Biome Australia And 2 Other Promising ASX Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, although it is up 22% over the past year with earnings expected to grow by 12% per annum in the coming years. Investing in penny stocks—often smaller or newer companies—can still open doors to growth opportunities when they demonstrate strong financial health. Despite being a somewhat outdated term, penny stocks continue to represent an underappreciated chance for growth at lower price points, and this article will explore several that could pair balance sheet strength with long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Biome Australia (ASX:BIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biome Australia Limited develops, commercializes, and markets various live biotherapeutics and complementary medicines in Australia and internationally, with a market cap of A$150.10 million.

Operations: The company's revenue is derived from its segment focused on innovative evidence-based products linking the gut and human health, totaling A$13.01 million.

Market Cap: A$150.1M

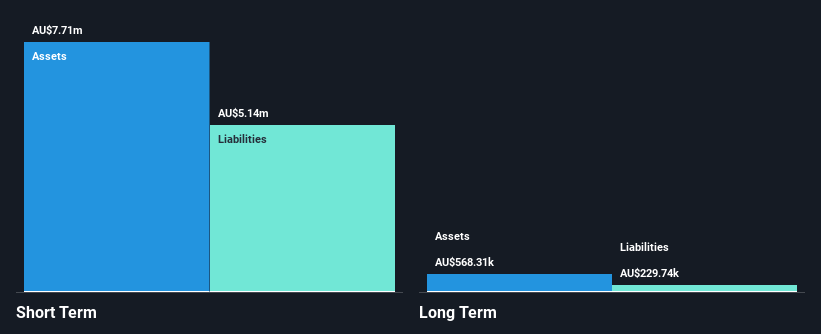

Biome Australia has demonstrated significant sales growth, with a 55% increase in first-quarter revenue for fiscal year 2025 compared to the same period last year, reaching A$4.25 million. Despite being unprofitable, it has reduced losses over five years and maintains more cash than debt. The company's short-term assets comfortably cover both its short and long-term liabilities. However, shareholders experienced dilution with an 8.3% increase in shares outstanding over the past year. While trading below estimated fair value, its high volatility presents potential risks for investors seeking stability in penny stock investments.

- Jump into the full analysis health report here for a deeper understanding of Biome Australia.

- Gain insights into Biome Australia's outlook and expected performance with our report on the company's earnings estimates.

Frontier Digital Ventures (ASX:FDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Digital Ventures Limited is a private equity firm that invests in and develops online classifieds businesses in emerging markets, with a market cap of A$173.43 million.

Operations: The company's revenue is derived from its investments in online classifieds businesses across various regions, with notable contributions from Infocasas (A$23.49 million), Fincaraiz (A$13.26 million), Encuentra24 (A$11.30 million), and other platforms such as Avito, Yapo, and Autodeal.

Market Cap: A$173.43M

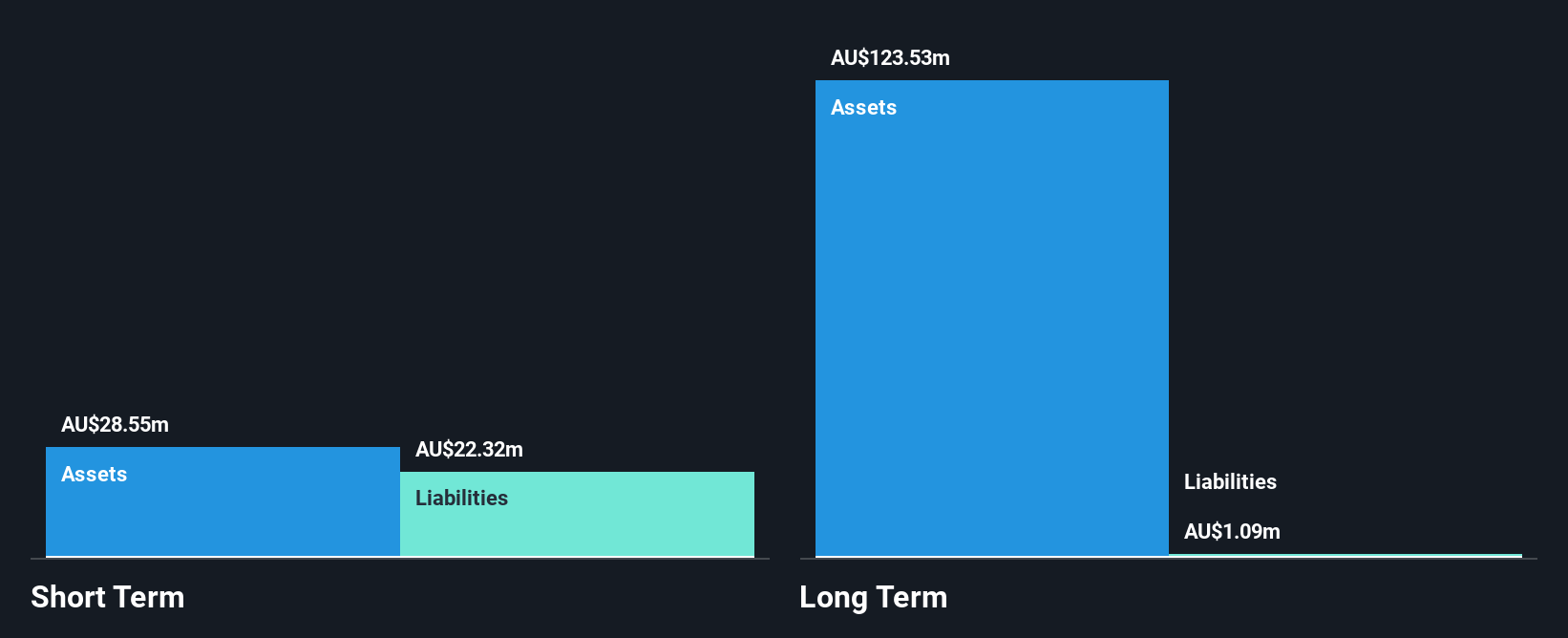

Frontier Digital Ventures, with a market cap of A$173.43 million, focuses on online classifieds in emerging markets. Despite being unprofitable and having increased losses over the past five years, its revenue grew to A$35.49 million for the first half of 2024 compared to A$31.18 million a year ago, reducing net loss significantly from A$9.91 million to A$1.47 million. The company has more cash than debt and sufficient short-term assets to cover liabilities but faces challenges with an inexperienced management team and recent delisting from OTC Equity due to inactivity as of October 15, 2024.

- Click here to discover the nuances of Frontier Digital Ventures with our detailed analytical financial health report.

- Evaluate Frontier Digital Ventures' prospects by accessing our earnings growth report.

Melbana Energy (ASX:MAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Melbana Energy Limited is involved in oil and gas exploration activities in Cuba and Australia, with a market cap of A$107.85 million.

Operations: Melbana Energy Limited does not report specific revenue segments.

Market Cap: A$107.85M

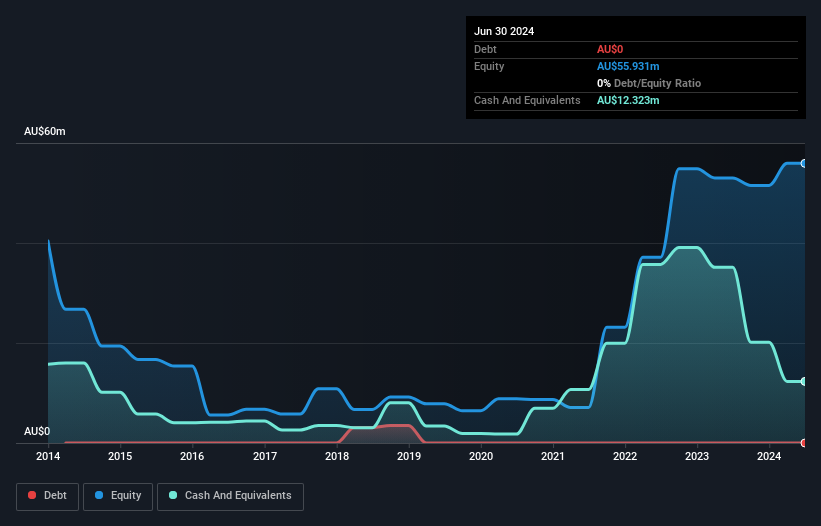

Melbana Energy Limited, with a market cap of A$107.85 million, focuses on oil and gas exploration in Cuba and Australia. The company has recently transitioned to profitability, reporting a net income of A$3.26 million for the year ended June 2024, after a previous loss. It remains pre-revenue with less than US$1 million in revenue but benefits from being debt-free and having short-term assets exceeding liabilities by A$10.9 million. Despite high non-cash earnings and volatile share prices, its board is experienced while its management team is relatively new; recent index exclusion may impact investor sentiment.

- Dive into the specifics of Melbana Energy here with our thorough balance sheet health report.

- Examine Melbana Energy's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Access the full spectrum of 1,027 ASX Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FDV

Frontier Digital Ventures

A private equity firm specializing in investing and developing online classifieds business in emerging markets.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives