- Australia

- /

- Metals and Mining

- /

- ASX:WAF

Does Early Kiaka Mine Launch and Grid Power Plan Shift the Bull Case for West African Resources (ASX:WAF)?

Reviewed by Sasha Jovanovic

- West African Resources recently reported the successful early commissioning and below-budget start-up of the Kiaka gold mine in Burkina Faso, with plans to achieve full grid power by the final quarter of 2025 to further boost production throughput.

- This operational achievement accompanies management's plan to update the company's resource reserve and ten-year production plan, which reflects both ongoing development and a focus on future growth opportunities.

- We'll explore how delivering the Kiaka mine ahead of schedule and under budget could shape West African Resources' investment outlook and future growth narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

West African Resources Investment Narrative Recap

To be a shareholder in West African Resources, you need to believe that its multi-year production growth, anchored by timely delivery of projects like the Kiaka gold mine and stable unhedged gold operations, can outweigh execution and country-level risks. The early and below-budget Kiaka commissioning meaningfully advances the short-term production catalyst by accelerating ramp-up, but reliable access to grid power remains the most important, unresolved risk; without it, higher energy costs could offset much of the upside from increased throughput.

Among recent announcements, the reaffirmation of production guidance for 2025 stands out as especially relevant, underscoring management’s confidence in meeting their targets despite operational changes and expansion. This updated guidance provides investors with a reference point to assess how quickly Kiaka can contribute to total output and whether cost assumptions, particularly around energy, remain intact given the power infrastructure transition.

However, if full grid power at Kiaka is delayed or more difficult to secure than anticipated, investors should be aware that ...

Read the full narrative on West African Resources (it's free!)

West African Resources' outlook anticipates A$2.2 billion in revenue and A$782.2 million in earnings by 2028. This reflects an annual revenue growth rate of 35.7% and an increase in earnings of A$454.7 million from the current A$327.5 million.

Uncover how West African Resources' forecasts yield a A$3.60 fair value, a 18% upside to its current price.

Exploring Other Perspectives

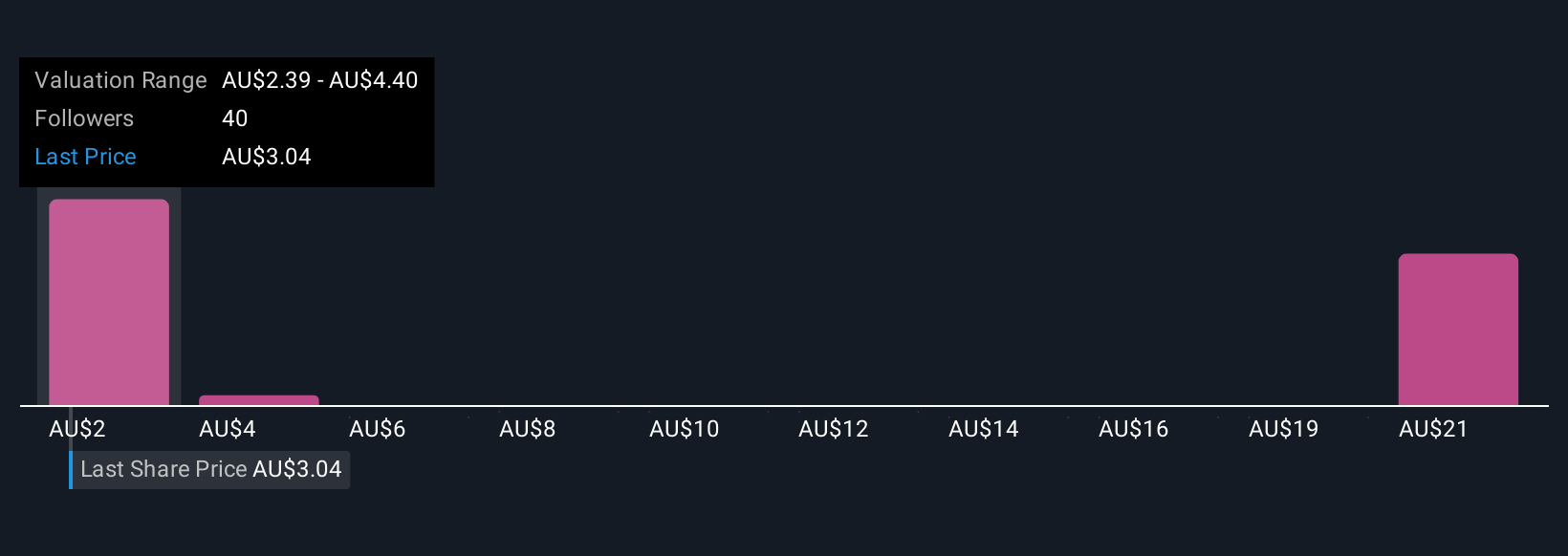

Fair value estimates from nine Simply Wall St Community members range widely, from A$2.39 up to A$22.59 per share. With strong production ramp-up now underway at Kiaka, contrasting views highlight how quickly operational milestones, and persistent power supply risks, shape sentiment about the company’s future performance.

Explore 9 other fair value estimates on West African Resources - why the stock might be worth over 7x more than the current price!

Build Your Own West African Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West African Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free West African Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West African Resources' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives