As the Australian market opens nearly flat amid the kickoff of the 2025 election campaign, investors are keeping a close eye on potential shifts in economic policy and their impacts on various sectors. While penny stocks might seem like a term from another era, they continue to offer intriguing possibilities for those looking beyond well-established companies. These smaller or newer firms can present unique opportunities when backed by strong financials, and we'll explore three such stocks that stand out for their potential in today's evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.65 | A$128.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.83 | A$1.04B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.55 | A$73.12M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.42 | A$373.87M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.625 | A$122.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.23 | A$153.26M | ✅ 3 ⚠️ 2 View Analysis > |

| NobleOak Life (ASX:NOL) | A$1.45 | A$132.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.37 | A$794.89M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.86 | A$1.31B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.395 | A$46.35M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 969 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Frontier Digital Ventures (ASX:FDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Digital Ventures Limited is a private equity firm that invests in and develops online classifieds businesses in emerging markets, with a market cap of A$112.73 million.

Operations: Frontier Digital Ventures generates revenue from its investments in online classifieds businesses across various markets, with notable contributions from Infocasas (A$19.43 million), Fincaraiz (A$14.14 million), Encuentra24 (A$11.65 million), Avito (A$7.66 million), and Yapo (A$7.61 million).

Market Cap: A$112.73M

Frontier Digital Ventures, with a market cap of A$112.73 million, invests in online classifieds in emerging markets. Despite generating A$68.08 million in sales for 2024, the company remains unprofitable with a net loss of A$10.27 million, up from the previous year. The management team is relatively new, averaging 1.5 years in tenure; however, the board is experienced with an average tenure of 7.3 years. The company possesses more cash than its total debt and maintains sufficient short-term assets to cover liabilities but was recently dropped from the S&P/ASX All Ordinaries Index on March 7, 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Frontier Digital Ventures.

- Assess Frontier Digital Ventures' future earnings estimates with our detailed growth reports.

Ridley (ASX:RIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ridley Corporation Limited, with a market cap of A$833.83 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: The company generates revenue through two main segments: Bulk Stockfeeds, contributing A$894.26 million, and Packaged/Ingredients, adding A$389.70 million.

Market Cap: A$833.83M

Ridley Corporation Limited, with a market cap of A$833.83 million, has shown resilience in the competitive animal nutrition sector despite recent challenges. The company reported half-year sales of A$658.85 million and net income of A$22.19 million, reflecting stable financial performance compared to the previous year. Ridley's short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity management. The company's debt levels have decreased significantly over five years, enhancing financial stability while maintaining satisfactory interest coverage from EBIT and operating cash flow. Although earnings growth was negative last year, forecasts suggest a 12.22% annual increase moving forward.

- Jump into the full analysis health report here for a deeper understanding of Ridley.

- Explore Ridley's analyst forecasts in our growth report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$635.44 million.

Operations: The company's revenue is derived from two main segments: Advisory, which generated A$34.17 million, and Software, contributing A$74.88 million.

Market Cap: A$635.44M

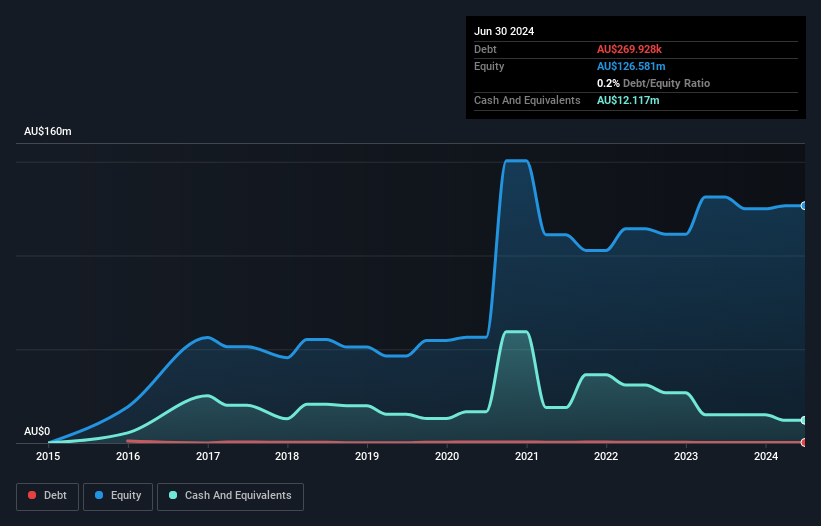

RPMGlobal Holdings Limited, with a market cap of A$635.44 million, faces challenges as it reported a decline in net income to A$4.73 million for the half-year ended December 31, 2024. Despite this, RPMGlobal remains debt-free and maintains high-quality earnings with short-term assets exceeding both short-term and long-term liabilities, indicating strong liquidity. However, profit margins have decreased from last year’s 9.7% to 6.2%, and earnings are forecasted to decline by an average of 27.2% annually over the next three years. The management team is experienced with an average tenure of 3.8 years, providing stability amid financial pressures.

- Click to explore a detailed breakdown of our findings in RPMGlobal Holdings' financial health report.

- Evaluate RPMGlobal Holdings' prospects by accessing our earnings growth report.

Where To Now?

- Click through to start exploring the rest of the 966 ASX Penny Stocks now.

- Looking For Alternative Opportunities? The end of cancer? These 21 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives