- Australia

- /

- Metals and Mining

- /

- ASX:WAF

West African Resources (ASX:WAF) grows 8.9% this week, taking five-year gains to 210%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For example, the West African Resources Limited (ASX:WAF) share price has soared 210% in the last half decade. Most would be very happy with that. In more good news, the share price has risen 22% in thirty days.

Since the stock has added AU$77m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for West African Resources

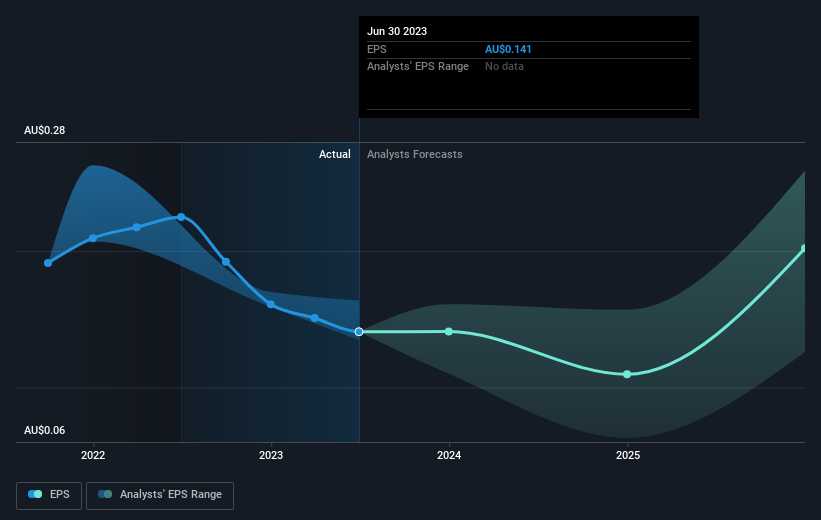

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, West African Resources moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the West African Resources share price is down 6.6% in the last three years. Meanwhile, EPS is up 312% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -2.3% a year for three years.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how West African Resources has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in West African Resources had a tough year, with a total loss of 21%, against a market gain of about 1.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 25% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for West African Resources that you should be aware of.

But note: West African Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives