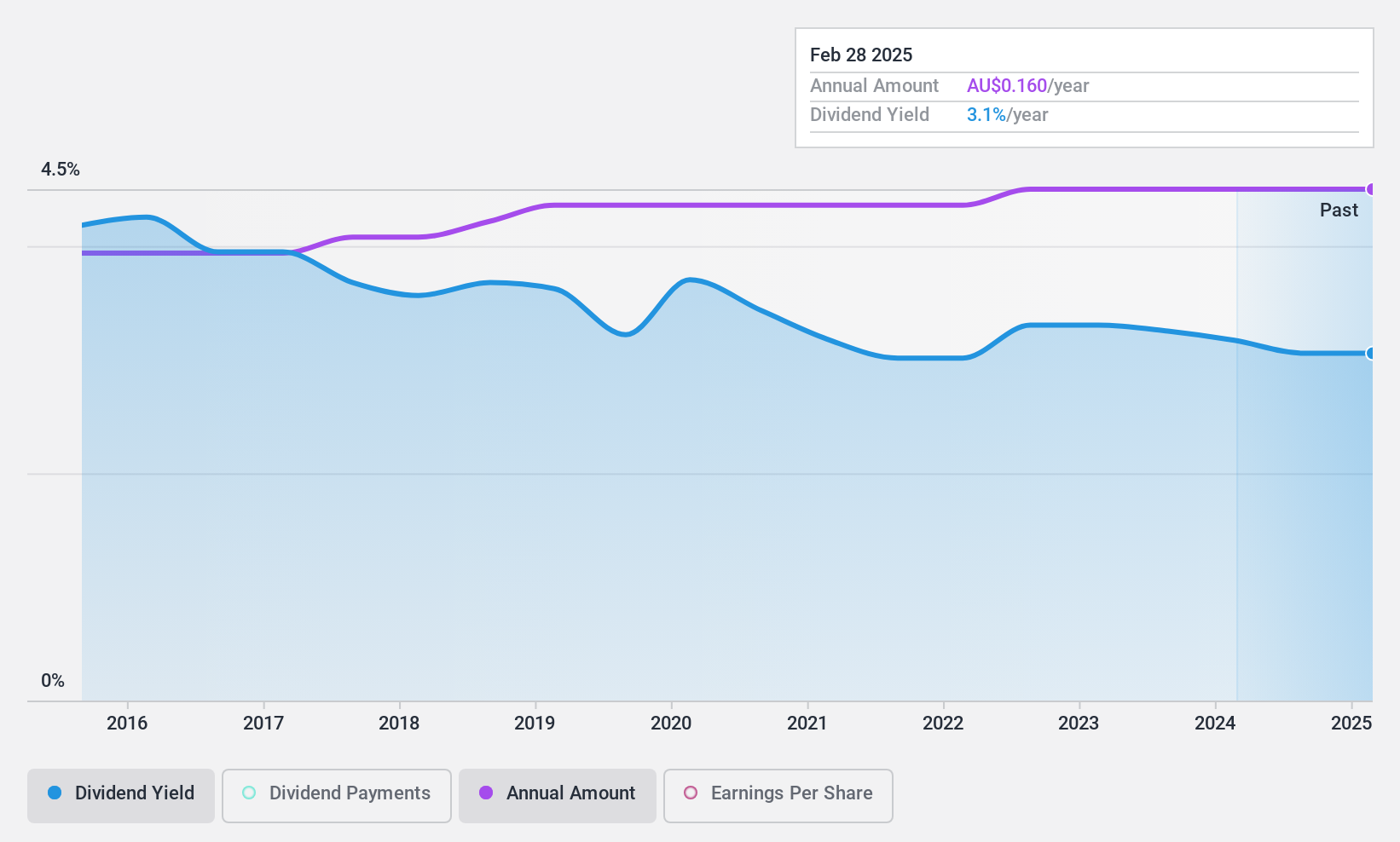

Diversified United Investment (ASX:DUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.15 billion.

Operations: The company generates revenue primarily from its investment company segment, amounting to A$46.41 million.

Dividend Yield: 3%

Diversified United Investment's dividend yield of 3% is lower than Australia's top 25% dividend payers. Despite a decade of reliable and stable growth, the high payout ratio of 94.2% suggests dividends are not well covered by earnings, though they are supported by cash flows with an 89.4% cash payout ratio. Recent earnings showed modest growth, with net income rising to A$18.52 million for the half-year ended December 2024.

- Click here to discover the nuances of Diversified United Investment with our detailed analytical dividend report.

- Our expertly prepared valuation report Diversified United Investment implies its share price may be too high.

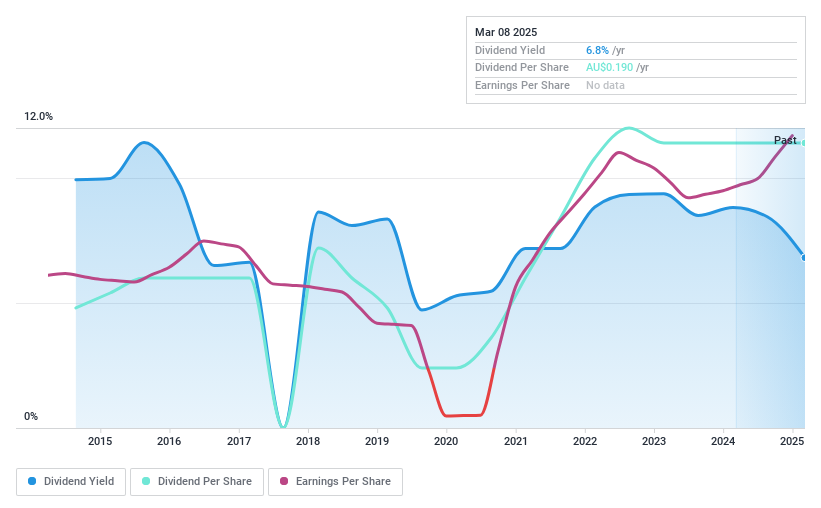

GR Engineering Services (ASX:GNG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and internationally, with a market cap of A$484.85 million.

Operations: GR Engineering Services Limited generates its revenue from providing engineering, procurement, and construction services to the mining and mineral processing industries across Australia and international markets.

Dividend Yield: 6.6%

GR Engineering Services' dividend yield of 6.55% ranks in the top 25% of Australian dividend payers. Recent earnings growth, with net income rising to A$21.82 million for the half-year ended December 2024, supports its dividends, which are covered by a payout ratio of 81.7% and a cash payout ratio of 35.6%. Despite past volatility in payments, dividends have increased over the last decade. The latest fully franked interim dividend rose to 10 cents per share from last year's 9 cents.

- Take a closer look at GR Engineering Services' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that GR Engineering Services is trading behind its estimated value.

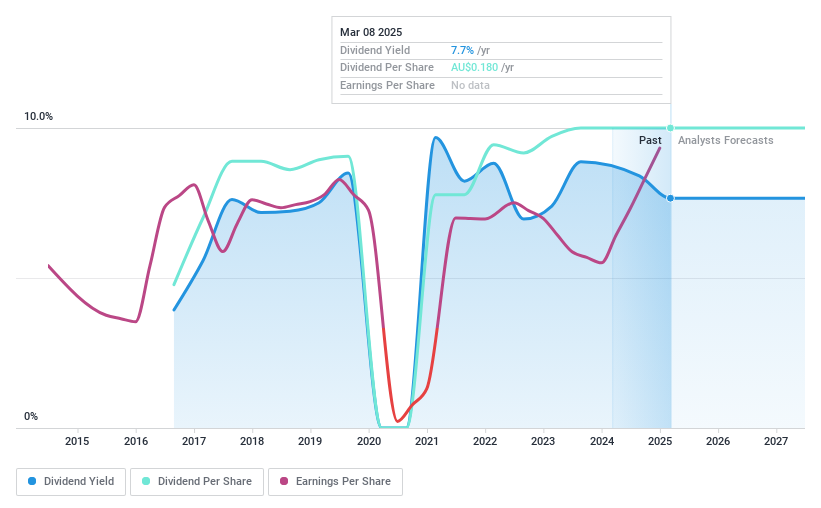

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$370.18 million.

Operations: IVE Group Limited generates revenue from its advertising segment, amounting to A$975.43 million.

Dividend Yield: 7.5%

IVE Group's dividend yield of 7.53% is among the top 25% in Australia, supported by a payout ratio of 66.7% and a cash payout ratio of 26.9%. Despite past volatility and only eight years of payments, dividends have grown recently. The company declared an interim dividend of A$0.095 per share for H1 2025, fully franked. A recent share buyback program worth A$10 million reflects sound capital management amid strong earnings growth and improved profitability.

- Dive into the specifics of IVE Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of IVE Group shares in the market.

Where To Now?

- Investigate our full lineup of 33 Top ASX Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUI

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion