- Australia

- /

- Entertainment

- /

- ASX:EVT

Investors who have held EVT (ASX:EVT) over the last five years have watched its earnings decline along with their investment

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term EVT Limited (ASX:EVT) shareholders for doubting their decision to hold, with the stock down 14% over a half decade.

While the last five years has been tough for EVT shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for EVT

We don't think that EVT's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over five years, EVT grew its revenue at 7.8% per year. That's a pretty good rate for a long time period. We doubt many shareholders are ok with the fact the share price has fallen 3% each year for half a decade. Clearly, the expectations from back then have not been satisfied. The lesson is that if you buy shares in a money losing company you could end up losing money.

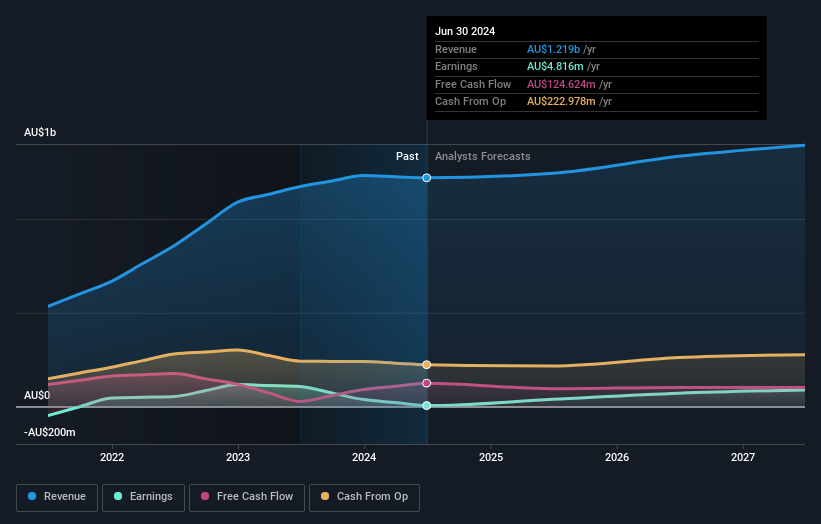

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, EVT's TSR for the last 5 years was -6.1%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

EVT shareholders are down 4.3% for the year (even including dividends), but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with EVT , and understanding them should be part of your investment process.

EVT is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EVT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EVT

EVT

Engages in the entertainment business in Australia, New Zealand, Singapore, and Germany.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives