- Australia

- /

- Basic Materials

- /

- ASX:WGN

ASX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Australian stock market is poised for a positive start, with the ASX200 set to open 0.43% higher following the Reserve Bank's decision to cut the cash rate, despite mixed signals from US markets overnight. In such a climate, investors might be drawn to penny stocks—an investment category that often spotlights smaller or emerging companies offering potential value and growth opportunities. While the term 'penny stocks' may seem outdated, these investments can still provide intriguing prospects when backed by strong financials and clear growth paths.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.83 | A$147.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.93 | A$1.16B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.74 | A$82.08M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.64M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.33 | A$2.66B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.46 | A$164.18M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.795 | A$879.69M | ✅ 5 ⚠️ 3 View Analysis > |

Click here to see the full list of 997 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

EZZ Life Science Holdings (ASX:EZZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EZZ Life Science Holdings Limited is involved in the formulation, production, marketing, and sale of health and wellbeing products across Australia, New Zealand, Mainland China, and internationally with a market cap of A$82.08 million.

Operations: The company's revenue is primarily derived from its Company Owned segment, contributing A$71.78 million, and the Brought in Lines segment, which adds A$3.26 million.

Market Cap: A$82.08M

EZZ Life Science Holdings has demonstrated robust financial growth, with earnings increasing by a very large margin over the past year, outpacing both its historical average and the broader Life Sciences industry. The company is debt-free, enhancing its financial stability, and boasts a high Return on Equity of 37.5%. EZZ's short-term assets significantly exceed its liabilities, ensuring liquidity. Recent events include an increase in dividends and inclusion in the S&P/ASX Emerging Companies Index. Despite trading below fair value estimates, EZZ continues to show potential for growth with forecasted annual earnings expansion of 14.34%.

- Unlock comprehensive insights into our analysis of EZZ Life Science Holdings stock in this financial health report.

- Assess EZZ Life Science Holdings' future earnings estimates with our detailed growth reports.

Michael Hill International (ASX:MHJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Michael Hill International Limited owns and operates jewelry stores in Australia, New Zealand, and Canada with a market cap of A$167.40 million.

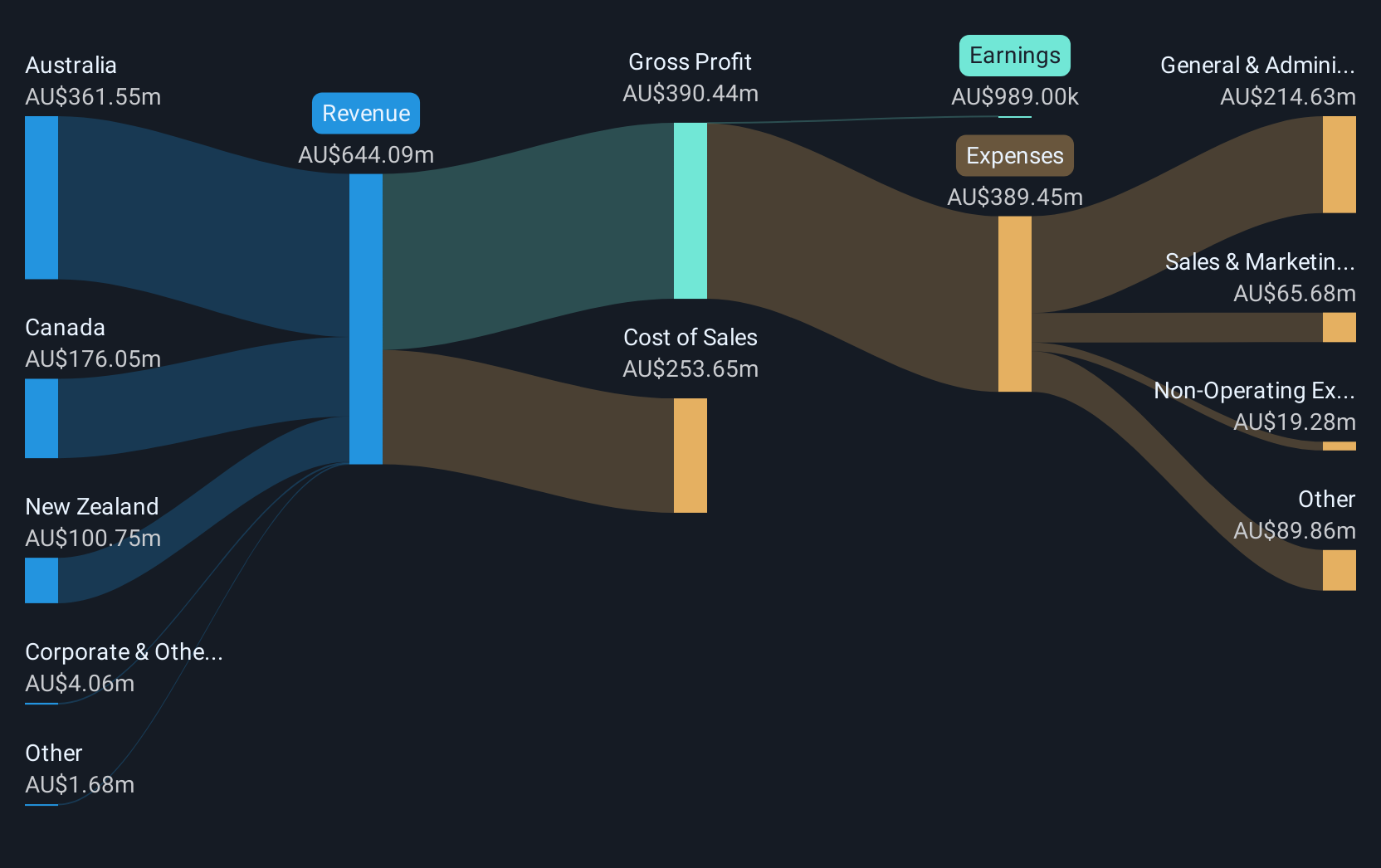

Operations: The company generates revenue of A$644.09 million through its jewelry retail operations across Australia, New Zealand, and Canada.

Market Cap: A$167.4M

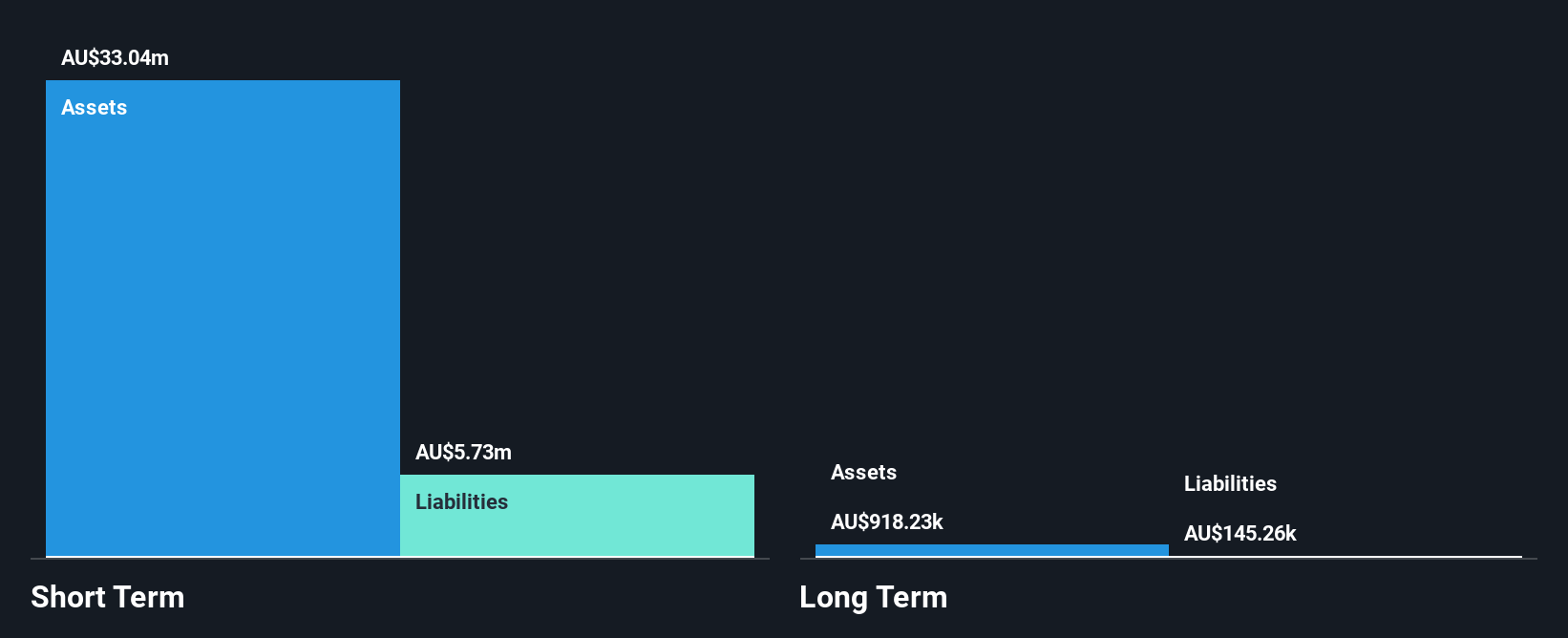

Michael Hill International faces challenges as a penny stock with earnings declining by 8.9% annually over the past five years and recent profit margin contraction to 0.2%. Despite trading at a significant discount to estimated fair value, the company maintains financial stability with short-term assets exceeding liabilities and satisfactory net debt levels. The board's experience and stable weekly volatility add resilience amid leadership changes following CEO Daniel Bracken's passing. Interim CEO Andrew Lowe is supported by an experienced team, ensuring continuity during this transitional phase while the board seeks a permanent leader. Earnings are forecasted to grow significantly annually.

- Navigate through the intricacies of Michael Hill International with our comprehensive balance sheet health report here.

- Gain insights into Michael Hill International's outlook and expected performance with our report on the company's earnings estimates.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wagners Holding Company Limited produces and sells construction materials in Australia, the United States, New Zealand, the United Kingdom, PNG, and Malaysia with a market cap of A$401.50 million.

Operations: The company's revenue is derived from Construction Materials at A$235.11 million, Project Services at A$146.75 million, Earth Friendly Concrete at A$0.11 million, and Composite Fibre Technology at A$63.02 million.

Market Cap: A$401.5M

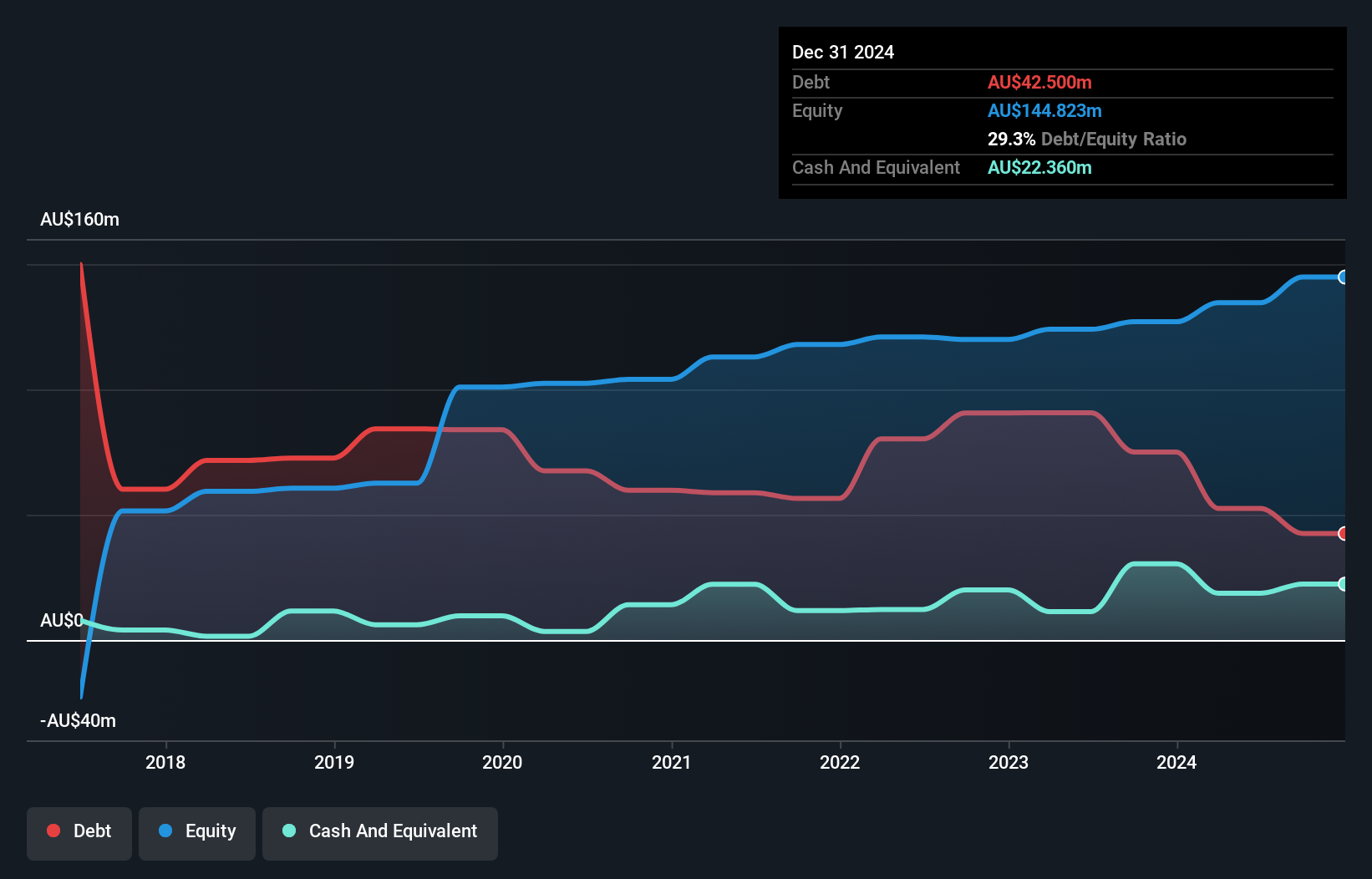

Wagners Holding demonstrates potential in the penny stock arena with a satisfactory net debt to equity ratio of 13.9% and high-quality earnings. The company has shown impressive earnings growth, surging by 195.5% over the past year, surpassing its five-year average of 24.6%. However, short-term assets (A$121.2M) fall short of covering long-term liabilities (A$173.9M). Despite a dip in sales for the half-year ending December 2024, net income rose significantly to A$12.34 million from A$2.81 million a year earlier, reflecting improved profit margins and well-covered interest payments by EBIT at 3.3x coverage.

- Get an in-depth perspective on Wagners Holding's performance by reading our balance sheet health report here.

- Learn about Wagners Holding's future growth trajectory here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 997 ASX Penny Stocks by clicking here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials in Australia, the United States, New Zealand, the United Kingdom, and PNG & Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives