- Australia

- /

- Metals and Mining

- /

- ASX:WA1

How Confirmation of High-Grade Niobium Zones Will Impact WA1 Resources (ASX:WA1) Investors

Reviewed by Sasha Jovanovic

- Earlier this week, WA1 Resources announced positive assay results from its Luni Niobium Project in Western Australia's West Arunta region, confirming the continuity of high-grade niobium zones and ongoing progress on siteworks and infrastructure development.

- This milestone not only highlights the project's potential scale but also signals the company's intent to accelerate its positioning within the global niobium market.

- We’ll explore how the confirmation of extensive high-grade niobium zones shapes WA1 Resources’ broader investment narrative and industry profile.

Find companies with promising cash flow potential yet trading below their fair value.

What Is WA1 Resources' Investment Narrative?

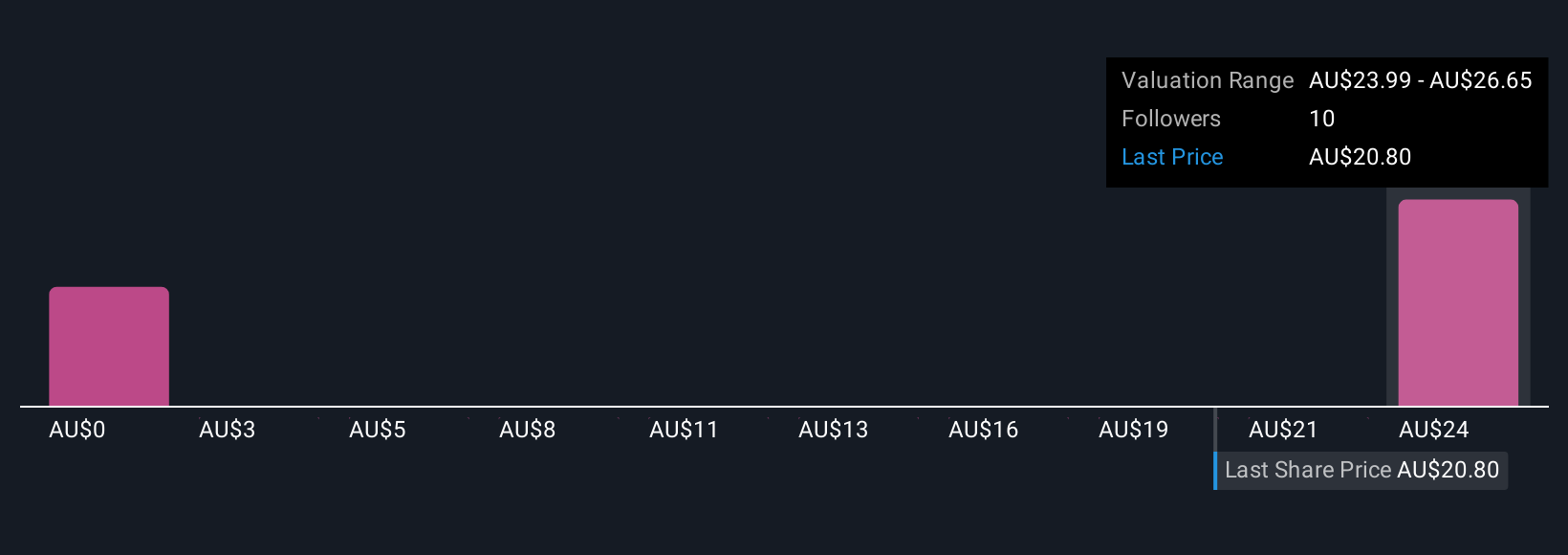

For shareholders, the big picture at WA1 Resources hinges on belief in the commercialisation prospects of its high-grade niobium discovery at Luni, despite a lack of revenue and widening losses. The recent positive assay results mark an important shift in near-term catalysts, injecting momentum and heightening expectations around an updated resource estimate targeted for 2026. While the company remains unprofitable and dependent on new capital, this news provides a clearer path for future project development, including advancing infrastructure and potential market entry. Risks have shifted: previously, doubts around exploration continuity dampened sentiment, but success on site now pivots focus to execution risk, regulatory progress, and sustainability of funding as priorities. With a sharply higher share price following the news, short-term investor attention may now turn to milestones such as infrastructure build-out and preliminary offtake discussions that could transform the company’s profile over the coming year.

On the other hand, challenges around profitability and funding are still front of mind for long-term holders.

Exploring Other Perspectives

Explore 6 other fair value estimates on WA1 Resources - why the stock might be worth less than half the current price!

Build Your Own WA1 Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WA1 Resources research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free WA1 Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WA1 Resources' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WA1 Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WA1

WA1 Resources

Engages in the exploration and development of mineral resources in Western Australia and Northern territory.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion