- Australia

- /

- Metals and Mining

- /

- ASX:TUL

Tulla Resources (ASX:TUL) adds AU$22m to market cap in the past 7 days, though investors from a year ago are still down 56%

It's nice to see the Tulla Resources Plc (ASX:TUL) share price up 13% in a week. But that's not enough to compensate for the decline over the last twelve months. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 56% in that time. Some might say the recent bounce is to be expected after such a bad drop. It may be that the fall was an overreaction.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Tulla Resources

Because Tulla Resources made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Tulla Resources saw its revenue grow by 3,381%. That's a strong result which is better than most other loss making companies. In contrast the share price is down 56% over twelve months. Yes, the market can be a fickle mistress. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

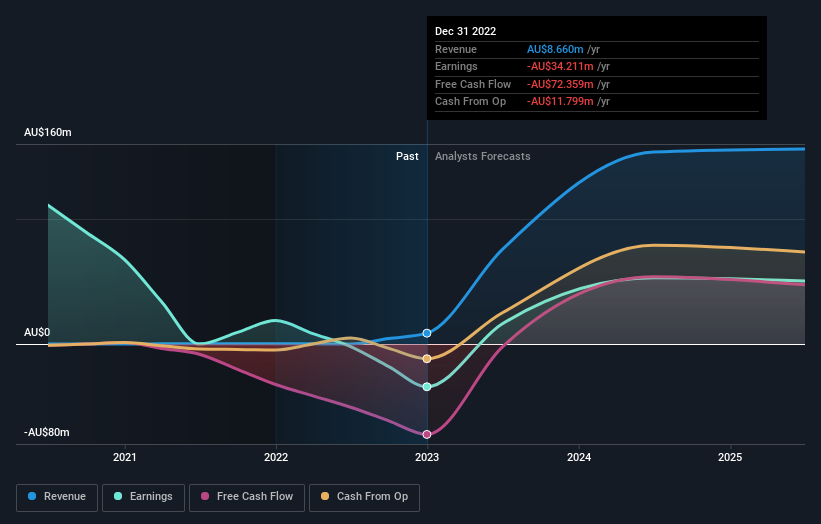

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Tulla Resources' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Tulla Resources shareholders are down 56% for the year, even worse than the market loss of 2.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 18%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Tulla Resources you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tulla Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TUL

Tulla Resources

Tulla Resources Plc, together with its subsidiaries, engages in the exploration, evaluation, and development of gold property in Australia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives