- Australia

- /

- Metals and Mining

- /

- ASX:WSI

WestStar Industrial's (ASX:WSI) Performance Is Even Better Than Its Earnings Suggest

WestStar Industrial Limited (ASX:WSI) just reported healthy earnings but the stock price didn't move much. We think that investors have missed some encouraging factors underlying the profit figures.

Check out our latest analysis for WestStar Industrial

A Closer Look At WestStar Industrial's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

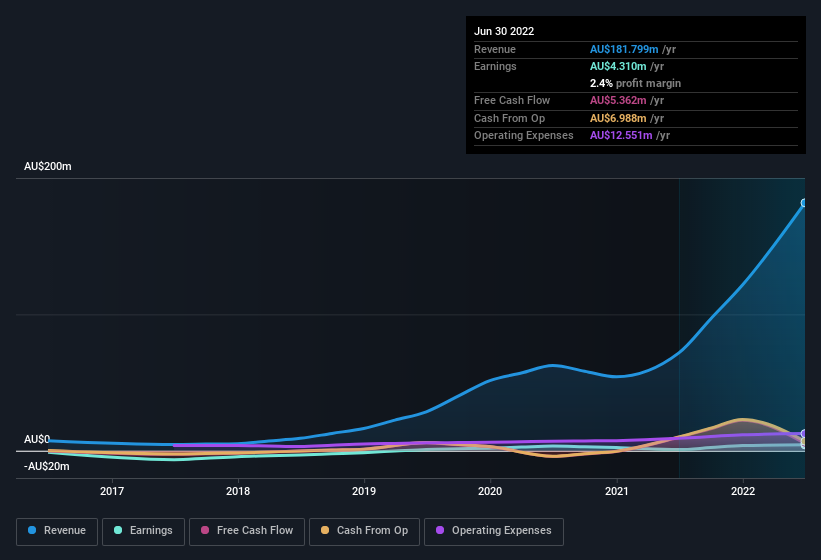

Over the twelve months to June 2022, WestStar Industrial recorded an accrual ratio of -0.37. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of AU$5.4m during the period, dwarfing its reported profit of AU$4.31m. WestStar Industrial did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of WestStar Industrial.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. WestStar Industrial expanded the number of shares on issue by 14% over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of WestStar Industrial's EPS by clicking here.

A Look At The Impact Of WestStar Industrial's Dilution On Its Earnings Per Share (EPS)

As you can see above, WestStar Industrial has been growing its net income over the last few years, with an annualized gain of 336% over three years. But EPS was only up per year, in the exact same period. And at a glance the 429% gain in profit over the last year impresses. On the other hand, earnings per share are only up 35% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if WestStar Industrial can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On WestStar Industrial's Profit Performance

In conclusion, WestStar Industrial has strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share growth is weaker than its profit growth. Based on these factors, we think that WestStar Industrial's profits are a reasonably conservative guide to its underlying profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. At Simply Wall St, we found 2 warning signs for WestStar Industrial and we think they deserve your attention.

Our examination of WestStar Industrial has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if WestStar Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WSI

WestStar Industrial

An industrial services company, provides engineering, fabrication, construction, and maintenance services to resources, energy, oil and gas, petrochemical, water, defence, and infrastructure sectors in Australia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives